Stephen T. Parente, Minnesota Insurance Industry Chair of Health Finance; Director Emeritus, Medical Industry Leadership Institute, Professor, Department of Finance, Carlson School of Management, University of Minnesota; Roger Feldman, Professor Emeritus, University of Minnesota

Contact: Stephen T. Parente, stephen.parente@gmail.com

Abstract

What is the message?

We examine the presence of deliberate diagnostic coding intensity for risk-based beneficiary prospective payments in Medicare Advantage (MA) compared to traditional fee-for-service Medicare from 2010 through 2014. We find that risk ratings based on adjusted diagnostic groups (ADGs) and hierarchical condition categories (HCCs) are similar for the fee-for-service population, but the ADG risk adjustor significantly reduces risk scores in the Medicare Advantage population. Like the HCC system, ADGs are based on patients’ diagnoses, but they are not used for MA payment. Our results suggest that upcoding within the risk adjustment system may have over-stated risk differences in the fee-for-service and Medicare Advantage populations, leading to higher payments to Medicare Advantage plans.

What is the evidence?

The analysis is based on large national samples of Medicare FFS and Medicare MA medical claims data for years of service 2010 to 2014.

Submitted: March 31, 2019; accepted after review: April 15, 2019.

Cite as: Stephen T. Parente, Roger Feldman. 2019. Comparing Diagnostic Coding Intensity for Medicare Advantage and Fee for Service. Health Management Policy and Innovation, Volume 4, Issue 1.

Overview

Medicare beneficiaries may choose to receive services from the traditional fee-for-service (FFS) program or from a private Medicare Advantage (MA) plan. For those who join an MA plan, the government makes a fixed, prospective payment adjusted by its estimate of the relative risk of the enrollee. The risk score for each enrollee is based on beneficiary demographics and diagnostic conditions known as Hierarchical Condition Categories (HCCs). The HCC diagnostic classification system begins by classifying over 14,000 diagnostic codes into a smaller number of diagnostic groups that represent related conditions (Pope, et al., 2011)[1].

For the two types of plans, the HCCs have different sources of data and a different impact on payments. For beneficiaries who chose the fee-for-service program, HCCs are obtained from claims that providers submit for payment. The HCC scores derived from those claims generally do not affect providers’ revenues. For Medicare Advantage, by contrast, hierarchies are imposed so that a person is coded for only the most severe manifestation among related diseases and then the conditions that best explain Medicare Part A and B expenditures are used to adjust the payments. MA plans submit HCCs to the Centers for Medicare and Medicaid Services (CMS) each quarter and the plans’ revenues increase if they can more comprehensively document the health conditions of their enrollees. This has led to concern that MA plans are coding their enrollees’ health conditions with greater intensity to receive higher payments (GAO, 2013; Kronick & Welch, 2014)[2][3], a tactic known as upcoding.

Determining the existence and extent of coding differences in intensity is difficult because observed differences in HCCs between FFS Medicare and MA plans could depend on risk selection as well as coding intensity. For example, HCCs in MA plans would be higher if people with more severe health conditions tend to enroll in MA plans.

Two recent studies have attempted to identify the differences in coding intensity due to upcoding. Alice Burns and Tamara Hayford followed a cohort of beneficiaries who were all in the FFS program in 2008. [4] Over the next five years, some stayed in FFS while others switched to MA plans. Burns and Hayford found that risk scores of the switchers grew faster than those of stayers, with the effect of MA enrollment on the growth in risk scores increasing over time.

Michael Geruso and Timothy Layton exploited the fact that MA enrollment within county markets increased rapidly following changes in MA payment policy in 2006. [5] If the same enrollee generates different risk scores in MA and FFS, then we should observe changes in market-level risk associated with the increase in MA market penetration. Geruso and Layton found that enrollees in MA plans generate 6% to 16% higher diagnosis-based risk scores than they would in FFS Medicare.

Thus, both studies hint at the idea that MA plans are selectively upcoding risk levels. Nonetheless, the implications do not fully rule out selection effects that might confound coding intensity and risk selection.

Our Study

We contribute to the literature on coding intensity by using a novel approach to separate coding intensity from risk selection. We first evaluate the HCC risk scores for two large samples of FFS and MA enrollees from 2010 through 2014. The results indicate consistently higher risk for MA enrollees. Then we use a different risk adjustor – the Johns Hopkins University ADGs – to evaluate the risk scores.[1] Like the HCC system, ADGs are based on patients’ diagnoses, but they are not used for MA payment. We find that ADGs and HCCs are similar for the FFS population, but the ADG risk adjustor significantly reduces risk scores in the MA population, making them approximately equal to FFS. As an additional analysis, we show that these effects apply to specific conditions where the two risk adjustment systems can be compared. Our results suggest that the current risk adjustment system over-states risk differences in the FFS and MA populations, consistent with the idea that MA plans are selectively upcoding.

