R. Lawrence Van Horn, Vanderbilt University; Arthur Laffer, Laffer Associates; and Robert L. Metcalf, Concert Genetics

Abstract

Contact: Larry van Horn larry.vanhorn@vanderbilt.edu

Cite as: R. Lawrence Van Horn, Arthur Laffer, Robert L. Metcalf. 2019. The Transformative Potential for Price Transparency in Healthcare: Benefits for Consumers and Providers. Health Management Policy and Innovation, Volume 4, Issue 3.

Price Transparency Will Improve Healthcare Markets

The U.S. healthcare industry, which at $3.6 trillion in 2018 represents almost 18 percent of the U.S. economy, lacks available real prices at the time of purchase, despite the fact that an increasing share of Americans purchase healthcare services out of pocket. We believe that price transparency will benefit consumers by reducing costs associated with revenue cycles and reducing misallocation of resources, which in turn can simultaneously create opportunities for providers.

The U.S. healthcare industry lacks meaningful prices

In today’s healthcare industry, the concept of a relevant, meaningful price for healthcare services has been lost. The prices proffered in U.S. healthcare are wrong. Today’s prices do not reflect a market clearing price and thus miss beneficial transactions for consumers and producers.

Any rational discussion of pricing is further confused by the dominant and ambiguous role of insurance. There are charged amounts, allowed amounts, patient responsibility net of copays, coinsurance, and deductibles, all of which confuse the consumer and are hidden or unknown at the time of purchase.

Prices charged do not reflect any apparent underlying logic aligned with consumer interests. Recent empirical research show that the actual transactional price of healthcare services varies all over the place within the same hospitals, across hospitals within a market, across state lines, and between cash transactions versus transactions covered by insurance. Price transparency is an essential precursor if we hope to improve the health of Americans in a financially responsible manner.

Consider the following example. The average commercial price for a prostatectomy in Washington DC is $33,285, with a range from $18,151 to $60,853, a difference of more than 330 percent. [1] An individual with a family deductible of $7,000 and 20 percent coinsurance would face out-of-pocket costs of between $9,230 and $17,770 using their insurance. However, a pure cash price alternative is available at $13,968. [2] Hence, if the insurer’s negotiated rates are in the top quartile, the individual would be better off paying cash.

This example highlights both the significant price variation as well as the potential for up front transparent cash prices to benefit consumers. These findings suggest that the healthcare market is dysfunctional as a result of market failure due to a lack of price and quality transparency available to consumers at the time of purchase.

With 30 percent of the employed workforce now in high-deductible health plans, households are being been transformed into at-risk, cash-wielding consumers. After deductibles are met, many individuals are still subject to coinsurance payments. Thus, negotiated prices are crucial to decision-making and providers increasingly must receive payment directly from patients. Taken together, out-of-pocket “patient responsibility” is now the third largest payer in most U.S. hospitals. Consumers—even determined consumers—cannot discern in advance the price they will pay for basic medical services.

Forty years of expanding third-party insurance has created a payment apparatus that is opaque to a consumer. Contracts are based on unit of services, Current Procedural Terminology codes, or Diagnosis Related Groups that do not conform to common sense ways in which patients would purchase medical care. Furthermore, contracted rates between payors and providers are protected as proprietary and confidential elements despite patients being enjoined financially to their terms ex post. In other markets such as hotels, airlines, and higher education price discrimination is common, but not even in the darkest recesses of the market such as payday loans do we require consumers to pay prices not discernable in advance. Quite simply, this is a problem where transparency regulation is a reasonable intervention.

The move to high deductible health plans

One of the most significant shifts in healthcare demand over the last decade is the steady rise of high deductible plans. Of the 153 million commercially insured individuals, 82 percent have a health plan with a minimum annual deductible, paid by the member, before coverage begins. The average annual deductible is $1,655, up 41 percent since 2014 and 162 percent since 2009. The percentage of households impacted by higher deductibles is growing fast—70 percent of single coverage deductibles exceed $1,000 and more than 30 percent exceed $2,000, up from 18 percent just five years ago. [3]

This shift to high deductibles has created a large and growing segment of consumers paying cash for healthcare services. In 2017, consumers spent $365 billion out of their own pockets [4]. This is less than Medicare ($660 billion) and Medicaid ($521 billion), but greater than any single private insurer. At the same time, there are now more than 25 million Health Savings Accounts that hold $53.8 billion in assets, up 19 percent over the previous year. [5]

Non-value-added healthcare expenditure is high

U.S. spending on healthcare is 17.8 percent of GDP, considerably greater than ten other similar countries, where the mean is 11.5 percent. The major drivers of higher spending are not demographics, social determinants, public health spending, or over-utilization of healthcare services, although each of those items vary, but rather higher administrative costs and higher prices.

