David Wohlever Sánchez, Jackie Xu, and Qiang Zhang, Duke University

Abstract

What is the message?

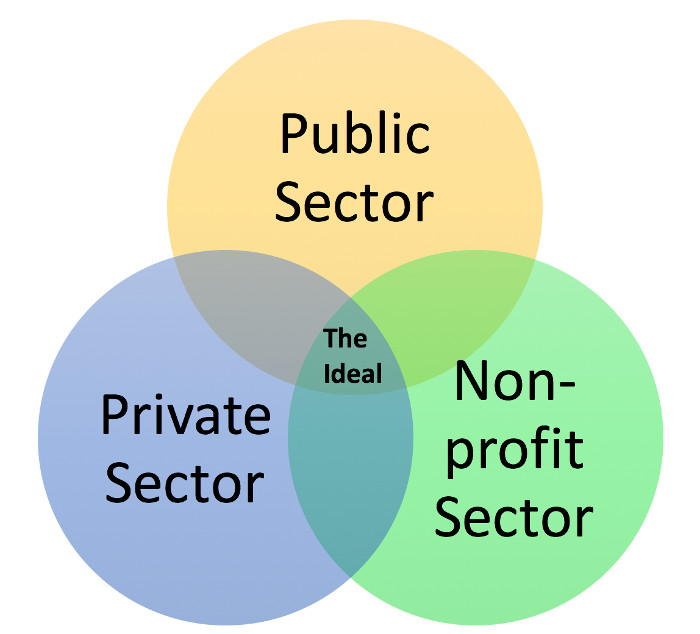

Behind the high-cost drug industry lies a complex environment with many stakeholders with different incentives and strategies. In this article, we cover these major stakeholders, and their role, incentive, notable strategies, and relationship to drug prices to gain a comprehensive outlook of the healthcare market structure. We find that the healthcare system represents an unbalanced market with information asymmetry, a lack of competition, and exploitative practices. Existing solutions include different government policies and work from direct-action NGOs and advocacy NGOs. However, there remains a lack of integration between the private, public, and non-profit sectors, which can represent a next step in addressing this problem.

What is the evidence?

Our research is based on over 45+ academic sources and multiple interviews with stakeholders and industry experts, including a pharmaceutical executive, NGO founder, and Duke business and medical professors.

Submitted: December 1, 2018; accepted after review: July 21, 2018

Cite as: David Wohlever Sánchez, Jackie Xu, Qiang Zhang. 2018. High-Cost U.S. Drugs: A Tale of Unhealthy Markets. Health Management Policy and Innovation, Volume 3, Issue 2.

Introduction

While one might expect that high prices in an industry indicate a functioning market system, the US drug market is anything but ideal, characterized by a lack of competition, asymmetric information, and misaligned incentive structures.

From 2013 to 2015, net spending on prescription drugs increased approximately 20% in the United States, outpacing a forecast 11% increase in aggregate healthcare expenditures. In 2013, per capita spending on prescription drugs was $858, compared to an average of $400 for 19 advanced industrialized nations.

This problem has a tangible human cost. High costs are often passed to patients through higher copays, deductibles, and premiums for those on insurance and higher out-of-pocket expenses for those without coverage.1 Research suggests that as many as one in four patients cannot afford and do not fill their prescriptions, and the elderly and patients with chronic conditions are the most affected.

In many cases (including Medicare, Medicaid, and subsidized insurance plans), healthcare is a public venture, making price hikes a “tragedy of the commons.”2 This concentration of interests makes legislative change difficult; accordingly, we must search for solutions beyond only government policy.

Additionally, international trends demonstrate that high prices in the US put distorting pressures on global drug prices.3 Since U.S. drug markets and international drug markets are so intertwined, it is important that any changes in the U.S. market are carefully considered, given the potential implications to international markets. Accordingly, it is critical that we avoid blunt force or overly distortive economic policy. Holistic, market-driven, and competition-inducing reform is necessary to properly address this global challenge.

History

Starting in the 1990s, in a spur of scientific innovation, the pharmaceutical industry developed blockbuster drugs, extremely popular and profitable compounds. However, patents only last so long—at least, in theory.

