Kevin A. Lobo, Chairman and Chief Executive Officer, Stryker Corporation, and Will Mitchell, Rotman School of Business, University of Toronto

Contact: Will Mitchell, william.mitchell@rotman.utoronto.ca

Kevin Lobo has been CEO of Stryker Corporation since October 2012 and Board Chair since July 2014. Kevin’s experience includes executive positions with KPMG, Unilever, Kraft, Rhone-Poulenc, and Johnson & Johnson.

Will Mitchell holds the Anthony S. Fell Chair in New Technologies and Commercialization at the Rotman School of Management of the University of Toronto. Will’s research focuses on business dynamics in developed and emerging markets, with an emphasis on the global life sciences sector.

Abstract

What is the message?

M&A success arises from five principles for acquisition excellence

- External R&D via M&A complements internal R&D.

- Serial acquirers create shareholder value.

- “Bolt on” and “extension” deals leverage core strengths at home and abroad.

- Balance capital allocation among acquisitions and shareholders.

- Seek deals that are accretive to growth.

What is the evidence?

These recommendations draw from research on business growth, together with executive experience at multiple life sciences businesses.

Links: Slide

Submitted: December 13, 2016; Accepted after review: February 27, 2017

Cite as: Kevin A. Lobo and Will Mitchell. 2017. Using Acquisitions for Successful Growth: Learning from Stryker Corporation. Health Management Policy and Innovation, Volume 2, Issue 1.

Introduction

Markets reward firms that achieve ongoing profitable growth. Despite the conventional wisdom in the popular press that M&A destroys value for acquirers, and so damage a buyer’s ability to achieve profitable growth, recent research demonstrates a strong complementarity between internally and externally driven growth strategies. Laurence Capron and Will Mitchell’s book “Build, Borrow, or Buy” (HBS Press, 2012) highlights the value of pursuing a balanced strategy of seeking resources both internally and externally. At the core, multiple studies find that firms that know when and how to use both internal development and M&A gain advantages for innovation, growth, profitability, and long term survival.

The benefits of balanced resource seeking arise strongly in the commercial life sciences sector. Health care and life sciences leaders such as Johnson & Johnson, Siemens Healthcare, GE Healthcare, Hitachi Medical Systems, and many others have built decades-long strength by both investing heavily in internal projects while also actively seeking acquisition targets that provide new products and capabilities. This article highlights the lessons learned at one of the leaders in the life sciences sector, Stryker Corporation.

Background: Stryker Corporation

Stryker is a medical technology company headquartered in Kalamazoo, Michigan. The company was founded based on innovation in mobile hospital beds in 1941. Stryker now offers products and services through three business segments: Orthopaedics, MedSurg, and Neurotechnology-Spine. In 2016, the company had ~33,000 employees, total revenue of $11.3 billion, and total assets of $20.4 billion, with net profit of 14.5% of sales (8.1% of assets). Stryker entered the Fortune 500 in 2002; in 2016, the company was ranked at #287. For many years, Stryker has regularly shown up on U.S. and international listings of highly admired companies in terms of innovativeness, shareholder returns, and employment.