A 2019 article estimated the total cost of waste in U.S. healthcare to be as high as $935 billion, about 25 percent of total spend. The largest two drivers of waste were administrative complexity ($265.6 billion) and pricing failure ($240.5 billion). [6] Administrative costs accounted for 8 percent of healthcare spending, versus 1 percent to 3 percent in other developed countries. U.S. healthcare service prices are substantially higher than comparable counties, driven primarily by input prices and pharmaceutical spend that are twice that of other high income countries. [7]

Price transparency offers business opportunities for providers

Price transparency promises major business opportunities for providers. The healthcare marketplace has increased in complexity in both terms of service and organization over the last 40 years. This complexity has distanced these organizations from their consumers and the industry has lost sight of consumer preferences, consumer experience, and the practical constraints on the consumer’s ability to pay. This mismatch between producers and consumers of healthcare services leads to an opportunity for a new entrant to simplify, cut prices, and radically change the industry structure.

Three components combine to create this unprecedented opportunity for providers to transform healthcare markets: 1) the move toward high deductible plans in the employer sponsored market, 2) the presence of significant non-value-added activities in and around heath care transactions, and 3) the extreme price variation and high price levels in healthcare markets. As price transparency expands, either by government mandate or market pressure, a growing body of research suggests that average prices to consumers will decline. More importantly, price transparency fosters a market-driven environment that rewards innovative provider models.

This is the path of creative destruction and disruptive innovation supported by free markets. For providers with distinguished brands or services differentiated in terms of quality, cost, or both, this is a moment to seize a once-in-a-generation opportunity to lead, transform, and benefit consumers and themselves.

Healthcare Price Variation Has A Major Impact on Consumers

Consumers increasingly are facing higher out-of-pocket costs

As high deductible plans proliferate, consumers will increasingly face the full price of medical care services until their deductible is met. This price could either be hidden price, one negotiated in secret between payor and provider or, with greater transparency, it could be a price posted up front by the provider. Numerous studies have indicated that the price level will change depending on the path taken.

A 2019 report by the RAND Corporation analyzed price variation in hospital services using employer-sponsored private health plan claims data. Using Medicare pricing methodologies, including the imbedded adjustment for patient populations, regional variations in cost, and other factors such as research costs, the study recalculated employer sponsored claims as if they were Medicare claims. This effectively created an adjusted baseline price for facility and state-by-state comparison. Hospital prices, combining inpatient and outpatient services, varied significantly by state, ranging from a low of 150 percent of Medicare (Michigan) to a high of 300 percent (Indiana). Prices ranged even more for outpatient services, where the maximum reimbursement was 600 percent of Medicare. [8]

A new comparison of bundled cash prices to commercial reimbursement for similar services

While prior research has documented both the price level and price variation paid by commercial insurers relative to Medicare, to date there has not been a comparison with cash prices for similar services. We performed such a comparison of bundled cash prices for a subset of services compared with commercially reimbursed amounts for the same service bundles.

We began by obtaining a sample of more than one billion claims for commercial insurers for July 2017 to July 2019. [9] These claims were then bundled into services by incorporating the most common professional and institutional claims that are associated with the procedure. From this information we calculated the allowed amount, which is the true price.

We performed the same exercise for cash payment of equivalent services over a similar time frame utilizing data supplied by MDSave, the largest cash transaction platform in the U.S. MDSave allows providers to place transparent cash prices in the market and, in turn, enables consumers to purchase a bundled healthcare service online thereby mirroring consumer e-commerce experiences in most other sectors. The consumer receives a voucher for the service at the chosen provider and the provider receives reimbursement from MDSave within a week of service delivery. This is a largely frictionless transaction.