As drug compounds became more complex, marginal pharmaceutical improvements became more difficult, meaning manufacturers had to find new sources of revenue. This meant increased costs of R&D for new drugs, as well as efforts by firms to protect their market exclusivities. The combination of direct-to-consumer advertising, loose patent law, and unparalleled lobbying put stress on the market, contributing to the high prices patients see today.

Core Realities: A Model to Contextualize High Prices

In order to contextualize the problem, we must understand four core realities.

First, drugs, especially life-saving drugs, are generally price inelastic; demand will change little despite price hikes.

Second, science and technology are complicated and expensive. Research and development costs make it difficult for firms to enter the market.

Third, the U.S. government is only partly responsive. At the macro level, government responds to popular demand for healthcare provisions (e.g. Medicare/Medicaid/subsidies) and drug safety regulations (i.e. FDA). At the micro level, however, politicians react to lobbyists who help reelect them.

Fourth, we are in a profit-driven market system. Accordingly, we should not expect firms to neglect profit maximization insofar as we wouldn’t expect firms in other industries to do so.

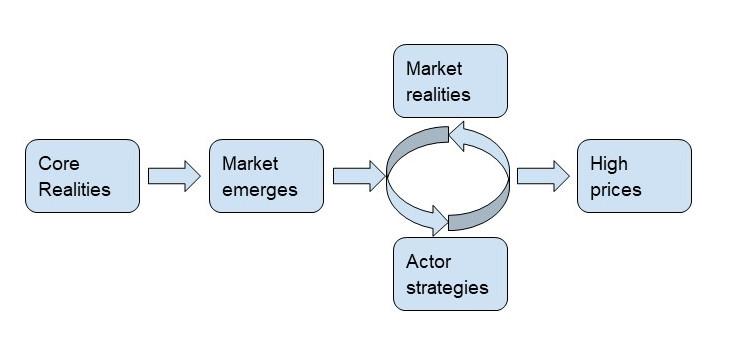

These core realities lead to a system where market realities inform actor strategies, and vice versa. This creates a feedback loop that results in high prices.

Core Realities in Practice: Factors that Drive Up Prices

These core realities create an unhealthy market characterized by the following:

Regulation: The FDA process creates a barrier to entry by increasing production costs and putting downward pressure on competition.4

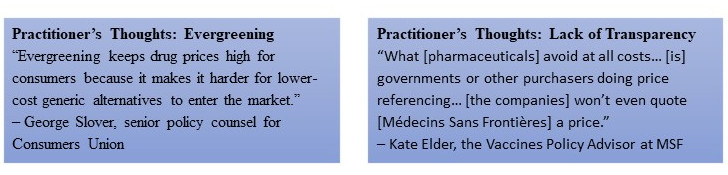

Lack of transparency5: There is little transparency with R&D and production costs, since firms are not required to release this data. Thus, firms can easily “justify” high prices by claiming high costs.

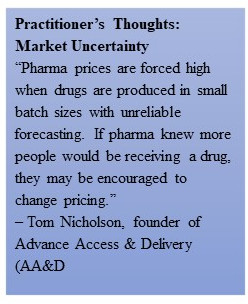

Market uncertainty: Since this space is complex, suboptimal pricing schemes can emerge.

Types of High Priced Drugs:

In the prescription drug market, there are three main categories of high-cost drugs:

- Patented pharmaceuticals6: Once approved by the FDA, drugs can be sold at any price that a payer agrees to cover. These drugs stay high-priced, so long as no adequate substitutes exist. This state-granted monopoly administered via patent laws limits competition. However, these laws do spur innovation by creating incentives to develop new drugs.