Growth at Stryker Corporation: Based on Internal &D and Acquisitions

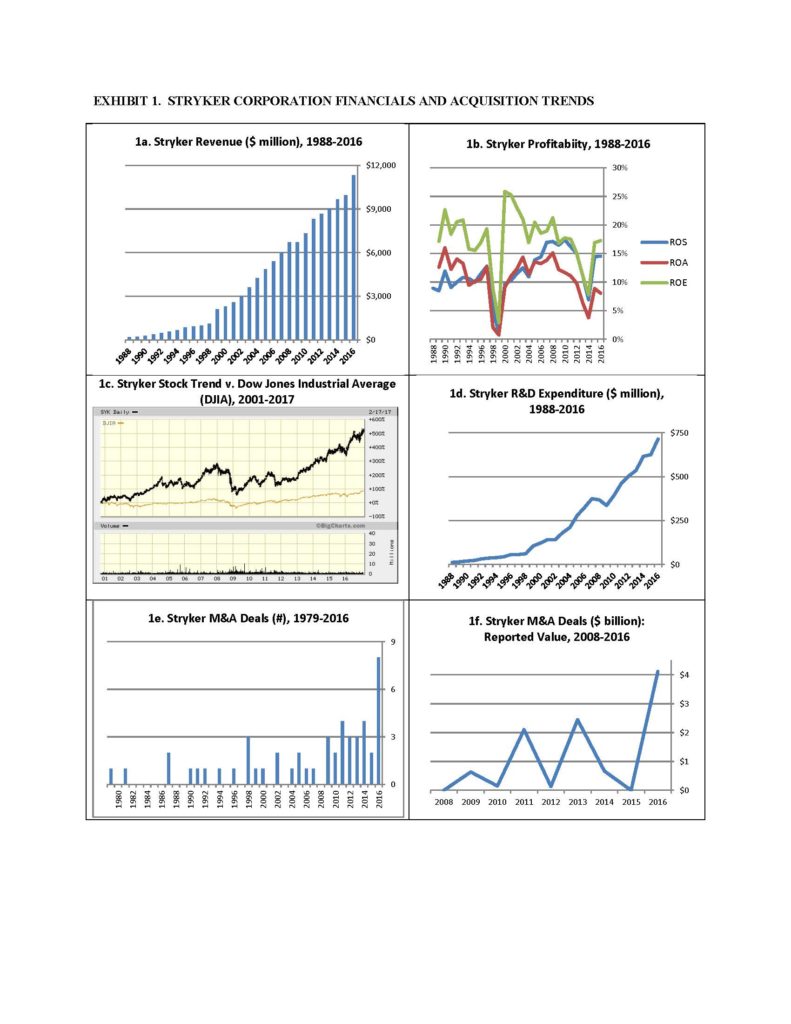

Stryker is a growth company. Since going public in 1979, Stryker has had 37 consecutive years of sales growth; Exhibit 1a depicts the steady growth in revenue since 1988. The company has also been reliably profitable (Exhibit 1b). Due to the combination of growth and profitability, the market has driven Stryker’s stock price up at several multiples over the Dow Jones Industrial Average over the past two decades (Exhibit 1c).

The core question is what strategies have driven the profitable growth that the market has rewarded?

At heart, Stryker’s growth strategy relies on two major levers: organic growth based on investments in internal R&D and marketing, complemented by supporting growth based on acquiring whole or parts of businesses. Exhibit 1d reports the growth of R&D since 1988. R&D now exceeds $700 million annually (more than 6% of sales). In parallel, Exhibits 1e and 1f highlight examples of Stryker’s acquisition activity; both numbers of deals and reported value have increased in recent years.

Opportunities to grow based on internal investments in R&D will come as no surprise to our readers. The gains from greenfield investments in existing skills are central to most growth prescriptions – compared to external sourcing, internal investment often offers benefits of greater control, deeper understanding, and faster projects.

But those benefits arise primarily if the internal projects build directly from existing strengths. Attempting to jump start even moderately exploratory new products through internal initiatives frequently ends up with projects that are slow and flawed, leaving firms lagging more successful competitors.

This is where “external development” via acquisitions complements gains from internal R&D. Buying via M&A offers a means of gaining faster and more effective access to new products, new markets, and new skills. The advances can reach far beyond a firm’s ability to build internally.

Critically, internal R&D and M&A are not substitutes in this balanced approach to growth. Rather, they are complementary strategies. Stryker’s combination of continued growth of investment in R&D at the same time as it has increased its acquisition activity is a strong example of this complement.

Yet simply buying targets is no guarantee of M&A success. The conventional wisdom that acquisitions destroy value stems from highly visible deals that failed dismally, because buyers bought in the wrong conditions, over-paid, and could not integrate the targets effectively. What then is the magic of successful M&A strategy?

Starting Points: Four Basic Rules for Acquisition

In part, M&A success stems from a few long-standing rules.

- First, know the strategic value that you want to achieve from a deal and establish major milestones for getting there.

- Second, undertake deep due diligence of both the financial value of a target and the strategic value of a deal.

- Third, know who the key people from both the target and acquirer will be in achieving the strategic value – and make sure they have motivations to stay.

- Fourth, have the discipline to walk away from a deal, either because the price is too high, the strategic value is too low, or the people you need are likely to leave. Quite simply, let your competitors do the bad deals.

Stryker pays close attention to these four basic rules. Yet following the basic rules, as obvious as they may seem, is often difficult. Stryker’s experience highlights several themes that help firms follow the basic rules, while building an even more nuanced acquisition strategy. In the remainder of this article, we discuss five key principles for making acquisitions a part of a successful growth strategy.

Beyond the Basics: Five Principles for Acquisition Excellence

Stryker adheres to five principles for its acquisition activity.