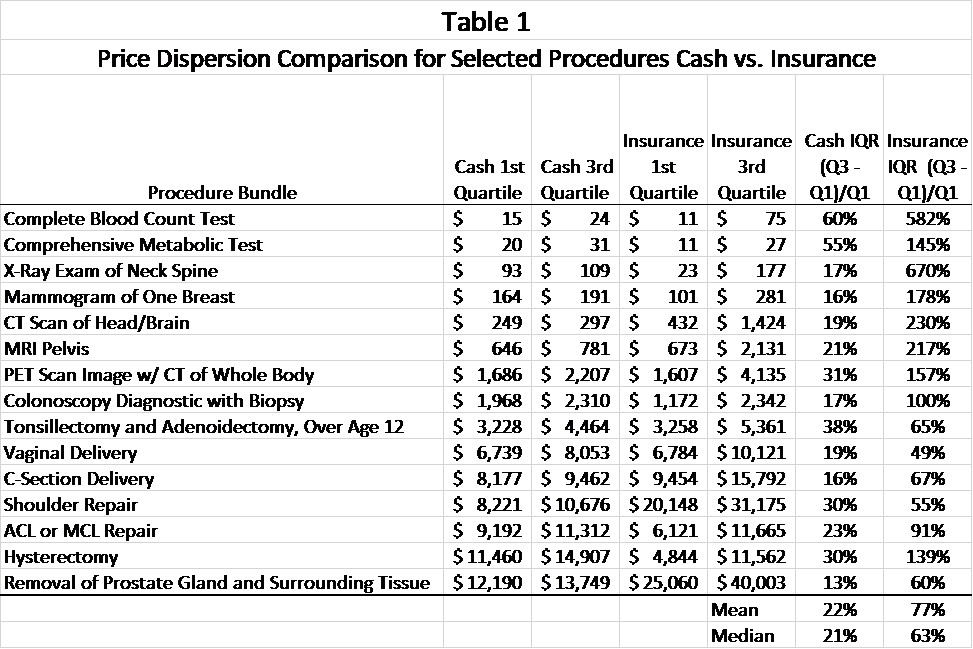

Table 1 compares the spread between cash and insurance in prices for the same 15 bundled procedures. We compare select lab, imaging, and routine procedures. We chose to report the 25th and 75th percentile interquartile ranges as this middle 50 percent of the respective distribution is the most conservative comparison.

Several observations are noteworthy. Focusing first on individual price levels, the 25th percentile for cash is lower than the insurer price in about half the cases. With two exceptions, however, the 75th percentile cash price is less expensive than the insurer price, often substantially. Thus, the cash price tends to be lower at the higher end of the price range.

Second, we constructed a market basket of services, weighted by the relative frequency of procedures, and quantified the difference in the average cash versus insurer price. On average, the cash price was 39 percent less expensive for the same market basket compared with the insurer price.

Third, the mean interquartile spread is 22 percent for cash compared to 77 percent for insurance. Hence, there is significantly more variation in the distribution of insurer prices for the same service. Moreover, insurer prices are frequently higher at the high end.

Why the comparisons matter

The results of the studies are important. If there were little variation in price, the cost of not shopping would be low. For example, few individuals engage in active search for gasoline prices as the market is competitive and the variation is low, with price variation mainly driven by location differences.

By contrast, the healthcare evidence here suggests that, given the significant price variation in the insurer market, consumers are significantly disadvantaged if they do not shop. It is not plausible for service or quality differences to warrant such price variation. Instead, this data is consistent with a market characterized by limited price competition.

Again, these differences are important. The RAND study estimated that shifting prices from the 75th percentile to the 25th percentile would reduce hospital care costs for employers by 40 percent. This would have a major impact on healthcare expenditures, because hospital care accounts for 44 percent of total personal healthcare spending for privately insured individuals.

Impact Of Transparency On Prices

A limited body of peer-reviewed literature has further quantified the impact of transparency on healthcare prices. James Robinson and Timothy Brown analyzed a 2011 price transparency program with California Public Employees Retirement System enrollees. In this program, enrollees were provided with procedure-specific shoppable prices for hip and knee replacements, as well as a list of high quality, low cost facilities. Furthermore, if the enrollee elected a high cost facility, he or she was liable for any amount above the reference price. In the first year of the program, employees chose low cost facilities 21.2 percent more frequently and high cost facilities 34.3 percent less frequently. Prices at low cost facilities remained constant and high cost facility prices declined by 18 percent. [10]

A 2014 article analyzed claims data for three common services—laboratory tests, advanced imaging, and clinician office visits—comparing a cohort of employees that used employer-provided price transparency platforms with those that did not. Use of the price transparency platform resulted in lower reimbursement prices in all three areas, albeit with greater reduction in laboratory and imaging than in clinician office visits. [11] Similar results were found in a 2019 study of the Kentucky Employee Health Plan [12] and by Hans Christensen and colleagues. [13]

The Southwest Airlines Analog

Southwest disrupted the airline industry

Southwest Airlines provides a useful example from another industry. Consider the airline industry in 1970, before Southwest. The industry was highly regulated, complex, and inefficient, with prices so high that most consumers could not afford to fly. Along came a visionary, Southwest Airlines founder Herb Kelleher, with an entirely contrarian perspective. He believed that if air travel could be reimagined, reengineered, and delivered at far lower cost, new consumers would flood into the market.

