Kevin A. Schulman, MD, Clinical Excellence Research Center, Stanford University

Contact: Kevin A. Schulman, kevin.schulman@standford.edu

What is the message? This paper analyzes the impact of moral hazard on prices established by pharmaceutical manufacturers and the implications for policy makers. The findings show that the escalation of drug prices will likely continue unabated in the absence of significant mechanisms to induce restraint and discipline in this market. What is the evidence? Moral hazard is a powerful theory of how health insurance influences the delivery of healthcare. While moral hazard has been used to understand changes in demand for services through insurance, a literature review shows that until now, its impact on pharmaceutical prices has not been well developed. The findings documented in this paper should therefore help spark a vigorous debate on the implications of different pharmaceutical pricing models for the US market. Submitted: December 18, 2017; accepted after review: July 21, 2018 Cite as: Kevin A. Schulman. 2018. The Supply-Side Effects of Moral Hazard on Drug Prices. Health Management Policy and Innovation, Volume 3, Issue 2.

Unit prices for pharmaceutical products are reaching ranges never before experienced. Prices for cancer products are routinely over $100,000 per patient per annum, while novel CAR-T therapies are being offered for $475,000 per patient. These prices are a dramatic increase over the prices of the most expensive drugs only a decade ago.[1]

Prices are set by pharmaceutical manufacturers in negotiation with payers, and are set to reflect the fact that these products have a value based in intellectual property that is far greater than the marginal cost of production. Historically, the pharmaceutical industry has argued that prices are justified on the basis of research and development costs, the high risk of drug failure[2], and the value of new products.[3] Rarely are the prices ascribed to the actual price of manufacturing the products. At the same time, industry critics have highlighted the role of public funding in biomedical sciences as directly or indirectly supporting the development of many products, and the changing nature and risk of drug development characterized by much smaller and speedier clinical development programs and accelerated review times at FDA.[4]

While these arguments have existed for many years, the nature of biomedical research has changed. The industry has moved development of products from broad, mass-market molecules to niche investments in cancer and orphan diseases. The concern over high drug prices in these markets has been met with additional arguments for high prices based on limited market sizes in many of these product niches.[5]

In the current market environment, there is limited direct pressure on manufacturers setting these unprecedented prices. In contrast to many other countries, the US government does not directly negotiate over pharmaceutical prices except within the Veteran’s Administration (VA) system. Even when direct negotiation is possible, the lack of competition within market segments limits the bargaining power of private payers. As a result, high and increasing prices directly impact health insurance premiums across the market, and the cost of the federal health plans, Medicare and Medicaid.[6] [7]

The Supply Effects of Moral Hazard

The extraordinary prices for pharmaceutical products can only be imagined in a world where patients have health insurance. Health economists have long been worried about the economic impact of health insurance on the patterns of consumption of healthcare due to a concept called “moral hazard.” Moral hazard describes the change in individual behavior between conditions of self-pay and conditions of third party payment. Kenneth Arrow was awarded the Nobel prize in economics for developing this framework[8]. Mark Pauly further developed the theory to focus on demand.[9]

The basic framework is easy to understand. We all make purchases based on our concept of value. We generally make purchases of goods or products for $1.00 when we perceive that they offer $1.00 worth of value. This concept of value is an individual determination – we all have our own tastes, preferences, and needs which form our assessment of value.

Third-party payment alters this fundamental calculus. Consider going out to dinner with a group of friends. After the menu is passed around, you notice items of lower and higher price, salad, and steak. You can approach payment in one of two ways: individual checks or splitting the check. If you all decide on individual checks before you order, you may decide to purchase the lower-cost salad since you are on a budget. However, what happens if you decide to split the check after you order? You may be worried that everyone else at the table is likely to order the higher-priced steak, and you will have to pay your share of their higher-priced meals. Since you are paying for their steak, why not order your own steak so at least you get the benefit of the higher price you will pay for dinner. In this simple illustration, your behavior changes between self-payment and third-party payment models.