- Specialty generics (“orphan drugs”)7: On-patent and off-patent specialty drugs that a small number of people need. However, since they are often life-saving, demand is inelastic.8 Even when patents expire, the lack of competition is caused by the high cost of entry and the low demand.9

- “Super generics”10: New generics with more convenient methods of administration (e.g., nasal vs. injection) or combination of multiple pills into one.11 Slightly more effective, much more expensive. High cost of entry decreases competition.12

Stakeholder Analysis & Strategies

Stakeholders employ strategies to “maintain the loop” and their marketplace position, having direct and indirect impact on the problem landscape.

| Stakeholder | Role | Incentive | Strategy | Relationship to price |

| Pharmaceutical Manufacturers | Manufacture drugs; R&D | High prices; strict patent law | Evergreening, lobbying, information asymmetry, strategic payouts | “Price-makers” in problematic cases, “price-takers” in competitive cases |

| Hospitals / Physicians | Receives drugs from manufacturers at discount; drug vendors that can pocket profit | Generally profit-driven | Utilize price mark-ups when selling drugs to patients | Intermediary that drives up prices for the patient or payer |

| Pharmacy Benefit Managers | Mediators between insurance companies and pharmaceuticals, negotiate prices and coverage options | Profit-driven | Receive discounts from manufacturers to promote their product over competitors’ | Act as mediators and drive up transactions costs; negotiate discounts and rebates |

| Patient Advocacy Groups | Advocates for and educates patients | Profit-driven given relationship with manufacturers | Provide educational materials that are not value-based | Contribute to information asymmetry that drives up prices |

| Government at the micro level | Public expectation to provide for high-quality, low-cost, and safe healthcare system | Hold interest in lower drug costs as funder of Medicare/Medicaid | Subsidize R&D; regulate drug manufacturers via FDA | As regulators, drive prices up (FDA); subsidize costs of production via research grants |

| Health insurance providers | Compete with other insurance providers to include many treatments in their plans but constrained by costs | Generally want lower costs for themselves so their share of the payout is lower | Negotiate group discounts | Historically price-takers; now generally attempt to negotiate down prices |

| Universities | Fuel basic science for pharmaceutical drug R&D, often funded by government | Seek grant money to fund research and other activities | Do not have the capacity to manufacture drugs, sell royalty rights to pharmaceutical companies13;

receive grants and donations from pharmaceuticals |

Currently do little to influence pricing schemes |

Notable Strategies

Pharmaceuticals/Manufacturers:

- “Evergreening”14: Involves tweaking a small aspect of a drug’s formula or delivery method to extend patent by 20 years.

- Lobbying: In 2016, pharmaceuticals spent $244 million lobbying, the most of any US industry.15

- Paying generic manufacturers to drop patent challenges16: 2005 Federal Trade Commission decision allows manufacturers to pay generic companies to drop patent challenges.

- Lack of transparency on internal finances17: Cost of R&D is often a justification for exorbitant prices18. However, manufacturers spend nearly twice as much on marketing products as on R&D.

Hospitals: Charity hospitals (serving underprivileged neighborhoods) receive discounted drugs and sell them for profit. Through the 340b program, Medicare/Medicaid exclude these discounted rates when establishing payouts, which allows hospitals and manufacturers to profit heavily. An expanding number of hospitals now qualify for this status.

Patient Advocacy Groups (PAGs): PAGs receive donations and drug royalties from pharmaceutical companies. Accordingly, they provide “education” to patients about the drugs that are most effective/efficient, without any consideration of value-pricing.19

Universities: More than half of the 26 most transformative drugs of the last 25 years originated in publicly funded research.20 They also often receive grants and donations from manufacturers. However, they do not have the capacity to manufacture drugs, so they sell royalty rights to pharmaceutical companies.21 They play very little role in determining price schemes.

The Solution Landscape

At the core of the problem lies an unbalanced market, characterized by information asymmetry, lack of competition, and exploitative practices. Below are some existing solutions that have improved market systems in the U.S. and other countries.

