Inmaculada Hernandez, Nico Gabriel, Skaggs School of Pharmacy and Pharmaceutical Sciences, University of California, San Diego; Jingchuan Guo, University of Florida College of Pharmacy; Aryana Sepassi, University of California, Irvine School of Pharmacy & Pharmaceutical Sciences; Walid F. Gellad, University of Pittsburgh School of Medicine; and Sean Dickson, West Health Policy Center

Contact: inhernandez@health.ucsd.edu

Abstract

What is the message? The authors use glucagon-like peptide-1 receptor agonists (GLP-1 RAs), medications used in the treatment of type 2 diabetes and obesity, to dissect manufacturer discounts into discounts negotiated between manufacturers and payers, or commercial discounts, versus mandatory discounts. Manufacturer discounts increased sharply after approval, representing over half of the gross sales in 2019. Although both mandatory and voluntary discounts increased over time, mandatory discounts increased faster, driven by Medicaid and 340B programs.

What is the evidence? Data from SSR Health for five GLP-1 RAs to estimate the difference between gross and net sales, which represents total discounts.

Timeline: Submitted: June 10, 2023; accepted after review Sept. 1, 2023.

Cite as: Inmaculada Hernandez, Nico Gabriel, Jingchuan Guo, Aryana Sepassi, Walid F. Gellad, Sean Dickson. 2023. Decomposition of Pharmaceutical Manufacturer Discounts into Voluntary and Mandatory Discounts for Glucagon-Like Peptide-1 Receptor Agonists. Health Management, Policy and Innovation (www.HMPI.org), Volume 8, Issue 2.

Financial disclosure: This work was funded by the West Health Policy Center.

Role of Funder/Sponsor Statement: The funder was involved in the design and conduct of the study, in the interpretation of results, and in the preparation and review of the manuscript. The funder was not involved in collection, management, or analysis of the data. The study was not submitted to the funder for approval, and the funder had no role in the decision to submit the manuscript for publication.

Acknowledgement: Gabriel had full access to all the data in the study and takes responsibility for the integrity of the data and the accuracy of the data.

Introduction

Rising manufacturer discounts for prescription drugs have resulted in increasingly diverging trends between the price tag of medications (list prices) and the average revenue to pharmaceutical manufacturers per unit after discounts (net prices).1 The overall difference between the list and the net prices of a drug, often called the “gross-to-net-bubble,” comprises mandatory discounts under government programs (including Medicaid, 340B, and the coverage gap discount program), as well as voluntary discounts negotiated between manufacturers and pharmacy benefit managers. These voluntary discounts, which we refer as “commercial discounts”, are confidentially negotiated in the Part D and group health insurance markets in exchange for formulary placement. To our knowledge, no study has estimated to what extent rising differences between list and net prices in the initial post-marketing years of a drug are driven by rising mandatory versus commercial discounts. While drug manufacturers continue to argue that minimum discounts required under the Inflation Reduction Act will substantially impact revenue, little information is available to allow policymakers to weigh the veracity of these claims. This study sheds light on the relative magnitude of both commercial and mandatory discounts in a recent class of drugs that will soon be eligible for Medicare negotiation.

The decomposition of manufacturer discounts into mandatory versus voluntary commercial discounts has been limited by the lack of data on commercial discounts. Although mandatory discounts are calculated using statutory formulas, discounts to Medicaid and 340B programs depend on commercial discounts due to the Best Price provision. Specifically, the Best Price provision stipulates that the Medicaid base rebate for branded drugs will equal the greater of 23.1% of list price or the highest discount offered to any purchaser. As a result, it is not possible to accurately estimate Medicaid and 340B discounts without data on commercial discounts. In recent years, investment firms have estimated manufacturer discounts using net sales data from company reports.2 While the use of these indirect estimations of net prices constituted a major advance to the pharmaceutical pricing literature, these existing data sources are not able to accurately isolate voluntary commercial discounts from mandatory discounts.3 This is because they do not account for the Best Price provision and they bundle 340B and coverage gap discounts with commercial discounts, which results into overestimated commercial discounts. To overcome these limitations, we recently developed an algorithm that leverages data from multiple sources to isolate commercial discounts from mandatory discounts under the Medicaid, 340B, and coverage gap programs.4 Our methodology accounts for the relationship between commercial discounts and Medicaid base rebates established by the Best Price provision, as well as by the Medicaid rebate cap.