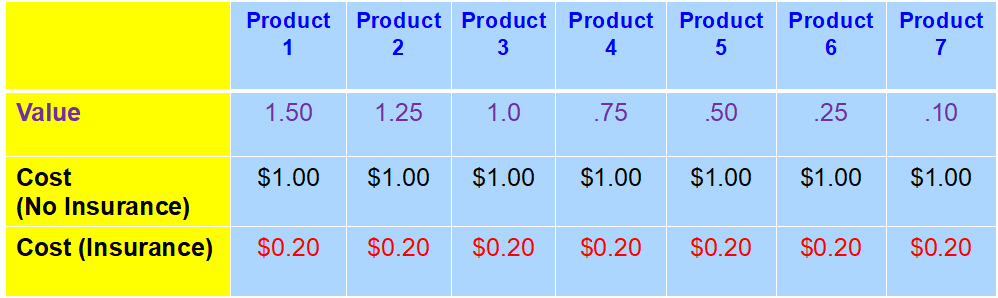

Health insurance is one form of third-party payment. Under health insurance, rather than paying the full cost of medical products, you pay only a co-payment (fixed amount), or co-insurance (a percentage payment) for medical products. As illustrated in Exhibit 1, products 1-3 offer at least $1.00 of value for $1.00 of cost. In a self-payment model, you would be expected to purchase only products 1-3 since only these products have a value of $1.00. In an insurance model, however, you only pay the copayment of $0.20. Now, products 1-6 offer value equal to or greater than the $0.20 copayment, so using the same rule (only buying products that offer value greater than or equal to the price you pay), you would purchase products 1-6. Again, behavior changes under conditions of third-party payment.

Exhibit 1: Hypothetical Set of Products Based on Value, Cost and Insurance Status

Legend: Value-perception of value to the patient (in dollar equivalents). Cost (No insurance)-assumes only cash payments for the product. Cost (insurance)-assumes the product is covered by an insurance policy with a 20% coinsurance requirement.

While many economists have argued that health insurance increases the overall cost of healthcare due to these changes in demand,[10] there is also the concept of good moral hazard where people can purchase goods or products through insurance that would otherwise be unaffordable.[11]

To this point, the discussion of moral hazard has focused on the impact of moral hazard on the demand for healthcare products. However, the impact of moral hazard also extends to the supply side of health care.[12] [13] [14] While much of the literature examines the impact of moral hazard on the provision of services and technology, there is also an impact on the price of products. Given insurance, the suppliers of high-value products can realize that products are perceived as being significantly underpriced since insured patients only consider the out-of-pocket costs and not the full cost of therapy. Applying a value framework to pricing can lead manufacturers to raise their prices to meet the value threshold rather than simply developing a price to meet their internal financial expectations. This supply-side moral hazard effect on the price of pharmaceutical products has been much less discussed in the literature.[15] [16]

Again, going back to the basic example of product 1 in Exhibit 1, this product provides great value to patients under conditions of self-payment and even more under conditions of third-party payment. Sophisticated suppliers will notice these conditions. In a competitive market, suppliers will have little ability to influence the welfare surplus enjoyed by patients in this example since the price is determined by the market and is driven by the entry and exit of firms. However, there are circumstances when suppliers have power to influence prices, especially in healthcare.

Suppliers can have market power when they have a barrier to market entry such as a patent awarded to a pharmaceutical manufacturer or a product developed for a niche category which is too small to attract competition. In these cases, suppliers can increase the price of product 1 based on value. If they decide to price at the total value of the product, they could raise the price from $1.00 to $1.50 to capture the full value to patients. Under our conceptual model, this pricing strategy would be attractive to patients even in a cash pay market.

However, under conditions of third-party payment, suppliers can consider an even more aggressive pricing strategy by considering that patients measure value against their co-insurance, not the full cost of the product. Under these conditions, suppliers can raise the price to $7.50 while consumers would have a cost-share of $1.50, or an amount equal to the value they expect to receive from the therapy. As a result of supply-side moral hazard, the cost increased from $1.00 to $7.50 in this simple example.

The supply side implications of moral hazard are potentially significant. Beyond the short-term impacts on patients, this effect can have longer term effects by distorting the drug development portfolio. In Exhibit 2, we imagine a manufacturer with a simple two product portfolio, with each product having equal development costs and market price. In analyzing their options, the firm invests in the opportunity with the largest market size.[1] However, in Exhibit 3, under conditions of market power, they can consider the question of value of the therapy to patients in setting a price. In this case, they chose to undertake development of product B despite its smaller market size.

Thus, the supply-side effects of moral hazard can be seen in both the prices of products in the marketplace, and in the portfolio of drug products available on the market.

