Ishan Paranjpe, Stanford University School of Medicine; Chen Wei, Stanford University School of Medicine; Pranav Sharma, Drexel University College of Medicine; Roy H. Lan, Stanford University School of Medicine; Maitreyi Sahu, University of Washington; Joseph Dieleman, University of Washington; Kevin Schulman, Clinical Excellence Research Center, Stanford University; Alexander Sandhu, Stanford University

Contact: kevin.schulman@stanford.edu

Abstract

What is the message? This study characterizes and identifies factors contributing to price variations in orthotopic heart transplantation and ventricular assist devices both within and across United States hospitals.

What is the evidence? An analysis of reported price data from 6,378 hospitals aggregated in the Turquoise Health database.

Timeline: Submitted: November 30, 2023; accepted after review December 13, 2023.

Cite as: Ishan Paranjpe, Chen Wei, Pranav Sharma, Roy H. Lan, Maitreyi Sahu, Joseph Dieleman, Kevin Schulman, Alexander Sandhu. 2023. Price Variability of Heart Transplant and Ventricular Assist Procedures across the United States. Health Management, Policy and Innovation (www.HMPI.org), Volume 8, Issue 3.

Introduction

The prevalence of heart failure (HF) in the United States is expected to increase from 6.9 million in 2020 to 8.5 million in 2030.(1) According to the American College of Cardiology/American Heart Association (ACC/AHA) guidelines, treatment of end-stage HF with orthotopic heart transplantation (OHT) and ventricular assist devices (VAD) are both Class I recommendations.(2) Both OHT and VAD are resource-intensive interventions with high healthcare costs and market prices (3). Prior studies suggest that the financial toxicity of cardiovascular care can negatively impact quality of life and worsen clinical outcomes.(4–6) For advanced HF, little is known about the actual price of LVAD implantation and how this varies across hospitals.

In order to promote price transparency, the 2021 Hospital Price Transparency Final Rule mandated hospitals publicly disclose insurer-negotiated and self-pay rates for all medical services(7). This study sought to characterize and identify factors contributing to variations in OHT and VAD prices both within and across United States hospitals using self-reported hospital prices compiled with a commercial database.

Methods

Data Sources

Following passage of the federal Hospital Price Transparency Rule in 2021, all US hospitals were mandated to publicly release pricing data. We used the Turquoise Health database, an aggregation of these reported price data from 6,378 hospitals. Each hospital disclosed several prices, including the gross chargemaster price, discounted self-pay price, negotiated commercial insurance prices, and Medicare prices (hospitals were required to post these prices, not any information on the cost of providing the service). Given the significant variability in compliance with this federal mandate, many hospitals reported prices for only certain of these categories.

We restricted our analysis to all cardiac surgery hospitals approved for adult heart transplants by the Organ Procurement and Transplantation Network. We included hospitals that reported prices for Medicare Severity Diagnosis Related Code (MS-DRG) 001 and 002 or common procedural terminology (CPT) codes 33982, 33983, 33979, and 33980 which encode services related to heart transplant and ventricular assist devices. The payments for the procedural CPT codes represent the amount to the proceduralist for the individual procedure while the MS-DRG represents the hospital payment for the overall care during the hospitalization, including the procedure. To account for regional differences in labor cost, prices for each procedural code were normalized to Medicare Fee Schedule using Resource-Based Relative Value Scale (RVU) and Geographic Practice Cost Indices (GPCI) adjustment factors as previously done(8). Adjusted price = Commercial price / (RVUwork*GPCIwork + RVUpractive expense*GPCIpractice expense + RVUmalpractice*GPCImalpractice).

For each hospital in the Turquoise Health dataset, we obtained hospital characteristics using several publicly available data sources(9–18). All data sources were linked to the Turquoise dataset using each hospital’s Medicare provider ID. We extracted the overall hospital ranking, HF-specific mortality, and HF-specific readmission rate from the Centers for Medicare and Medicaid Services (CMS) Hospital Care Compare dataset. From the American Hospital Association Survey (AHA), we identified teaching hospitals, AHA region codes, and hospitals with cardiac surgery facilities. For teaching hospital status, major teaching hospitals were defined as members of the Council of Teaching Hospitals (COTH). Hospital margin data was obtained from the Healthcare Cost Report Information System.