We apply this novel peer-reviewed methodology4 to quantify temporal trends in manufacturer discounts of glucagon-like peptide-1 receptor agonists (GLP-1 RAs), a class of medications utilized in the treatment of type 2 diabetes and obesity, and to understand to what extent rising manufacturer discounts represent mandatory versus commercial discounts. This question is relevant because evaluations of rising discounts have heretofore focused on mature therapeutic classes that have been on the market for years.5–7 The isolation of commercial discounts for new therapeutic classes is important to compare discounts currently negotiated between manufacturers and payers with those required by the Inflation Reduction Act for drugs facing price negotiation after the ninth year post-approval.7 We selected GLP-1 RAs for our case study because of the market entry in recent years of multiple drugs considered therapeutically comparable, leading to competition through commercial discounts for formulary placement.

Methods

Study Sample

We identified GLP-1 RAs approved by the Food and Drug Administration for the treatment of type 2 diabetes before 2019. We did not include the GLP-1 RA approved for the treatment of obesity (Saxenda) in our sample, as this drug is not covered by Medicare Part D and therefore lacks data required for the estimation of discounts. For the selected drugs, we extracted 2012-2019 data from four sources: 1) net sales and total units from SSR Health;2 2) Medicare Part D claims data from a 5% sample of Medicare beneficiaries; 3) units and spending from the Centers for Medicare and Medicaid Services (CMS) spending dashboards;8,9 and 4) Medicare Part D prescriber utilization files.10 Adlyzin (lixisenatide) lacked SSR Health data and only had 24 Part D users in 2020; therefore it was excluded from analyses. The resulting sample included Bydureon (once weekly exenatide), Byetta (twice daily exenatide), Ozempic (semaglutide), Trulicity (dulaglutide), and Victoza (liraglutide).

Estimation of Gross Sales, Net Sales, and Total Discounts

Gross sales were estimated by multiplying the list price, extracted from SSR Health, by the total number of units sold obtained from Symphony Health.11 Net sales were extracted from SSR Health data and represent the average revenue per unit of product reported by manufacturers to shareholders or the US Securities and Exchange Commission.2 Estimates of net sales and prices from SSR Health have previously been used in the peer-reviewed literature.1,4,12 The difference between gross and net sales represents the total discount.

All outcomes were reported for each product and year. Because SSR Health estimates are sensitive to inventory variation, we did not report data for new products the first year after market entry, as previously done in the literature.4 Pharmaceutical manufacturers do not separately report net sales for each formulation, which precluded formulation-specific calculations. As a result, all outcomes were reported at the brand level, inclusive of all formulations and strengths within a brand name.

Decomposition of Total Discounts into Voluntary versus Mandatory Discounts

We decomposed total discounts into manufacturer discounts negotiated in commercial and Medicare Part D markets (commercial discounts) and mandatory discounts, which included discounts to Medicaid, 340B discounts, and coverage gap discounts in Medicare Part D. To do so, we estimated discounts to Medicaid, 340B discounts, and coverage gap discounts in Medicare Part D, and assumed that the difference between total discounts and the sum of these mandatory discounts represented commercial discounts. Due to the unavailability of data, discounts to Federal programs including the Department of Defense or Department of Veterans Affairs could not be separately estimated. As a result, these federal discounts were included under the commercial discounts category. This limitation however should have a minimal impact as these federal programs account for less than 5% of expenditures on prescription drugs.13

Medicaid Discounts

For each product and year, we estimated Medicaid discounts by multiplying the number of units reimbursed by Medicaid (obtained from the spending dashboard) by the Medicaid discount per unit. We estimated the Medicaid discount per unit the product as the sum of the base rebate and the inflation rebate. In doing so, we used a published algorithm developed by our research team that accounts for Best Prices set by commercial discounts and for the Medicaid rebate cap.4 This is explained in detail in the Supplemental Material.

340B Discounts

We estimated 340B discounts by multiplying the number of units sold for a given product that were eligible for 340B discounts by the 340B discount per unit, which is equivalent to the Medicaid discount per unit, as explained above. Due to the unavailability of claims data from commercial insurance and Medicaid, we used Medicare Part D claims data to estimate the proportion of units for a given product that were eligible for 340B discounts and extrapolated it to the entire market. We did not repeat the same exercise using Part B claims as GLP1-As are not covered by Medicare Part B.