Current Solutions Landscape

| R&D, Intellectual Property | Direct pricing negotiation | Increase competition | Increase transparency | |

| Government | Bayh-Dohl Act (patenting by federal research grantees) | Value-based pricing | Hatch-Waxman Act (facilitate generic entry) | Sunshine laws |

| Direct action NGOs | Public-private partnerships | Generic manufacturers | Organize into networks to collect market information for drug manufacturer

|

|

| Advocacy NGOs | Advocacy with pharmaceuticals and PBMs: release price and production costs |

Solutions for R&D/Intellectual Property Rights:

- Bayh-Dohl Act of 198022:

- Section 202 requires federal research grantees to confer a nonexclusive, royalty-free license on their patents to the government

- Government has “march-in rights” to demand a patented drug be manufactured on its behalf23

- Public-Private Partnerships:

- Public (NGO, government) and private (companies) actors co-finance R&D for diseases affecting developing countries that would not otherwise be attractive markets24

- Private companies receive PR benefits

Solutions for Direct Pricing Negotiation:

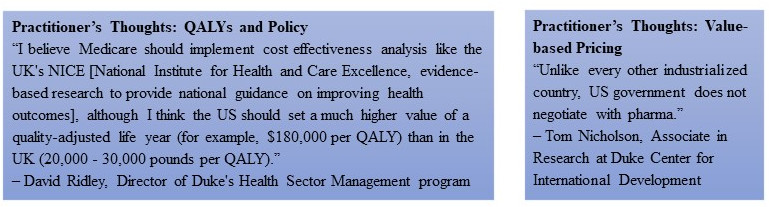

- Value-based pricing25:

- UK’s central advisory board calculates value of drug based on efficacy, safety, and total benefits to the healthcare system, setting prices accordingly

Solutions for Increasing Competition:

- Hatch Waxman Act of 1984

- Decreased the price of FDA generic drug applications26

- Granted a period of market exclusivity to generic manufacturers who challenged patents before they expired27

- Enabled, in part, the increase from 36% to 84% of generic product’s share of total prescriptions market in US28 (about 90% in 2018)

- Promote generic manufacturing by nonprofits

- Increased competition among drug manufacturers reduces prices

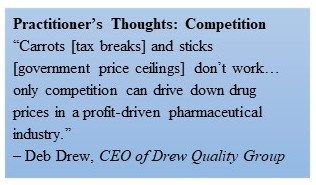

- The Drew Quality Group

- First approved 501(c)(3) to manufacture drugs, developing off-patent generic drugs and eventually legacy drugs29

- Must publicly disclose all financial information

Solutions for Increasing Transparency:

- Physician Payments Sunshine Act30

- Requires drug and medical device manufacturers to disclose payments made to physicians31

- Pharmaceutical companies market products by giving physicians free drug samples or gifts, skewing prescribing habits.32

- NGO Networks

- Create local networks of NGOs to gather market data on drug demand

- Build reliable forecasting, convincing pharmaceutical companies to lower drug prices to reach a wider market.33

- NGO Advocacy34

- Universities Allied for Independent NGOs35 have mitigated information asymmetry between patients and pharmaceuticals.

- Essential Medicines empowers students to petition their universities for better drug access policies.36

Lessons & Levers of Change

Media coverage of this issue has spotlighted manufacturers, but structural barriers within the healthcare system challenge reform.

At present, only the public and nonprofit sectors are direct actors in the solution landscape. Yet to build a more balanced market system, the private sector needs increased opportunities and stronger incentives to price products sustainably. This sector has the most leveraging power to change the pricing ecosystem.

Private Sector: Market governance

- Provide more robust opportunities for drug manufacturers to decrease R&D costs, encouraging price reductions

- Increase government grant funding and open knowledge collaboration with private manufacturing companies

Non-Profit: Informal governance

- Creation of NGO network: Pool local demands as negotiating power to reduce drug prices, or assume risk of drug manufacturers by holding excess stock; NGOs can leverage local knowledge; incentivize state governments to create NGO networks through common interest of providing medication for populations of need; advocacy NGOs can partner with NGO drug manufacturers, providing market information

- Venture-capital and government co-investment in NGO drug manufacturers to decrease capital barriers to entry.

- Incentivize and empower universities to leverage their position as the innovators of the science on which drug manufacturers rely; charitable social mission to educate individuals in service of society

- Publicize third-party, research findings on the value of drugs based on efficacy, safety, and overall societal benefits.