We constructed a measure of hospital market concentration as previously described(19). Market concentration was defined for each hospital using the Herfindahl–Hirschman index (HHI). We defined HHI as the sum of squared market share defined by inpatient bed capacity. The resulting HHI metrics ranges from 0 to 10,000. 0 represents perfect competition and 10,000 represents a complete monopoly.

Statistical analysis

To limit the effect of outliers, we excluded hospitals with reported commercial prices below the bottom 5st percentile above the top 5th percentile (visual inspection of these values suggested that the data were not plausible). Similar to prior work(20,21), to measure the variation in commercial insurance plan pricing within a hospital, we defined the within-hospital-ratio as the ratio of the 90th to 10th percentile payor-negotiated rate for a given billing code. To measure the pricing variation between hospitals, we defined the across-hospital-ratio as the ratio of the 90th percentile to 10th percentile median negotiated price across all hospitals for a given billing code.

We compared prices across payor type using a Kruskal-Wallis test with Dunn post-hoc analyses. We also compared the median commercial rates across hospital-specific characteristics using Kruskal-Wallis tests.

Results

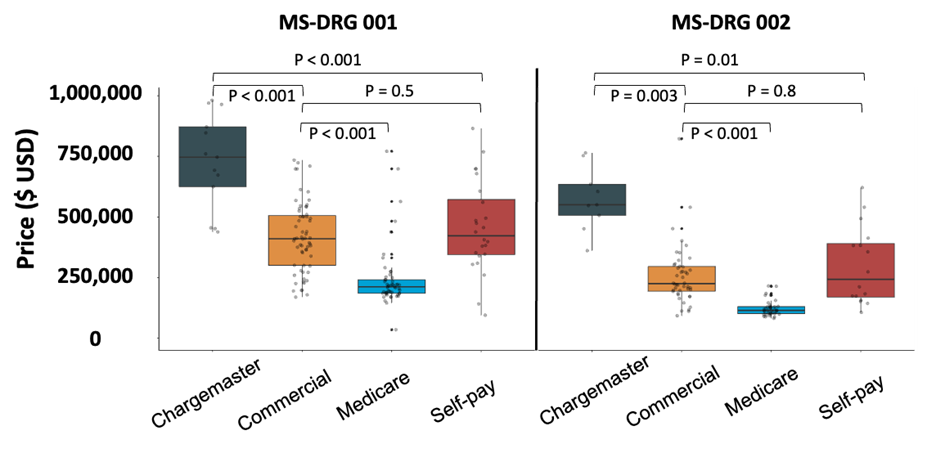

From the 6,378 hospitals in the Turquoise Health dataset, we limited our analysis to the adult heart transplant hospitals which reported prices for at least one heart transplant MS-DRG or CPT code. After removing outliers, we included 61 hospitals in our analysis. Hospitalization prices varied significantly by payor class. For MS-DRG 001, the median Medicare rate of $211,993 (IQR: $185,198 – $240,679) was significantly lower than commercial ($410,076, IQR: $338,451 –$501,594), chargemaster ($966,894, IQR: $733,065 – $1,174,278) and self-pay rates ($447,025, IQR: $350,684- $683,687) (Figure 1A, Table 1, P <0.05). Similar price differences were observed for MS-DRG 002 rates.

We observed significant variability across negotiated commercial contracts within the same hospitals. In terms of overall hospitalization prices, represented by MS-DRG codes, (Table 2), the median within center ratio (90th:10th percentile commercial rate) was 2.1 (IQR: 1.7 – 2.8) for MS-DRG 001 and 2.1 (IQR: 1.6 – 2.6) for MS-DRG 002. Intra-hospital payor variation was lower for individual procedures (Table 2). For individual surgical procedures (Table 2), CPT 33944 (backbench preparation of donor heart) had the greatest median within center ratio of 3.4 (IQR: 1.2– 8.3). Price variability across hospitals, as captured by the across-center ratio (90th:10th percentile median negotiated price), was 2.3 for MS-DRG 001 and to 2.1 for MS-DRG 002.

We then compared the median payor-negotiated commercial rate across hospital characteristics. In bivariate analyses (Table 3), we did not find statistically significant variation in price by geographic region. Commercial rates at major teaching hospitals were significantly higher than those at non-teaching hospitals (Table 3) for both MS-DRG 001 ($438,731 vs. $381,136, P = 0.02) and MS-DRG 002 ($258,066 vs. $200,658, P0.02). Hospital margin, total revenue, and total bed capacity were not significantly associated with hospitalization prices (Table 3). In a multivariate model adjusted for hospital margin, total revenue, total bed capacity, and geographic region, commercial rates for both MS-DRG 001 (P = 0.18) and MS-DRG 002 (P = 0.05) were not significantly associated with teaching hospital affiliation.