To estimate the proportion of Part D units for a given product that were eligible for 340B discounts, we extracted all Medicare Part D claims filled for the sample of drugs and quantified the proportion of units that were prescribed by 340-affiliated providers and dispensed in 340B pharmacies. To identify claims originating from 340B-affiliated providers, we matched the Medicare Part D Prescriber Utilization File10 to the 340B Covered Entity File for each year,12 as previously done.4,12 To identify claims dispensed at 340B pharmacies, we matched the dispensing pharmacy to the 340B Pharmacy File obtained from Health Resources & Services Administration.14

Coverage Gap Discounts

We also used Part D claims data from a 5% random sample of Medicare beneficiaries to quantify discounts under the Medicare Part D coverage gap discount program. Using the variable capturing gap discount amount reported in claims, we summed the total coverage gap discounts for each product and year in the 5% sample, and extrapolated the results to the entire Medicare population by multiplying by 20.

Data Analysis and Reporting

We first report trends in gross sales in 2012-2019 for each product. To understand to what extent trends in gross sales were driven by changes in list prices versus changes in utilization, we report temporal trends in list price changes and in the number of units sold per product every year. We then report trends in net sales, total discounts, and each discount type, all in nominal U.S. dollars. We report the proportion of gross sales and of total discounts represented by each discount type every year. Finally, to understand to what extent changes in Medicaid and 340B discounts are explained by changes in utilization versus changes in discounts per unit, we report trends in Medicaid and 340B utilization and in the Medicaid (and 340B) discount per unit.

Results are reported for the final set of products, which includes Bydureon (once weekly exenatide), Byetta (twice daily exenatide), Ozempic (semaglutide), Trulicity (dulaglutide), Victoza (liraglutide). Figures are not represented for Ozempic, as it only has 2019 data available due to its December 2017 approval.

Results

Trends in Gross Sales, Net Sales, and Total Discounts

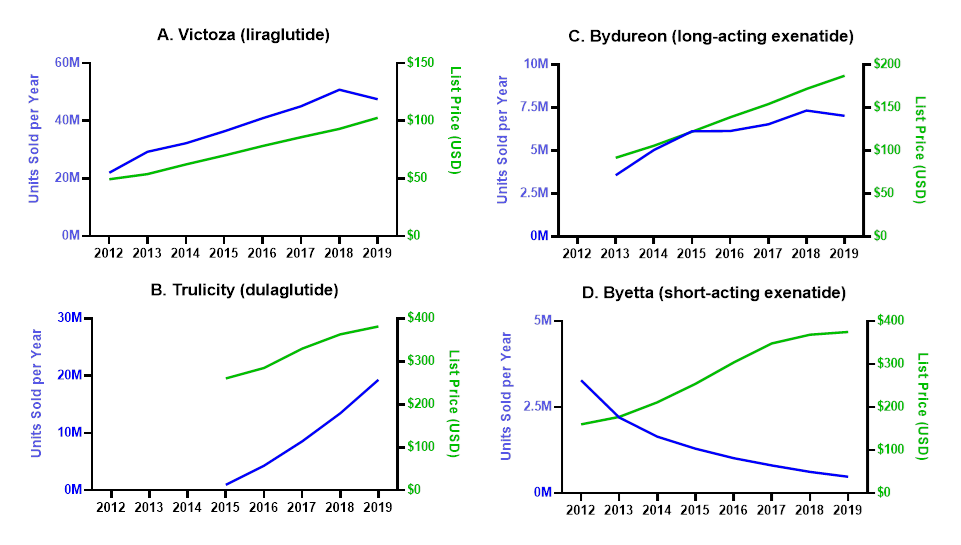

All products except Byetta had large increases in gross sales (Table 1), driven by a combination of list price and utilization increases (Figure 1). Byetta gross sales decreased from $526 million in 2012 to $179 million in 2019 as its utilization decreased by 85% .

Table 1. Proportion of Gross Sales Accounted by Each Discount Type.

| Gross Sales a | Gross-to-net Bubble (Total Discounts)b | Gross-to-net Bubble as % of Gross Sales | Discount Amount (Proportion of Gross Sales Accounted by Each Discount Type) | ||||||