Public: Official governance

- Leverage Bayh-Dohl Section 202 provision: Inform NGOs of existing institutional pathway; allow government to pass license to NGO drug manufacturers, who can then compete with pharmaceuticals in patented market

- Include accessibility requirements on existing R&D cost-sharing agreements through public-private partnerships

Conclusion

The question of “fair” pricing remains open. While we do not want to ignore the contributions of profit-seeking firms, we cannot bear exorbitant prices forever. We believe a middle ground exists where manufacturers can pocket a profit and patients can afford their drugs.

Governments, manufacturers, and NGOs ought to remember the human costs of restricted access. Solutions will only be found when stakeholder incentives align with reasonable pricing. This can be achieved; whether or not we follow through remains to be seen.

Endnotes

[1] Studies have found that people who see rises in their drug costs spend less on their families, other expenses, and sometimes even postpone retirement to keep their employer’s health insurance so they can afford the drug.

[2] This means that a few firms can internalize huge gains at the expense of the rest of society, the members of which each bear a tiny fraction of the true cost: a “death by a thousand papercuts.”

[3] For example, Canadian internet pharmacies, also dubbed mail-order pharmacies, enable Americans to purchase drugs from Canada, putting strong upward pressure on Canadian retail drug prices.

[4] There is a tradeoff here: the FDA keeps drugs safe, but also increases prices. This is not an all-or-nothing binary; we believe that there is a middle ground between drug safety and producer-side cost of regulation that would lead to optimal outcomes.

[5] This allows the pharmaceutical lobby to repeat the oft-given response that high prices are justified by cost of research. However, our research suggests cost of research and development is not as high as one might think.

[6] Example: Hepatitis C drug Sovaldi was originally planned to sell at $34,000. Gilead now sells Sovaldi at $84,000 for a 12 week treatment, or $1,000/pill.

[7] Example 1: Turing Pharmaceutical’s (former CEO Martin Shkreli) Daraprim jumped from $13.50 to $750/pill overnight. Daraprim treats a parasitic infection called toxoplasmosis that targets people with compromised immune systems, certain cancer patients. Toxoplasmosis infects an estimated 4,000 individuals in the US each year.

Example 2: Rodelis Therapeutic’s acquisition of cycloserine resulted in increase from $500 to $10,800 for 30 pills. Cycloserine treats multi-drug resistant tuberculosis (MDR-TB). In 2015, the US had 89 cases of MDR-TB.

[8] Inelastic meaning people will continue to buy regardless of price, since they need the drug.

[9] Firms that manufacture and sell these specialty drugs are able to set the price high enough so they are able to make a huge profit, but low enough such that new firms won’t be incentivized to enter the market, given cost of entry.

[10] Example: Amphastar Pharmaceutical is the only company to manufacture intranasal naloxone, which experienced a 100% price increase in 5 months.

[11] The existence of these effective generics improves patient health outcomes, but the difference between the more effective and less effective generics is likely not large enough to justify the huge price discrepancies.

[12] This leaves one or two firms at the top with the more effective, much more expensive generics.

[13] Example: Xtandi (prostate cancer blockbuster drug) will generate $33.3 million in royalties and other income for University of California.

[14] Example: Pfizer’s Caduet is a simple combination of Norvasc and Lipitor, which expired in 2007and 2011, respectively. Pfizer’s creation of Caduet when Norvasc and Lipitor were due to expire prevented other manufacturers from producing generic versions of these drugs.

[15] Example: Pharma lobbied Congress in 2003 to prevent Medicare from negotiating prices with pharmaceuticals for its new Part D program. Wholesale prices of brand-name drugs have increased average of 3.6 percent since the establishment of Medicare Part D.

[16] Example: In a patent challenge case against Cipro, a potential generic manufacturer received upfront and quarterly payments totaling $398 million and agreed to wait until patent expiration to market its product.

[17] In December 2016, 20 states filed complaints against pharmaceutical companies conspiring to artificially inflate prices generic drugs, coordinating through informal industry gatherings and personal calls/text messages.

[18] Example: Johnson & Johnson and Pfizer spent about 13 percent and 16 percent on R&D, respectively. At the same time, both companies spent about 30 percent of revenue on selling, marketing, and administrative expenses.