We then correlated quality metrics with reported commercial hospitalization prices. The median hospitalization price of MS-DRG 001 was not significantly associated (Table 3) with CMS heart failure specific mortality (P = 0.45) heart failure specific readmission rate (P = 0.87), or overall star rating (P = 0.96). Findings for quality metrics were similar for MS-DRG 002.

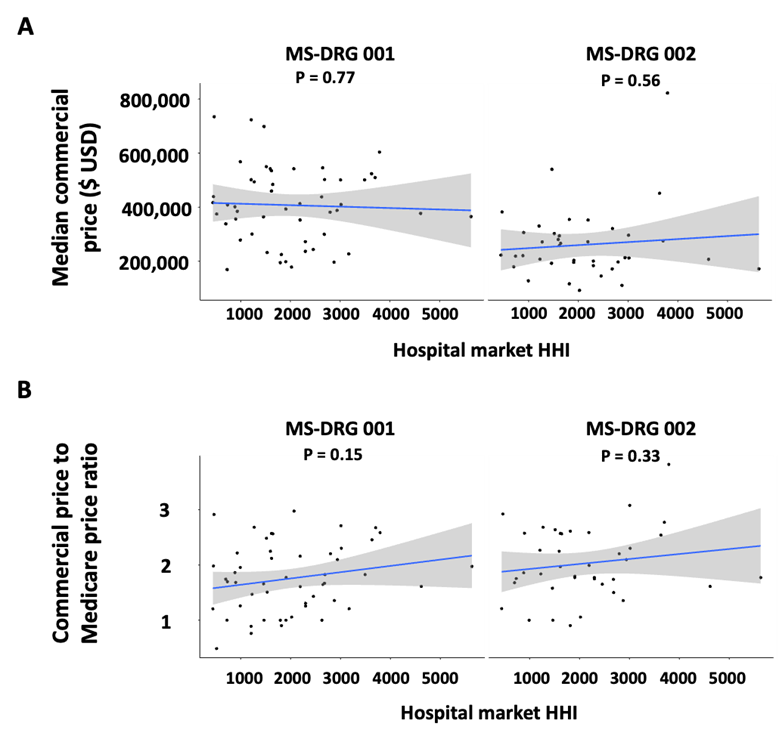

We hypothesized that market dynamics may influence hospitalization prices. We associated a previously reported measure of hospital market concentration (HHI) with median commercial hospitalization prices (Figure 2). HHI was not significantly associated with commercial price (Figure 2A) or the ratio of commercial price to Medicare price (Figure 2B) for MS-DRG 001 and MS-DRG 002.

Discussion

To combat rising healthcare costs, the 2021 Federal Hospital Price Transparency Rule mandated hospitals release price information for procedures and medications provided at their respective centers. Analysis of these data can offer insight into the magnitude of price variability in the commercial health plan market: there is substantial price variation both across hospitals and between commercial plans at each hospital, and median commercial prices were significantly higher than Medicare prices, but this variation in price does not seem to be related to care quality as there was no association between the price of care and HF-specific hospitalization outcome metrics.

Similar to prior reports of non-cardiovascular procedures(22,23), Medicare prices were substantially lower than commercial and self-pay rates. Although this was not an unexpected result, we also found variability in commercial prices within a single institution. For example, we found a 3-fold difference between 90th and 10th percentile commercial payor prices within individual hospitals for transplant/LVAD hospitalization costs. The substantial variation observed within hospitals suggest commercial insurance plans may have differential negotiating ability. One recent work found that insurers in the market with the fewest number of insurers (least competitive) pay 15% less to hospitals compared to insurers in the most competitive insurance markets(24), highlighting the role of market concentration in controlling price.