| Mandatory Discounts | Voluntary Negotiated Commercial Discounts c | ||||||||

| Coverage Gap Discounts | 340B Discounts | Medicaid Discounts | |||||||

| Bydureon | |||||||||

| 2013 | $327 M | $64 M | 19.7% | $8M (2.4%) | $3M (0.8%) | $3M (0.9%) | $51M (15.6%) | ||

| 2019 | $1317 M | $858 M | 65.1% | $69M (5.3%) | $82M (6.2%) | $100M (7.6%) | $607M (46.1%) | ||

| Byetta | |||||||||

| 2012 | $526 M | $103 M | 19.5% | $12M (2.2%) | $2M (0.3%) | $14M (2.6%) | $76M (14.4%) | ||

| 2019 | $179 M | $111 M | 62.0% | $11M (6.0%) | $10M (5.8%) | $16M (8.8%) | $74M (41.3%) | ||

| Ozempic | |||||||||

| 2019 | $2861 M | $1420 M | 49.6% | $74M (2.6%) | $112M (3.9%) | $69M (2.4%) | $1,164M (40.7%) | ||

| Trulicity | |||||||||

| 2015 | $254 M | $46 M | 18.1% | $5M (1.9%) | $2M (0.9%) | $1M (0.5%) | $37M (14.7%) | ||

| 2019 | $7367 M | $4212 M | 57.2% | $294M (4.0%) | $498M (6.8%) | $256M (3.5%) | $3,164M (42.9%) | ||

| Victoza | |||||||||

| 2012 | $1084 M | $112 M | 10.3% | $18M (1.7%) | $3M (0.3%) | $13M (1.2%) | $78M (7.2%) | ||

| 2019 | $4883 M | $2743 M | 56.2% | $254M (5.2%) | $396M (8.1%) | $413M (8.5%) | $1,679M (34.4%) | ||

| All SGLT2 Combined | |||||||||

| 2019 | $16607 M | $9343 M | 81.4% | $703M (4.2%) | $1,098M (6.6%) | $854M (5.1%) | $6,688M (40.3%) | ||

a Gross sales represent annual sales for a product at list price, before discounts are applied.

b Total discounts was calculated as the difference between gross and net sales.

c Commercial discounts represent voluntary discounts negotiated between manufacturers and Pharmacy Benefit Managers in the commercial and Medicare Part D markets. Discounts to the Department of Defense, Department of Veterans Affairs, or other Federal programs are included under commercial discounts, as acknowledged in the limitations.

Figure 1. Contribution of Changes in List Price and Utilization Towards Trends in Gross Sales

The units sold in a given year for each product and are plotted in the left Y axis. List prices are represented on the right Y axis.

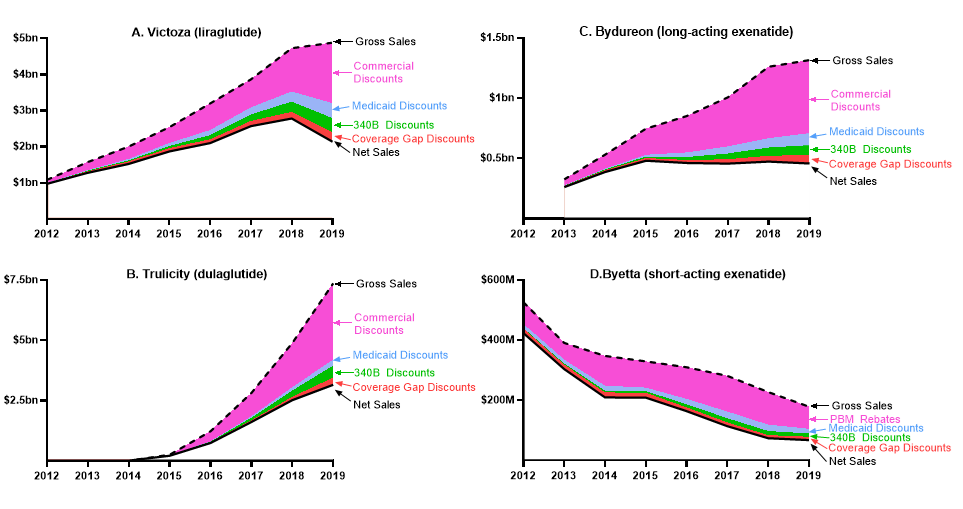

Gross sales of Victoza increased from $1.0 billion in 2012 to $4.8 billion in 2019 (Table 1), driven by a 108% increase in list price and a 116% increase in utilization (Figure 1A). In this period, total discounts increased from 10.3% of gross sales to 56.2%. As a result of these trends, net sales increased from $971 million in 2012 to $2.8 billion in 2018 and then decreased to $2.1 billion in 2019 (Figure 2A).

Figure 2. Trends in Gross Sales, Net Sales, and Discounts

Gross sales represent annual sales at list price, before discounts are applied (dashed line). Net sales represent annual revenue, after discounts are applied. The difference between gross and net sales represents total discounts. Commercial discounts represent voluntary discounts negotiated between manufacturers and Pharmacy Benefit Managers in the commercial and Medicare Part D markets. Discounts to the Department of Defense, Department of Veterans Affairs, or other Federal programs are included under commercial discounts, as acknowledged in the limitations.