Kelleher had a fundamentally different belief about underlying demand and demand elasticity for airline travel. The existing market incumbents, oriented toward business travel, assumed a relatively inelastic demand for air travel. Kelleher’s conjecture was that the demand for recreational travel was huge, but price elastic. Reaching this market required radical changes to services, delivery, production, distribution, and pricing.

Incumbents argued that the changes were heresy and that regulation was necessary to prevent collapse of the industry. Those same incumbents sued to prevent Southwest from offering low-cost and regulatory-exempt flights within the state of Texas. Because of this opposition and regulatory inertia, four years passed before Southwest could fly its first flight. This path to launch was so arduous that Kelleher described the first flight as his “proudest moment in business,” which he celebrated by crying and kissing the airplane. [14]

Forty years later, we know that Herb Kelleher was right. Airline prices have dropped by half and Americans travel by air five times more frequently. [15, 16]

Reduced air travel prices have not come at the cost of safety, reduced wages, or lower customer satisfaction. Air travel is also safer now than ever before. [17] Southwest pilots are the most productive and among the highest paid in the industry. [18, 19] Southwest Airlines has the highest customer satisfaction of any U.S. airline. [20]

Consider the parallels in U.S. healthcare

We believe there are logical parallels to the U.S. healthcare industry. Consider regulation and complexity. Healthcare regulation today is greater than that of the airline industry in 1970, as healthcare is regulated in each state and by multiple national governing bodies. Also like the 1970s airline industry, healthcare processes and systems have grown to staggering levels of complexity. The healthcare industry continues to invest in infrastructure and services that a cash-paying customer would not value, further increasing costs.

Now compare the price state of healthcare. A baby delivery in 1960 was 1.6 times the price of a flight from Chicago to Phoenix. Today a normal baby delivery is 30 times the price of such a flight.

The Size Of The Opportunity Depends On Elasticity Of Demand

Ultimately, the size of the opportunity in healthcare depends on the elasticity of demand. While estimating elasticity is difficult, research suggests the demand for medical care is relatively inelastic. Randall Ellis and colleagues estimated elasticities, depending on the type of service, to range from -0.02 to -0.44. [21] If demand is relatively inelastic, reflecting these estimates, the opportunity is smaller. Most benefits of price transparency would be limited to reduction in administrative costs.

As noted above, however, even in this more limited case, the opportunity is massive. Administrative waste in healthcare is estimated to be twice the size of the U.S. airline industry. [22] By charging cash-paying customers upfront, even at lower prices, providers can differentiate and remove downstream costs. Simplifying payments would also go a long way to address some of the worst aspects of health, including harassing and suing indebted patients. [23]

Yet healthcare demand might actually be more price elastic. Amanda Kowalski estimates demand elasticities between -0.76 and -1.49, significantly higher than prior estimates. [24] This estimate places us in the world of Southwest Airlines circa 1970.

The cash pay market for healthcare is already large, at more than $300 billion per year, and will continue to grow. Even at moderate price elasticities, the opportunity is substantial. Price-sensitive consumer demand, not government regulation, will drive the industry to a new equilibrium in service, venue, and price.

Looking Forward: Price Transparency Will Benefit Consumers and Create Opportunities For Providers

In industry after industry, consumer-driven innovation has led to improved customer experience and cost reduction. Even in regulated, capital-intensive markets with high barriers to entry, such as financial services, telecommunications, energy, and transportation, consumer-led innovation is spurring transformation. Healthcare should be next.

One might expect that reducing prices for healthcare services would result in lower physician salaries or net income to providers. However, such reductions will not necessarily occur. Given the estimates of pricing failures and administrative waste, simplification of the revenue cycle that addresses both issues holds the promise for a bright future.

Fifty years of insulation from consumer-driven demand signals has brought minimal health gains at massively increased costs. Consumers and healthcare leaders should be seeking to become and empower agents of change. Who will step forward as the Herb Kelleher of healthcare?

References and Notes

[1] Estimates based on authors’ analysis of 835 ERA information in the Washington DC market.

[2] Reported on MDSave.com, accessed 12/4/2019.

[3] Claxton G, Rae M, Damico A, Young G, McDermott D, Whitmore H. Health benefits in 2019: Premiums inch higher, employers respond to federal policy. Health Affairs 38 (10), 2019: 1752-1761.