Exhibit 2: Optimal Drug Portfolio without Moral Hazard

| Product | Cost of Development | Size of Target Market | Price | Revenue |

| A | $50,000,000 | 20,000 | $10,000 | $200 M |

| B | $50,000,000 | 10,000 | $10,000 | $100 M |

Legend: Cost of Development-out of pocket dollar costs of development (assumption). Size of Target Market: number of accessible candidates for therapy considering incidence and prevalence of underlying condition. Price-market price for the product (net price to manufacturer). Revenue-net revenue from the product (price times market size).

Exhibit 3: Optimal Drug Portfolio with Moral Hazard

| Product | Cost of Development | Size of Target Market | Value of Therapy | Price | Revenue |

| A | $50,000,000 | 20,000 | 1 | $10,000 | $200 M |

| B | $50,000,000 | 10,000 | 5 | $50,000 | $500 M |

Legend: Cost of Development-out of pocket dollar costs of development (assumption). Size of Target Market: number of accessible candidates for therapy considering incidence and prevalence of underlying condition. Value-perception of value to the patient (in dollar equivalents). Price-value price for the product (net price to manufacturer). Revenue-net revenue from the product (price times market size).

Possible Solutions

Four frameworks can be considered as part of a regime to set appropriate market prices: market competition, cost-effectiveness analysis, prizes, and profit regulation.

1. Market Competition

As suggested earlier, in competitive markets with free entry of firms, the supply-side effect of moral hazard is not an issue. Firms that attempt to extract a high price from the market will be quickly met with competitors. To a great degree, market competition has worked in the pharmaceutical market. When several firms with products enter a class, they often face price competition (although, this being healthcare, not all of this price competition is transparent and can occur in the form of a PBM rebate[17]).

A recent example is the cost of Hepatitis C treatment in the United States. The payer community was in shock over the original price of Solvaldi at $84,000 per patient for a 12-week course of therapy (or double that amount for 24-weeks).[18] This set off a debate around the price of the therapy, and led to significant challenges for many public and private health insurers.[19] However, the entry of additional novel therapies for patients with Hepatitis C led to price competition in the marketplace, with prices ranging from $26,400 to $62,500 per treatment course by 2017.[20]

While this may be seen as a success of the market model, we do not have a good understanding of which product categories will remain competitive in an era of precision medicine. As indications for products become more targeted at a molecular level, it may be difficult for fast-followers to enter specific niche markets, leading to the failure of this mechanism to address the pricing impact of moral hazard.

2. a. Economic Analysis

Over the last several years, we have seen the re-emergence of products’ economic value as a consideration for supporting prices. This concept was developed in the 1970s and 1980s as a tool to help understand the value of investments in new pharmaceutical therapies. Outside of the United States, regimes incorporating economic analysis have helped to set national formulary decisions in the UK, Germany, and Australia. These regimes can consider the patient population impacted by the condition, the potential outcomes of the therapy, and the net cost of the intervention (the net cost considers the cost of the new therapy, the cost of administration such as hospitalization for supportive care or side effects, less costs avoided as a result of the treatment). Through this analysis, products can be found to be cost saving (those rare products that reduce overall costs), or cost effective, requiring additional spending but providing additional value to patients.

Providing coverage for cost-effectiveness therapies is predicated on an interest in an investment in new therapies by everyone in the insurance pool or by taxpayers if addressing a publicly funded program. Generally, there is no direct process for such a determination, so this process is left to proxies such as a pharmacy and a therapeutic committee or some other type of formulary review committee.

Economic evaluation can be used to assess the value of therapies once a price is determined, or it can be used to set the price in advance to ensure “access” or uptake into the marketplace. The use of economic analysis before a product is marketed can help understand the potential value of the therapy in practice.[21] If economic evaluation is conducted once a product is on the market, findings that therapies are not cost-saving or that they do not meet a value threshold could reduce spending by limiting access to low-value therapies. At present, there is no consistent application of a value threshold in the United States.

2.b. Considerations for the Specialty Pharmaceutical Marketplace

Applications of the economic analysis framework to high-cost therapies could be problematic.

Economic evaluation can be used by manufacturers to help set a price for a product. Using this framework, high prices can be justified by expected benefits using outcome measures such as years of life gained for therapies that have a survival advantage, or quality-adjusted life years considering an impact on both length and quality of life.