Gross sales of Trulicity increased from $254 million in 2015, the year after approval, to $7.4 billion in 2019 (Table 1). In this period, discounts increased from or 18.1% of gross sales to 57.2%. As a result, net sales increased from $208 million in 2015 to $3.2 billion in 2019 (Figure 2B).

Gross sales of Bydureon increased from $327 million in 2013 to $1.3 billion in 2019 (Table 1), driven by a 97% increase in utilization and a 104% increase in list price (Figure 1B). In the same period, total discounts increased from or 19.7% of gross sales to 65.1%. Net sales increased in 2013-2015, when they peaked, and remained relatively constant in 2015-2019 (Figure 2B).

For all five products included in the sample combined, total manufacturer discounts in 2019 were estimated at $9.3 billion, or 56.3% of gross sales (Table 1).

Decomposition of Total Discounts into Voluntary and Mandatory Discounts

Mandatory Discounts

From 2012-2019, mandatory discounts represented the minority of total discounts, although the share of total discounts represented by mandatory discounts increased across the study period, driven by Medicaid and 340B discounts. For example, for Victoza, Medicaid discounts increased from 11.3% of total discounts in 2012 to 15.1% in 2019, and 340B discounts increased from 3.0% of total discounts in 2012 to 14.5% in 2019 (Table 2). This was driven by a combination of increased utilization in Medicaid and 340B and increased discounts per unit (Table 3). Specifically, in this time period, the proportion of total utilization represented by Medicaid and 340B increased from 3.1% to 9.2% of total units and from 0.8% to 8.8%, respectively, while the Medicaid and 340B discount per unit quintupled. Coverage gap discounts, in contrast, decreased as a share of total discounts, from 16.2% in 2012 to 9.3% in 2019 for Victoza (Table 2). Similar trends were observed for other products.

Table 2. Decomposition of Total Discounts into Discount Types.

| Proportion of the Gross-to-net Bubble Accounted by Each Discount Type | ||||||||||||

| Mandatory Discounts | ||||||||||||

| Coverage Gap Discounts | 340b Discounts | Medicaid Discounts | Voluntary Negotiated Commercial Discounts a | |||||||||

| Bydureon | ||||||||||||

| 2013 | 12.2% | 4.0% | 4.5% | 79.3% | ||||||||

| 2019 | 8.1% | 9.5% | 11.6% | 70.8% | ||||||||

| Byetta | ||||||||||||

| 2012 | 11.4% | 1.5% | 13.5% | 73.6% | ||||||||

| 2019 | 9.7% | 9.4% | 14.2% | 66.6% | ||||||||

| Ozempic | ||||||||||||

| 2019 | 5.2% | 7.9% | 4.9% | 82.0% | ||||||||

| Trulicity | ||||||||||||

| 2015 | 10.7% | 4.8% | 3.0% | 81.4% | ||||||||

| 2019 | 7.0% | 11.8% | 6.1% | 75.1% | ||||||||

| Victoza | ||||||||||||

| 2012 | 16.2% | 3.0% | 11.3% | 69.4% | ||||||||

| 2019 | 9.3% | 14.5% | 15.1% | 61.2% | ||||||||

a Commercial discounts represent voluntary discounts negotiated between manufacturers and Pharmacy Benefit Managers in the commercial and Medicare Part D markets. Discounts to the Department of Defense, Department of Veterans Affairs, or other Federal programs are included under commercial discounts, as acknowledged in the limitations.

Table 3. Trends in Medicaid and 340B Discounts per Unit and Proportion of Units Represented by Medicaid and 340B.

| Medicaid and 340B Discount per Unit | % Change in Medicaid and 340B Discount per Unit | % of Total Units Accounted by Medicaid | % of Total Units Accounted by 340B | |||||||