We hypothesized that specific hospital characteristics drive price differences. Notably, we found that teaching hospitals commanded significantly higher commercial rates compared to non-teaching hospitals. This association was not significant in multivariate analysis likely due to low statistical power. Prior work has reported mixed findings in terms of healthcare costs at teaching hospitals. One study of hospitalization costs for 21 common conditions among Medicare patients found that index hospitalizations were more expensive but readmissions were less expensive at teaching hospitals as compared to nonteaching hospitals(25). The exact reason for this association remains unclear. However, one potential explanation is that this price variability reflects uncontrolled differences in patient complexity (beyond case-mix adjustment). Teaching hospitals may care for more complex, higher risk transplant patients than non-teaching hospitals, although given the nature of the procedures we evaluated it is hard to understand how selection could be so systematic. These prices differences may also be explained by differences in negotiating power. Notably, other hospital characteristics, such as revenue, margin, bed capacity, and CMS quality metrics were not associated with price.

In addition to hospital-specific characteristics, we also studied the impact of hospital market concentration. Hospitalization prices were not statistically significantly associated with market concentration, although there was a trend to higher prices in more concentrated markets in relationship to Medicare prices. Previous studies have shown that more competitive markets tend to have lower prices(24,26). Our analysis was limited to a rare service performed by a small set of hospitals and thus may not generalize to prices of other services where market dynamics may play a larger role.

Price was also not associated with CMS heart failure specific readmission, mortality rates, or overall star rating. Unlike other industries in which higher price signals greater quality of goods and services, price and quality are frequently disassociated in healthcare. Previous work has also found that patients are unable to objectively evaluate healthcare quality(27). Our data support these findings and suggest that for heart transplants, price negotiations are likely not driven by objective quality metrics. Again, since our analysis was limited to heart transplant centers this finding may not be generalizable.

Conclusion

Here, we report several insights into the magnitude and sources of price variability for heart transplant and VAD hospitalizations. We report both significant inter- and intra-hospital price variation for commercially insured patients. These data raise several questions about the determinants of heart transplant price and whether the effect of hospital and market characteristics on price is generalizable across clinical service lines.

Figure 1: Variability in hospitalization price of heart transplant and VAD implantation by payor class. P values were computed using a Kruskal-Wallis test.

Figure 2: Market concentration and commercial price. Market concentration HHI was computed for a 30-mile region near each hospital. HHI was associated with A) median commercial hospitalization price and B) to the ratio of commercial price to Medicare price by fitting linear regression models.

Table 1: Median heart transplant hospitalization prices by payor class

| MS-DRG | Payor class | Number of hospitals | Median price |

| 1 | Chargemaster | 20 | $966,894 ($733,065 – $1,174,278) |

| Commercial | 57 | $410,076 ($338,451 – $501,594) | |

| Medicare | 49 | $211,993 ($185,108 – $240,679) | |

| Self-pay | 24 | $447,025 ($350,684 – $683,687) | |

| 2 | Chargemaster | 8 | $528,451 ($428,881 – $641,850) |

| Commercial | 42 | $224,850 ($196,725 – $292,881) | |

| Medicare | 37 | $114,661 ($101,810 – $129,210) | |

| Self-pay | 14 | $178,130 ($152,722 – $335,487) |

Table 2: Summary of commercial insurance negotiated hospitalization prices for heart transplant. The within center ratio is defined as the ratio of the 90th to 10th percentile commercial rate at each hospital. The across center ratio is defined as the ratio of the 90th percentile median commercial rate to the 10th percentile median commercial rate across hospitals.

| Code | Code description | Number of centers | Commercial median price, $ (IQR) | Within center ratio (IQR) | Across center ratio |

| MS-DRG 001 | Heart transplant or implant of heart assist system with MCC | 57 | 410,076 (338,451 – 501,594) | 2.1 (1.7 – 2.8) | 2.3 |

| MS-DRG 002 | Heart transplant or implant of heart assist system without MCC | 42 | 224,850 (196,725 – 292,881) | 2.1 (1.6 – 2.6) | 2.1 |

| CPT 33945 | Heart transplant, with or without recipient cardiectomy | 14 | 5,950 (4,347 – 7,718) | 1.9 (1.6 – 3.3) | 3.5 |

| CPT 33944 | Backbench standard preparation of cadaver donor heart allograft prior to transplantation, including dissection of allograft from surrounding soft tissues to prepare aorta, superior vena cava, inferior vena cava, pulmonary artery, and left atrium for implantation | 12 | 3,391 (1,428 – 4,243) | 3.4 (1.2 – 8.3) | 6.1 |

| CPT 33940 | Donor cardiectomy (including cold preservation) | 9 | 6,171 (3,391 – 26,679) | 1.4 (1 – 2.5) | 52 |