One means of enhancing the “value” of a therapy is to limit the indication to those that would perform best under this framework to support a high price. Therapies that have a large impact on pediatric cancer, for example, would offer the potential for large denominators in a cost-effectiveness framework since patients who benefit from therapy would have substantial remaining life expectancy. Thus, bringing a technology to market first for a pediatric indication would allow a price that would be considered poor value in other indications.

Application-specific pricing is a remedy to address this strategy where prices would be adjusted based on clinical indication. However, there is no evidence that these schemes have been successfully adopted and enforced. If enforcement of this method fails, then the “benchmark” price for a technology could be established by the best-case scenario rather than the expected use in the market.

Market “guarantees” could be another mechanism to enhance the effectiveness of therapies. Again, the issue would be the ability and cost to track “effectiveness” over time to enforce these contracts. Not only is there potential for significant disputes over patients who have adverse outcomes for a variety of reasons unrelated to the treatment (car accidents for example), significant administrative costs would be associated with the resulting “manual” billing process. Further, if a manufacturer offers this framework in advance of going to market, they could include their estimate of likely clinical effectiveness in setting their price (i.e., they raise the price above their initial consideration to account for the cost of the guarantee).

If patient perspective is considered in assessing value, there is significant concern that conditions involving highly emotional situations (such as a life-threatening illness or genetic diseases) or loss (a new diagnosis of cancer) lead to very high value on any potential benefits of therapy, and patients may appear to be risk-seeking in making treatment choices. [6], [21] This value framework of patients is expected to differ significantly from the value framework of people in the insurance pool not impacted by life-threatening illness.[22]

Cost-effectiveness of therapies is not tied to the overall cost in the market since total budget is tied to the price and the number of patients treated, not the value of a therapy.[21] Cost-effectiveness analysis can be used to prioritize new investments in pharmaceutical therapy, but will lead by definition to increases in spending.[23]

3. Prizes for Drug Discovery

Nobel Prize-winning economist Joseph Stiglitz developed the concept of a prize for drug discovery that would compensate inventors for their efforts while providing the public access to novel therapies closer to their marginal cost.[23] However, the mechanics of such an approach are challenging.

First, new drugs enter to market as a combination of both drug discovery and drug development. Discovery is the early-stage basic science work in a laboratory, while development requires teams of people to develop a formulation for use in humans, optimize drug manufacturing, test for toxicity, and undertake clinical testing. Discovery often occurs through public funding, while development requires private funding. A prize awarded for discovery would be very difficult to administer; many new targets and biologic mechanisms are discovered, only to later fall out of the drug development pipeline.

Similarly, a prize for drug discovery could create significant challenges in funding drug development, with no private incentive to invest in clinical research since post-prize research would be a public good. A prize awarded after drug development runs the risk of skewing development to tasks required to access the prize rather than to optimize the development program for market impact.

Finally, given the tremendous output of basic science in the United States, there may be a subjective component to the process of awarding prizes which could create significant uncertainty in the marketplace and reduce incentives for drug development.

4. Profit Regulation

In some European markets, price negotiation used to include profit regulation. Government purchasers developed a framework considering that the patent holder was a monopolist that needed to be regulated (like a utility). Profit regulation schemes considered the costs of drug development and manufacturing in setting price and market access, with additional consideration for manufacturers’ production capacity within a market. The manufacturer would be allowed a price that offered a return on these demonstrated costs. For example, in the UK, profits were limited to 21% until 1998, rising to 29%.[24]

Profit regulation allows for a separation of the research costs (supported by the public) and drug development costs incurred by the private sector. In addition to direct costs in clinical development, profit regulation schemes can consider the time cost of an investment. This mechanism was largely applied to the consideration of self-originated portfolios. It is not clear how these schemes would evaluate in-licensed products and whether there would be any consideration of the costs of acquiring molecules in calculating the allowable profit for firms. A decision to exclude acquisition costs from pricing considerations could have a significant negative impact on firms paying high prices to acquire novel therapies, but could potentially lead to a reduction in market prices for new products.[25] [26]

Under a profit framework, manufacturers would have incentives to develop products for a wide variety of indications. This could broaden the portfolio beyond the narrow niche of oncology and orphan products currently in development. While manufacturers might have an incentive to increase development costs under this framework to enable a higher nominal profit level,[27] in practice, the high cost of venture capital may limit the impact of this perverse incentive.