| Bydureon | ||||||||||

| 2012 | ||||||||||

| 2013 | $30.9 | Ref | 2.6% | 2.3% | ||||||

| 2014 | $45.3 | 46% | 3.0% | 2.5% | ||||||

| 2015 | $50.5 | 63% | 4.6% | 4.2% | ||||||

| 2016 | $78.8 | 155% | 7.9% | 5.0% | ||||||

| 2017 | $107.0 | 246% | 8.5% | 6.7% | ||||||

| 2018 | $125.1 | 304% | 8.5% | 7.5% | ||||||

| 2019 | $140.2 | 353% | 10.1% | 8.3% | ||||||

| Byetta | ||||||||||

| 2012 | $78.9 | Ref | 5.4% | 0.6% | ||||||

| 2013 | $99.0 | 26% | 6.1% | 1.3% | ||||||

| 2014 | $154.9 | 96% | 6.5% | 2.3% | ||||||

| 2015 | $115.3 | 46% | 8.0% | 3.5% | ||||||

| 2016 | $188.5 | 139% | 9.3% | 5.3% | ||||||

| 2017 | $275.2 | 249% | 10.2% | 6.1% | ||||||

| 2018 | $324.2 | 311% | 10.5% | 6.9% | ||||||

| 2019 | $300.7 | 281% | 11.0% | 7.3% | ||||||

| Ozempic | ||||||||||

| 2019 | $254.5 | 4.0% | 6.5% | |||||||

| Trulicity | ||||||||||

| 2015 | $75.5 | Ref | 1.9% | 3.0% | ||||||

| 2016 | $136.4 | 81% | 2.4% | 5.0% | ||||||

| 2017 | $194.9 | 158% | 3.4% | 6.4% | ||||||

| 2018 | $246.8 | 227% | 4.0% | 7.7% | ||||||

| 2019 | $288.4 | 282% | 4.6% | 8.9% | ||||||

| Victoza | ||||||||||

| 2012 | $18.4 | Ref | 3.1% | 0.8% | ||||||

| 2013 | $23.4 | 27% | 2.9% | 1.6% | ||||||

| 2014 | $33.0 | 79% | 3.7% | 2.7% | ||||||

| 2015 | $42.4 | 131% | 5.2% | 3.9% | ||||||

| 2016 | $53.4 | 190% | 6.5% | 5.2% | ||||||

| 2017 | $60.6 | 229% | 7.4% | 6.5% | ||||||

| 2018 | $72.5 | 294% | 7.6% | 7.7% | ||||||

| 2019 | $94.4 | 413% | 9.2% | 8.8% | ||||||

In 2019, for the five GLP-1As combined, coverage gap, Medicaid, and 340B discounts represented 7.5%, 9.1% and 11.8% of total discounts, respectively, for a total of 28.4% of manufacturer discounts represented by mandatory discounts.

Voluntary Discounts

From 2012-2019, voluntary commercial discounts represented the majority of total discounts; nevertheless, the share of total discounts represented by commercial discounts decreased across the study period. For example, commercial discounts represented 69.4% of total discounts for Victoza in 2012, but 61.2% of total discounts in 2019 (Table 2). Similar trends were observed for Bydureon (commercial discounts accounted for 70.8% of total discounts in 2019, down from 79.3% in 2013) and Trulicity (75.1% in 2019, down from 81.4% in 2015). For Ozempic, which was approved in December 2017, commercial discounts accounted for 82% of total discounts in 2019. In 2019, for the five GLP-1As combined, commercial discounts were estimated at $6.7 billion, or 71.6% of total discounts.

Discussion

We quantified trends for manufacturer discounts for GLP-1 RAs, a newer class of glucose lowering agents, and quantified to what extent rising discounts represented mandatory discounts under government programs versus commercial discounts voluntarily negotiated between insurers and manufacturers. We found that total manufacturer discounts for GLP1-As increased from 10% to 20% to over 50% of gross sales from 2012 to 2019. While voluntarily negotiated commercial discounts represented the majority of pharmaceutical discounts, the share of discounts represented by mandatory discounts increased over time, driven by increases in Medicaid and 340B discounts. In 2019, the last year of the study period, commercial discounts accounted for 71.6% of total discounts (equivalent to 40.3% of gross sales), while mandatory discounts represented the remaining 28.4% of total discounts. Results were consistent across specific drug products.

Our findings are consistent with Sarpatwari et al, who reported increasingly divergent trends between list and net prices for GLP-1 RAs.15 Our study however adds important new data, as it quantifies trends in discounts for each specific product, and further decomposes manufacturer discounts into mandatory versus voluntary discounts. While both mandatory discounts and voluntary discounts increased over time in absolute value and as a share of gross sales, mandatory discounts increased faster, driven by Medicaid and 340B discounts. Medicaid (and 340B) discounts per unit increased due to increases in inflation rebates triggered by increases in list prices, as well as increases in base rebates set by rising commercial discounts. These trends observed for the first years of the post-marketing life of a drug may, however, not generalize to the entire branded phase of a product or to other established therapeutic classes in the diabetes arsenal, such as insulins, which have triggered the Medicaid rebate cap since the mid-2010s. For these classes, the Medicaid rebate cap has limited further increases in Medicaid (and 340B) discounts per unit, although the removal of the Medicaid rebate cap by the American Rescue Plan Act of 2021 will lead to further increases in mandatory discounts after 2023.