[4] 2017 National Health Expenditures, Center for Medicare and Medicaid Services. [accessed 2019 December 5, 2019; available from: https://go.cms.gov/2qfLsDz ]

[5] 2018 Year-End Devenir HSA Research Report, [accessed Dec 5, 2019; available from: https://www.devenir.com/research/2018-year-end-devenir-hsa-research-report/ ]

[6] Shrank WH, Rogstad T, Parekh N. Waste in the U.S. health care system: Estimated costs and potential for savings. Journal of the American Medical Association 322(15), 2019, October 7: 1501-1509. This study reviewed and consolidated 71 estimates from 54 unique peer-reviewed publications, government reports, and other literature.

[7] Papanicolas I, Woski L, Jha AK. Health care spending in the United States and other high-income countries. Journal of the American Medical Association 319 (10), 2018:1024-1039.

[8] White C, Whaley C. Prices paid to hospitals by private health plans are high relative to Medicare and vary widely: Findings from an employer-led transparency initiative. Santa Monica, CA: RAND Corporation, 2019. https://www.rand.org/pubs/research_reports/RR3033.html

[9] These claims are electronic remittances (ERAs), otherwise known as 835 transactions.

[10] Robinson JC, Brown T. Increases in consumer cost sharing redirects patient volumes and reduce hospital prices for orthopedic surgery. Health Affairs 32(8), Health IT, Payment & Practice Reforms, August 2013. Available from https://www.healthaffairs.org/doi/full/10.1377/hlthaff.2013.0188

[11] Whaley C, Schneider CJ, Pinkard S, Kellerman G, Bravata D, Kocher R, Sood N.

Association between availability of health service prices and payments for these services. Journal of the American Medical Association, 312 (16), 2014 October 22-29: 1670-6. Prices declined by 13.93 percent (laboratory tests), 13.15 percent (advanced imaging), and 1.02 percent (clinician office visits).

[12] Rhoads J. Right to shop for public employees: How health care incentives are saving money in Kentucky. 2019 March 8. [accessed 2019 December 5; available from: http://bit.ly/2Rg5uJj ]

[13] Christensen HB, Floyd E, Maffett M. The effects of price transparency regulation on prices in the healthcare industry. [cited 2019 December 5; available from: https://www.bakerinstitute.org/media/files/event/01ce2e80/HPF-paper-AHEC-Floyd.pdf ]

[14] Herb Kelleher, quoted in “17 powerfully inspiring quotes from Southwest Airlines founder Herb Kelleher” by Peter Economy. [accessed 2019 December 5; available from: http://bit.ly/2LeOVd4 ]

[15] Thompson D. How airline ticket prices fell 50 percent in 30 years (and why nobody noticed). The Atlantic, 2013, February 28. [accessed 2019 December 5; available from: http://bit.ly/34FuFst ]

[16] International Civil Aviation Organization. Civil Aviation statistics of the world and ICAO staff estimates: Air transport, passengers carried, United States. [accessed 2019 December 5; available from: http://bit.ly/2OFmnv3 ]

[17] Aviation Safety Network, Flight Safety Foundation [accessed 2019 December 5; available from: https://aviation-safety.net/statistics/period/stats.php?cat=A1 ]

[18] MIT Global Industry Program, Airline Data Project. Total pilot and copilot average block hours per month, 2018. [accessed 2019 December 5; available from: http://web.mit.edu/airlinedata/www/Employees&Compensation.html ]

[19] MIT Global Industry Program, Airline Data Project. Total pilot wages & salaries and benefits & payroll taxes per pilot employee equivalent, 2018. [accessed 2019 December 5; available from: http://web.mit.edu/airlinedata/www/Employees&Compensation.html ]

[20] J.D. Power. 2019 North America airline satisfaction study. [accessed 2019 December 5; available from: https://www.jdpower.com/business/press-releases/2019-north-america-airline-satisfaction-study ]

[21] Ellis RP, Martins B, Zhu W. Health care demand elasticities by type of service. Journal of Health Economics 55, 2017: 232-243.

[22] The U.S. domestic airline industry reached $146.6 billion in revenue per year according to the IBISWorld Domestic Airlines in the U.S. Industry Report, June 2019. [accessed 2019 December 5; available from: http://bit.ly/2P7SBOy ]

[23] Makary M. The price we pay: What broke American health care and how to fix it. Bloomsbury Publishing, 2019.

[24] Kowalski A. Censored quantile instrumental variable estimates of the price elasticity of expenditure on medical care. Journal of Business & Economic Statistics 34(1), 2016: 107-117.