Given the fixed cost of drug development, this concept of profit regulation entails a scale problem. The market may have to facilitate purchase of a sufficient quantity of a novel therapy before this profit cap would apply.

One approach to profit regulation could be to provide a pathway to using less private capital in drug development. Leveraging private capital with public grant funding could allow private investors to achieve their expected returns while providing a pathway for lower drug prices post-approval.[28] The NIH’s recent announcement of a novel co-development program with industry would be a perfect opportunity to test such a program.[29]

Final Considerations

There is significant anecdotal evidence of an impact of supply-side moral hazard on specialty drug prices. In the face of this effect, public constraints on drug pricing may be required: “To avoid breaking the government’s budget, this would require some type of restraint on manufacturer prices, such as price-regulation or direct price controls.”[14]

Currently, there is no mechanism in the US market to address this issue in product categories with single solutions such as many specialty pharmaceutical categories. This paper developed the theory of why this is an issue, and examined how four currently available strategies can be used to assess the appropriate price for products for the US market. Each framework, the market, value, prize, and profit frameworks, have significant strengths and significant limitations. Each approach provides different incentives to shape the portfolio of products in development, and may result in different pricing frameworks for products that either the market (see Exhibit 4). Consideration of each of these schemes should include considerations of access, innovation and affordability of new drug products [21] At some level, all of these mechanisms are designed to ensure some conflict in setting prices within this market.

The escalation of drug prices will likely continue unabated in the absence of significant mechanisms to induce restraint and discipline into this market. Thus suggests the need for a vigorous debate on the implications of these different pricing models in the US market, a need recently highlighted by the National Academy of Medicine.[31]

Exhibit 4: Policy Solutions to the Effects of Moral Hazard on Price

| Scheme | Unit Price | Utilization | Total cost |

| Market Competition | High until competitors enter the market | May result in barriers to market access | Potential to increase the total cost |

| Economic Analysis | May increase prices for high value therapies | May enable market access | Potential to increase the total cost |

| Prize | Low marginal cost per patient | Enables increased use with little cost barrier | Total cost depends on how the prize scheme is established |

| Profit Regulation | Price cap based on investment | May enable market access | Total cost depends on regulation scheme |

References

- Reed SD, Antrom KJ, Ludmer JA, et al. Cost-effectiveness of imatinib versus interferon‑a plus low-dose cytarabine for patients with newly diagnosed chronic-phase chronic myeloid leukemia. Cancer. 2004;101:2574-2583.

- DiMasi JA, Grabowski HG, Hansen RW. Innovation in the pharmaceutical industry: New estimates of R&D costs. Journal of Health Economics. 2016;47:20-33.

- Paris V, Belloni A. Value in Pharmaceutical Pricing. OECD Health Working Papers. 2013(63), OECD Publishing, Paris.

- Bach PB. New Math on Drug Cost-Effectiveness. New England Journal of Medicine. 2015;373(19):1797-1799.

- Trusheim MR, Berndt ER, Douglas FL. Stratified medicine: strategic and economic implications of combining drugs and clinical biomarkers. Nature Reviews Drug Discovery. 2007;6(4):287-293.

- Hirsch BR, Balu S, Schulman KA. The impact of specialty pharmaceuticals as drivers of health care costs. Health Affairs (Millwood). 2014;33(10):1714-1720.

- Warraich HJ, Schulman KA. Health Care Tax Inversions — Robbing Both Peter and Paul. New England Journal of Medicine. 2016;374(11):1005-1007.

- Arrow KJ. Uncertainty and the Welfare Economics of Medical Care. The American Economic Review. 1963;53(5):141-149.

- Pauly MV. The Economics of Moral Hazard: Comment. The American Economic Review. 1968;58(3):531-537.

- Newhouse JP. A summary of the RAND Health Insurance Study. Annals of the New York Academy of Science. 1982;387:111-114.

- Nyman JA. Is ‘moral hazard’ inefficient? The policy implications of a new theory. Health Aff (Millwood). 2004;23(5):194-199.

- Rice TH. The Impact of Changing Medicare Reimbursement Rates on Physician-Induced Demand. Medical Care. 1983;21(8):803-815.