Although the share of total discounts represented by voluntary discounts decreased as a result of the faster increases represented by Medicaid and 340B discounts, commercial discounts negotiated between manufacturers and pharmaceutical benefit managers increased from less than 15% of gross sales to over 40%, accounting for $6.7bn in 2019. These discounts are reflective of competition for formulary space between agents. Additionally, GLP-1 RAs compete with sodium-glucose co-transporter 2 (SGLT-2) inhibitors, a class of oral antidiabetic drugs that, like GLP-1 RAs, has demonstrated lowering the risk of cardiovascular and renal outcomes in type 2 diabetes.16 Our findings demonstrate that competition between brands for formulary space is effective at generating discounts that offset, at least partially, increases in list prices. However, while these discounts benefit the entire pool of beneficiaries through decreased premiums, commercial discounts are not directly passed on to the actual drug users, as cost-sharing is based on list prices. As policymakers consider reforms to the pharmaceutical reimbursement system, they should develop solutions that enable patients to benefit from commercial rebates at the point of sale, as was done with the limit on insulin cost-sharing for Medicare beneficiaries under the Inflation Reduction Act.17 Additionally, manufacturers should make available discounted formulations of branded products at a list price equivalent to the net price faced by insurers after discounts. Such formulations, which have been offered for some authorized generics and biosimilars,18 enable uninsured or underinsured patients access medications at list prices comparable prices to net prices faced by payers, and prevent the exacerbation of inequities in access generated by the current pricing and discounting dynamics.

Our study demonstrates that, for at least one competitive drug class, commercial discounts voluntarily negotiated between pharmaceutical manufacturers and payers largely exceed the minimum statutory discounts required by the Inflation Reduction Act for drugs selected for Medicare negotiation well before drugs would be eligible for negotiation.17 Specifically, the Inflation Reduction Act sets a minimum discount of 25% for drugs marketed between 9 and 16 years at the time of negotiation; drugs will not be eligible for negotiation before the ninth year to preserve incentives for research and development. We observe voluntary discounts that largely exceed the 25% threshold in the first few years after market entry of a new drug, which is of relevance for two reasons: First, manufacturers willingness to provide discounts early after approval at levels higher than those required by the Inflation Reduction Act undermines concerns regarding the Inflation Reduction Act disincentivizing innovation. Second, according to a peer-reviewed study, Ozempic and Trulicity are expected to face Medicare drug price negotiation in 2027 and 2028, respectively.19 We demonstrate that current discounts offered to Part D payers exceed the minimum 25% statutory discount, therefore, it will be the current net price faced by Part D payers that will set the ceiling for the maximum negotiated price. As cost-sharing will be based on the negotiated price, beneficiaries will see higher reductions in cost-sharing associated with drug price negotiation than anticipated from the minimum statutory discounts.

Our study is subject to three main limitations. First, the analysis of trends in out-of-pocket expenses was considered outside of the scope of our evaluation of trends in manufacturer discounts. As a result, our paper does not provide evidence of the impact of manufacturer discounts on patient cost-sharing. Second, due to the unavailability of claims data from Medicaid or from commercially insured populations, we extrapolated that the proportion of units subject to 340B discounts from Medicare Part D to the entire market. It is possible that this generalization resulted in measurement error; however, this approach is superior to alternative methods previously used that fail to estimate 340B discounts and bundle them with voluntarily negotiated commercial discounts. Third, due to lack of drug specific data on federal discounts, discounts to the Department of Defense, Department of Veterans Affairs, or other Federal programs are included under commercial discounts. However, the impact of this limitation is minimal, as these programs represent less than 5% of prescription drug spending in the US. 13 Fourth, our algorithm uses the average commercial discount to estimate the Best Price rebate Medicaid and 340B, while it is the greatest discount offered to any payer what establishes Best Price. This approximation is needed due to lack of net pricing data from each specific payer, but is once again a considerable improvement over previous estimates of Medicaid discounts, which did not account for the Best Price provision and simply assumed that a base rebate of 23.1% of list price regardless of commercial discounts.

Conclusion

Manufacturer discounts for GLP-1 RAs increased from 13.3% of gross sales in 2012 to 56.3% in 2019. While voluntary commercial discounts represented the majority of manufacturer discounts, they decreased as a share of total discounts over time, driven by faster increases in Medicaid and 340B discounts. At the end of the study period, mandatory discounts represented 28.4% of manufacturer discounts, while voluntary discounts negotiated between manufacturers and payers represented the remaining 71.6%, equivalent to 40.3% of gross sale. Well before the ninth year after approval, when drugs will be first eligible for negotiation, commercial discounts voluntarily negotiated between pharmaceutical manufacturers and payers for a new drug class largely exceed the minimum statutory discounts required by the Inflation Reduction Act for drugs facing price negotiation.