| CPT 33982 | Replacement of ventricular assist device pump(s); implantable intracorporeal, single ventricle, without cardiopulmonary bypass  | 11 | 3,468 (2,872 Р6,794) | 1.6 (1.2 Р2.8) | 9.4 |

| CPT 33983 | Replacement of ventricular assist device pump(s); implantable intracorporeal, single ventricle, with cardiopulmonary bypass  | 11 | 3,468 (2,935 Р4,353) | 1.6 (1.2 Р2.3) | 3.5 |

| CPT 33979 | Insertion of ventricular assist device, implantable, intracorporeal, single ventricle  | 15 | 3,377 (2,428 Р4,770) | 2 (1.2 Р3.5) | 10 |

| CPT 33980 | Removal of ventricular assist device, implantable, intracorporeal, single ventricle  | 14 | 3,179 (2,219 Р5,469) | 2 (1.3 Р3.1) | 8.9 |

Table 3: Factors associated with price variability for negotiated commercial rates by MS-DRG billing code

| MS-DRG 001 | MS-DRG 002 | |||||

| Number of hospitals | Median Commercial Price, $ (IQR) | P Value | Number of hospitals | Median Commercial Price, $ (IQR) | P Value | |

| AHA Region | ||||||

| New England (CT, MA, ME, NH, RI, VT) | 2 | 469,830 (453,948 – 485,712) | 0.17 | 1 | 330,341 (330,341 – 330,341) | 0.1 |

| Middle Atlantic (NJ, NY, PA) | 11 | 381,452 (251,890 – 413,587) | 8 | 221,086 (208,616 – 311,039) | ||

| South Atlantic (DC, DE, MD, VA, WV, NC, SC, GA, FL) | 12 | 498,002 (383,826 – 529,380) | 7 | 275,211 (249,148 – 313,696) | ||

| East North Central (OH, IN, IL, MI, WI) | 13 | 484,080 (388,134 – 534,958) | 9 | 258,066 (213,475 – 272,224) | ||

| East South Central (KY, TN, AL, MS) | 1 | 364,261 (364,261 – 364,261) | 2 | 152,380 (132,161 – 172,600) | ||

| West North Central (MN, IA, MO, ND, SD, NE, KS) | 5 | 393,423 (297,719 – 412,117) | 4 | 215,232 (182,028 – 270,389) | ||

| West South Central (AR, LA, OK, TX) | 11 | 365,330 (286,164 – 415,600) | 9 | 200,658 (183,858 – 207,873) | ||

| Mountain (MT, ID, WY, CO, NM, AZ, UT, NV) | 1 | 352,800 (352,800 – 352,800) | 1 | 352,800 (352,800 – 352,800) | ||

| Pacific (WA, OR, CA, AK, HI) | 1 | 549,960 (549,960 – 549,960) | 1 | 302,482 (302,482 – 302,482) | ||

| Teaching status | ||||||

| Major Teaching | 19 | 381,136 (289,092 – 401,749) | 0.021 | 15 | 200,658 (175,842 – 239,961) | 0.02 |

| Non-teaching | 38 | 438,731 (366,966 – 532,194) | 27 | 258,066 (213,505 – 301,365) | ||

| Number of hospitals | Correlation Coefficient | P value | Number of hospitals | Correlation Coefficient | P value | |

| Margin | 56 | -0.0021 | 0.99 | 41 | -0.1 | 0.52 |

| Total Revenue ($ USD) | 56 | 0.13 | 0.33 | 41 | 0.33 | 0.038 |

| Total Beds | 57 | 0.11 | 0.43 | 42 | 0.11 | 0.49 |

| CMS Overall Star Rating | 55 | 0.0069 | 0.96 | 40 | 0.037 | 0.82 |

| CMS 30-day Heart Failure Specific Readmission Score | 55 | -0.021 | 0.87 | 40 | -0.11 | 0.49 |

| CMS 30-day Heart Failure Specific Mortality Score | 55 | -0.099 | 0.45 | 40 | 0.034 | 0.84 |

References

- Urbich M., Globe G., Pantiri K., et al. A Systematic Review of Medical Costs Associated with Heart Failure in the USA (2014–2020). Pharmacoeconomics 2020;38(11):1219–36. Doi: 10.1007/s40273-020-00952-0.