- Debpuur C, Dalaba MA, Chatio S, et al. An exploration of moral hazard behaviors under the national health insurance scheme in Northern Ghana: a qualitative study. BMC Health Services Research. 2015;15:469.

- Amy Finkelstein. With Kenneth J. Arrow, Jonathan Gruber, Joseph P. Newhouse, and Joseph E. Stiglitz. Moral Hazard in Health Insurance. New York: Columbia University Press. December 2014

- Lakdawalla D, Sood N. Innovation and The Welfare Effects of Public Drug Insurance. Journal of Public Economics. 2009;93(3-4):541-548.

- Havighurst CC, Richman BD. Distributive Injustice(s) in American Health Care. Law and Contemporary Problems. 2006;69(4):7-82.

- Dabora MC, Turaga N, Schulman KA. Financing and Distribution of Pharmaceuticals in the United States. JAMA. 2017 May 15. doi: 10.1001/jama.2017.5607.

- Hepatitis C Online. Sofosbuvir. https://www.hepatitisc.uw.edu/page/treatment/drugs/sofosbuvir-drug.

- Liao JM, Fischer MA. Early Patterns of Sofosbuvir Utilization by State Medicaid Programs. New England Journal of Medicine. 2015;373(13):1279-1281. doi: 10.1056/NEJMc1506108.

- Sagonowsky E. Fierce Pharma. AbbVie’s new pan-genotypic hepatitis C drug Mavyret deeply underprices the competition http://www.fiercepharma.com/pharma/abbvie-s-new-pan-genotypic-hep-c-drug-mavyret-undercuts-competition. Published Aug. 3, 2017.

- Schulman KA, Glick HA, Rubin H, et al. Cost-effectiveness of HA-1A monoclonal antibody for gram-negative sepsis: economic assessment of a new therapeutic agent. The Journal of the American Medical Association. 1991;266:3466-3471.

- Mark DB, Schulman KA. PCSK9 Inhibitors and the Choice Between Innovation, Efficiency, and Affordability. The Journal of the American Medical Association. 2017;318(8):711-712.

- Rasiel EB, Weinfurt KP, Schulman KA. Can prospect theory explain risk-seeking behavior by terminally ill patients? Medical Decision Making. 2005;25:609-613.

- Birkett DJ, Mitchell AS, McManus P. A Cost-Effectiveness Approach to Drug Subsidy and Pricing in Australia Economic Analyses of Drugs Have Led to Greater Efficiency and Access, but Costs Continue to Rise at Unsustainable Rates. Health Affairs (Millwood). 2001;20(3):104-114.

- Stiglitz, JE. Prizes, Not Patents. Project Syndicate. https://www.project-syndicate.org/commentary/prizes–not-patents?barrier=accessreg. Published March 6, 2007. Accessed November 1, 2017.

- Sood N, De Vries H, Gutierrez I, et al. The effect of regulation on pharmaceutical revenues: experience in nineteen countries. Health Affairs (Millwood). 2009;28(1).

- Schulman KA, Little L, Mullangi S, et al. AbbVie. Harvard Business School Case 316-095. 2016.

- Gilead. Gilead Sciences to Acquire Kite Pharma for $11.9 Billion. http://www.gilead.com/news/press-releases/2017/8/gilead-sciences-to-acquire-kite-pharma-for-119-billion Published August 28, 2017. Accessed November 1, 2017.

- Bradley J, Vandoros S. Creative compliance in pharmaceutical markets: the case of profit controls. Expert Review of Pharmacoeconomics Outcomes Research. 2012;12(1):31-38.

- Valverde AM, Reed SD, Schulman KA. Proposed ‘grant-and-access’ program with price caps could stimulate development of drugs for very rare diseases. Health Affairs (Millwood). 2012;31(11):2528-35.

- Steenhuysen, J. U.S. NIH. 11 drugmakers partner to accelerate cancer therapy research. Reuters. https://www.reuters.com/article/us-usa-healthcare-cancer/u-s-nih-11-drugmakers-partner-to-accelerate-cancer-therapy-research-idUSKBN1CH22E. Published October 12, 2017. Accessed November 1, 2017.

- Augustine NR, Madhavan G, Nass SJ. Making Medicines Affordable: A National Imperative. The National Academies of Sciences, Engineering, and Medicine. November, 2017.