References

- Hernandez I, San-Juan-Rodriguez A, Good CB, Gellad WF. Changes in List Prices, Net Prices, and Discounts for Branded Drugs in the US, 2007-2018. JAMA. 2020;323(9):854-862.

- SSR Health. Accessed September 14, 2022. https://www.ssrhealth.com/dataset/

- Ippolito B, Levy J. Best Practices Using SSR Health Net Drug Pricing Data. Health Affairs Forefront. doi:10.1377/forefront.20220308.712815

- Dickson S, Gabriel N, Hernandez I. Estimated Changes in Price Discounts for Tenofovir-Inclusive HIV Treatments Following Introduction of Tenofovir Alafenamide. AIDS 2022 doi: 101097/QAD0000000000003401.

- San-Juan-Rodriguez A, Piro VM, Good CB, Gellad WF, Hernandez I. Trends in list prices, net prices, and discounts of self-administered injectable tumor necrosis factor inhibitors. J Manag Care Spec Pharm. 2021;27(1):112-117.

- Ferris LK, Gellad WF, Hernandez I. Trends in list and net prices of self-administered systemic psoriasis therapies manufactured by US-based pharmaceutical companies. JAMA Dermatol. 2020;156(10):1136-1138.

- Wang J, Lee CC, Kesselheim AS, Rome BN. Estimated Medicaid Spending on Original and Citrate-Free Adalimumab From 2014 Through 2021. JAMA Intern Med. Published online January 30, 2023. doi:10.1001/jamainternmed.2022.6299

- Centers for Medicare & Medicaid Services. Medicare Part D Spending Dashboard. Accessed September 29, 2022. https://data.cms.gov/summary-statistics-on-use-and-payments/medicare-medicaid-spending-by-drug/medicare-part-d-spending-by-drug

- Centers for Medicare & Medicaid Services, Medicaid Spending Dashboard. Accessed January 19, 2023. https://data.cms.gov/summary-statistics-on-use-and-payments/medicare-medicaid-spending-by-drug/medicaid-spending-by-drug

- Medicare Provider Utilization and Payment Data: Part D Prescriber. Accessed September 14, 2022. https://data.cms.gov/provider-summary-by-type-of-service/medicare-part-d-prescribers

- Symphony Health Data Overview. Accessed September 14, 2022. https://symphonyhealth.com/what-we-do/view-health-data

- Dickson S, Gabriel N, Gellad W, Hernandez I. Reduction in Medicaid rebates paid by pharmaceutical manufacturers for outpatient injected, inhaled, infused, implanted, or instilled drugs: The 5i loophole. J Health Polit Policy Law. Published online July 14, 2022. doi:10.1215/03616878-10041219

- Centers for Medicare and Medicaid Services. National Health Expenditure Data. Accessed January 13, 2023. https://www.cms.gov/research-statistics-data-and-systems/statistics-trends-and-reports/nationalhealthexpenddata/nationalhealthaccountshistorical

- Health Resources & Services Administration. 340B Drug Pricing Program. Accessed September 14, 2022. https://www.hrsa.gov/opa

- Sarpatwari A, Tessema FA, Zakarian M, Najafzadeh MN, Kesselheim AS. Diabetes drugs: List price increases were not always reflected in net price; Impact of brand competition unclear. Health Aff (Millwood). 2021;40(5):772-778.

- McGuire DK, Shih WJ, Cosentino F, et al. Association of SGLT2 inhibitors with cardiovascular and kidney outcomes in patients with type 2 diabetes: A meta-analysis. JAMA Cardiol. 2021;6(2):148-158.

- Yarmuth JA. Inflation Reduction Act of 2022.; 2022. Accessed January 19, 2023. http://www.congress.gov/

- Amjevita (adalimumab-atto), first Biosimilar to Humira, now available in the United States. Amgen Press Release. Amgen. Accessed February 27, 2023. https://www.amgen.com/newsroom/press-releases/2023/01/amjevita-adalimumabatto-first-biosimilar-to-humira-now-available-in-the-united-states

- Dickson S, Hernandez I. Drugs Likely Subject to Medicare Negotiation, 2026-2028. J Manag Care Spec Pharm. 2023;29(3):229-235.