- Heidenreich PA., Bozkurt B., Aguilar D., et al. 2022 AHA/ACC/HFSA Guideline for the Management of Heart Failure: A Report of the American College of Cardiology/American Heart Association Joint Committee on Clinical Practice Guidelines. vol. 145. 2022.

- Mulloy DP., Bhamidipati CM., Stone ML., Ailawadi G., Kron IL., Kern JA. Orthotopic heart transplant versus left ventricular assist device: A national comparison of cost and survival. J Thorac Cardiovasc Surg 2013;145(2):566–74. Doi: 10.1016/j.jtcvs.2012.10.034.

- Annapureddy A., Valero-Elizondo J., Khera R., et al. Association Between Financial Burden, Quality of Life, and Mental Health Among Those With Atherosclerotic Cardiovascular Disease in the United States. Circ Cardiovasc Qual Outcomes 2018;11(11):e005180. Doi: 10.1161/CIRCOUTCOMES.118.005180.

- Bernard D., Fang Z. Financial burdens and barriers to care among nonelderly adults with heart disease: 2010–2015. J Am Heart Assoc 2019. Doi: 10.1161/JAHA.118.008831.

- Valero-Elizondo J., Khera R., Saxena A., et al. Financial Hardship From Medical Bills Among Nonelderly U.S. Adults With Atherosclerotic Cardiovascular Disease. J Am Coll Cardiol 2019. Doi: 10.1016/j.jacc.2018.12.004.

- CMS. CMS Completes Historic Price Transparency Initiative.

- Xiao R., Ross JS., Gross CP., et al. Hospital-Administered Cancer Therapy Prices for Patients with Private Health Insurance. JAMA Intern Med 2022. Doi: 10.1001/jamainternmed.2022.1022.

- Provider of Services Current Files | CMS.

- HCAHPS: Patients’ Perspectives of Care Survey | CMS.

- AHA Annual Survey.

- Disproportionate Share Hospital (DSH) | CMS.

- Documentation and Files | CMS.

- Compendium of U.S. Health Systems.

- FAQ. Dartmouth Atlas of Health Care.

- Hospital General Information | Provider Data Catalog.

- Complications and Deaths – Hospital | Provider Data Catalog.

- Unplanned Hospital Visits – Hospital | Provider Data Catalog.

- Cooper Z., Doyle Jr JJ., Graves JA., Gruber J. Do Higher-Priced Hospitals Deliver Higher-Quality Care? NBER Work Pap Ser 2022.

- Xiao R., Rathi VK., Gross CP., Ross JS., Sethi RKV. Payer-Negotiated Prices in the Diagnosis and Management of Thyroid Cancer in 2021. JAMA – J Am Med Assoc 2021. Doi: 10.1001/jama.2021.8535.

- Wu SS., Rathi VK., Ross JS., Sethi RKV., Xiao R. Payer-Negotiated Prices for Telemedicine Services. J Gen Intern Med 2022. Doi: 10.1007/s11606-022-07398-4.

- Gul ZG., Sharbaugh DR., Guercio CJ., et al. Large Variations in the Prices of Urologic Procedures at Academic Medical Centers 1 Year After Implementation of the Price Transparency Final Rule. JAMA Netw Open 2023;6(1):e2249581–e2249581. Doi: 10.1001/jamanetworkopen.2022.49581.

- Rochlin D. Commercial Price Variation for Breast Reconstruction in the Era of Price Transparency. JAMA Surg 2022.

- Losasso AT., Toczydlowski K., Yang Y. Insurer Market Power And Hospital Prices In The US. Health Aff 2023. Doi: 10.1377/hlthaff.2022.01184.

- Burke LG., Khullar D., Zheng J., Frakt AB., Orav EJ., Jha AK. Comparison of Costs of Care for Medicare Patients Hospitalized in Teaching and Nonteaching Hospitals. JAMA Netw Open 2019. Doi: 10.1001/jamanetworkopen.2019.5229.

- Cerullo M., Chen SY., Gani F., et al. The relationship of hospital market concentration, costs, and quality for major surgical procedures. Am J Surg 2018. Doi: 10.1016/j.amjsurg.2018.07.042.

- Rao M., Clarke A., Sanderson C., Hammersley R. Patients’ own assessments of quality of primary care compared with objective records based measures of technical quality of care: Cross sectional study. Br Med J 2006. Doi: 10.1136/bmj.38874.499167.7C.