[19] 67% of patient advocacy groups receive funding from for-profit companies.

[20] Example: Sanofi’s collaboration with Harvard University is part of corporate strategy to fill pipeline with innovative drugs.

[21] Example: Xtandi (prostate cancer blockbuster drug) will generate $33.3 million in royalties and other income for University of California.

[22] Originally, this Act allowed federally-funded inventors and their employers to retain patent ownerships, incentivizing the commercialization of government funded R&D.

[23] However, note that all six petitions to the National Institutes of Health (NIH) to exercise march-in rights have been denied. The NIH claimed that drug pricing itself was not sufficient to provoke march-in rights.

[24] Examples include the International AIDS Vaccine Initiative, Global Alliance for TB Drugs Development (Stop TB), and Medicines for Malaria Venture (MMV). The Stop TB Partnership led to an agreement signed by Janssen Therapeutics to provide medication free for eligible MDR-TB patients—a promised donation of 30 mil over a 4 year period to low/middle income countries.

[25] In Australia, the Pharmaceutical Benefits Advisory Committee reviews the comparative effectiveness of various drugs. Similar patterns are also seen in Germany under the Federal Joint Committee, Canada under the Patented Medicines Prices Review Board, and the UK under the National Institute for Health and Clinical Excellence. In all these nations, the price of a drug is determined by the value it will bring.

[26] An Abbreviated New Drug Application (ANDA) process granted by the Act reduced the cost of completing an FDA application for approval of a generic drug.

[27] The first generic manufacturer(s) to file a Paragraph IV challenge against a brand-name patent is granted a 180-day period of exclusivity on the market before patent expiration. A Paragraph IV challenge is a claim to the FDA that the generic product does not infringe on the listed patent of a brand name drug, or that the brand-name patent is not valid.

[28] Other proposed reforms included the Greater Access to Affordable Pharmaceuticals Act in 2003, the Pharmaceutical Market Access Act of 2003, and the Pharmaceutical Market Access and Drug Safety Act of 2011. While these acts slightly differ in detailed nuances, their ultimate intent was to break down barriers of entry for generic drugs within the drug market.

[29] Legacy drugs are patented products that companies no longer desire in their product lineup. Drew Quality Group has two classifications of drugs. 1) Surplus drugs generate capital for future growth. 2) Service drugs may be sold at or below production cost to increase access of medications to vulnerable populations.

[30] Signed into the Affordable Care Act of 2010.

[31] All reports made to Centers for Medicare and Medicaid Services.

[32] Doctors may begin prescribing medications driven by personal motivations. In 2014, nearly 40% of the 50 largest pharmaceutical companies had academic medical center leaders on their Board of Directors, giving these individuals with significant weight on directions of medical research a financial responsibility to generate profits to shareholders.

[33] Example: AA&D is working with cities around world to quantify demand for TB drugs, creating NGO coalitions to streamline and pool this demand and use as negotiating power. These NGO coalitions can also assume risks from pharmaceutical companies by holding excess drug stock.

[34] Examples: NeedyMeds.org, a national non-profit, maintains a website of free information on programs that help people who can’t afford their medications or other health-care costs. It also offers a free drug discount card. The patient advocacy groups Campaign for Personal Prescription Importation, PharmacyChecker.com, Prescription Justice Action Group, RxRights.org, and the publisher of TodaysSeniorsNetwork.com, together representing more than four million Americans, advocated for the need of political action on high drug costs. Organizations such as Pharmacists United for Truth and Transparency, comprised of more than 1,000 pharmacists and pharmacy owners, aim to expose the intricate business model of PBMs designed to exploit the other players within the prescription drug market. Other examples include the National Community Pharmacists Association and PBMwatch.com.

[35] More advocacy NGOs: Sites like GoodRx offer information on retail costs of medications at local pharmacies. FamilyWize offers free prescription drug savings cards, allowing patients to negotiate discounts with pharmacies.

[36] This group was founded by successful Yale student advocates who reduced price and opened generic manufacturing of Bristol-Meyers Squibb’s antiretroviral d4t (discovered at Yale).