Results

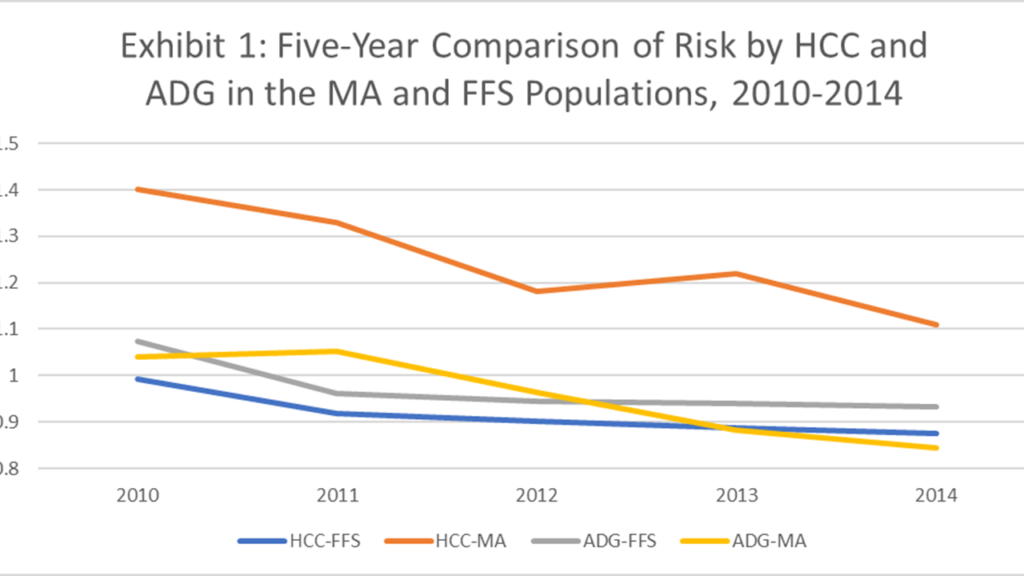

Exhibit 1 provides a five-year comparison of the FFS and MA populations using the payment-driving HCC risk adjustor and the non-payment ADG method. Both populations and methods show decreasing risks over time, but with differences for the two methods. The FFS population has a consistent pattern over time between the HCC and ADG methods. On the other hand, the MA population appears to have far greater risk when the HCC method is used rather than the ADG method.

Exhibit 1: Five-Year Comparison of Risk by HCC and ADG in the MA and FFS Populations, 2010-2014

Source: Medicare Fee for Service and Medicare Advantage Claims Data

Notes: Authors’ computations

In Exhibit 2, we show the results of a more detailed comparison of 2013 – 2014 MA versus FFS risk based on the prevalence of chronic and major conditions. While the MA population is often sicker than the FFS population, it is not always the case. For example, psycho-social conditions are less prevalent in the MA population than the FFS population. Also, the differences are far less for unstable chronic conditions between the FFS and MA population using ADGs (2014: 48% versus 42%). In our HCC-specific comparison we found the rate of HCC 18 (Diabetes) in the MA population to be almost twice the rate in the FFS population.

Exhibit 2: Prevalence of Chronic and Major Conditions in the MA and FFS Populations, 2013-2014

Source: Medicare Fee for Service and Medicare Advantage Claims Data

Notes: Authors’ computations

Implications: MA plans may be using code intensity to drive higher payments

We find evidence suggesting that MA plans may be using greater code intensity to drive higher risk scores and hence, higher payment rates. This greater coding intensity could be an indication of upcoding. For upcoding to be ruled out in the MA population, we would expect the HCC and ADG risk scores to be closely parallel, as they are in the FFS data. This was not the case.

The results have a practical policy implications. The differences in coding intensity suggesting upcoding may be addressed using the present practice, adopted in 2015, of ICD10-based HCCs instead of the ICD9 version used during the period of our study. Hence, a policy recommendation would be for CMS to repeat our analysis using the ICD10 versions of the HCCs and ADGs to examine the consistency of payment-based risk scores for the MA population versus one not used for payment. Hopefully, ICD10 is less susceptible to differences in coding intensity designed to take undue advantage of the government payment incentives. This is an empirical question to be addressed in future analyses comparing MA and FFS population data.

References

[1] Pope, Gregory C., John Kautter, Melvin J. Ingber, Sara Freeman, Rishi Sekar, and Cordon Newhart, Evaluation of the CMS-HCC Risk Adjustment Model, Final Report on CMS Contract No. HHSM-500-000291 TO 0006, RTI International, March, 2011; available at https://www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/downloads/evaluation_risk_adj_model_2011.pdf.

[2] Hayford, Tamara Beth and Alice Levy Burns, “Medicare Advantage Enrollment and Beneficiary Risk Scores: Difference-in-Differences Analyses Show Increases for All Enrollees On Account of Market-Wide Changes,” Inquiry, 55 (2018), 1-11.

[3] Kronick, Richard and W. Pete Welch, “Measuring Coding Intensity in the Medicare Advantage Program,” Medicare & Medicaid Research Review, 4:2 (2014), E1-E19.

[4] Burns, Alice and Tamara Hayford, “Effects of Medicare Advantage Enrollment on Beneficiary Risk Scores,” Congressional Budget Office, Working Paper 2017-18, November, 2017; available at http://www.cbo.gov/publication/53270.

[5] Geruso, Michael and Timothy Layton, “Upcoding: Evidence from Medicare on Squishy Risk Adjustment,” National Bureau of Economic Research, Working Paper 21222, April, 2018; available at http://www.nber.org/papers/w21222.

[6] The Johns Hopkins ACG® System, Version 11.0 Technical Reference Guide, Johns Hopkins Bloomberg School of Public Health, November, 2014; available at http://docplayer.net/22388017-The-johns-hopkins-acg-system-version-11-0-technical-reference-guide-november-2014.html.