Principle 1: External R&D via M&A complements internal R&D

We made the central point of this first principle earlier. The core issue is that no company or division will ever have enough resources to fund all ideas or enough knowledge to explore all paths. Even financially strong and intellectually rich companies face real constraints in funding longer-term bets internally through the profit and loss statement. Acquisitions help avoid P&L burn.

Yet acquisitions are not a means of “saving” a weak division. Stryker requires strong internal R&D and marketing organizations to make its acquisition strategy work. Before a deal, internal personnel are critical for assessing targets, helping separate the wheat from the chaff. After a deal, internal staff members become even more important, in engaging and integrating the products and capabilities that come with the target. Hence, even as Stryker has increased the pace of its acquisitions in the past five years, internal R&D has risen over 100 basis points, from about 5% of sales to more than 6% of sales. Selling, general, and administrative expenses, meanwhile, also have increased substantially in magnitude (to almost $4 billion in 2016) while becoming more efficient, falling from 37% of sales in 2011 to under 35% of sales in 2016.

Principal 2: Serial acquirers create shareholder value

Research by Bain & Company (2012) shows that serial acquirers create more value than ad-hoc buyers. Firms that regularly undertake acquisitions learn how to seize the gains while avoiding pitfalls. Quite simply, repetition of similar activities creates value. Stryker has built strongly on this lesson.

Drawing from its experience, Stryker has developed a playbook that has improved the company’s acquisition batting average. Codifying the experience in the playbook helps achieve more thorough due diligence, underlies strong negotiations and bid strategy, drives superior integration planning and implementation during the critical first 100 days of a deal, and gives a due diligence team confidence to walk away from a deal.. At its core, the experience-based playbook helps the company adhere to the basic rules we described above, while providing deeper nuance beyond the basics.

Stryker also has learned to pace its flow of serial acquisitions. As Exhibit 1f highlights, after a burst of acquisition value, the company typically takes a year or more “digestion period” before seeking another large meal. Even a company with extensive acquisition experience and a strong acquisition playbook faces limits in time and personnel to devote to due diligence and integration. The slower pace of deals allows experienced staff to focus on making sure that recent larger deals succeed.

In turn, success in integrating the serial flow of acquisitions has increased the flow of companies approaching Stryker seeking buy-outs. Potential targets know that they have a better chance of success within Stryker than within many of its competitors. Many value the potential growth for their products and the continued opportunities for employees if they become part of Stryker.

Principal 3. Seek “bolt on” and “extension” deals that leverage core strengths at home and abroad

Most of Stryker’s deals provide new products and capabilities that leverage existing core strengths. The company has a strong sales organization in its U.S. home market, with marketing competencies and contracting capabilities that go far beyond the skills of smaller targets. Existing sales staff, complemented by new team members from the targets, drive value by selling new products that come from the deals. Thus, leveraging existing market strength via “bolt on” deals has been highly effective for the company.

The principle of leveraging core strengths goes beyond bolt on deals that add scale to existing product lines, also providing support for “extension” deals. The company’s three main business units – Orthopaedics, MedSurg, and Neurotechnology-Spine – each have a dedicated R&D group. The development staff in each unit can build on new capabilities that arrive with acquisition targets, quickly iterating new products that provide stronger customer solutions than either Stryker or its target could have achieved alone.

Beyond its home market, Stryker has growing global presence. The geographic scope provides global opportunities for both “bolt on” and “extension” deals. International breadth allows the company to gain competitive advantage by taking U.S. technologies abroad. In parallel, the growing number of ex-U.S. deals creates opportunities to bring international technology and products into U.S. markets. Together, the mix of “bolt on” and “extension” acquisitions in the U.S. and worldwide provide innovative products globally, as well as job growth in the company’s home market.

Stryker engages in far fewer “white space” deals that explore market and technological space far beyond the company’s current core. While the occasional white space acquisition is valuable in opening up new markets and potentially creating new divisions, these deals are far more challenging than bolt on and extension deals. One of the lessons of the serial acquisition experience is to reserve white space deals for a small number of exploratory initiatives. These deals are typically smaller experiments that provide potential launching pads for path-breaking growth, but will not damage the core business if they struggle to take flight.

Principal 4. Balance capital allocation among acquisitions and shareholders

Investing most available resources in growth is tempting, particularly for a successful firm in a dynamic industry, but also risks making long-term shareholders nervous about when they will receive payouts. Stryker’s annual capital allocation typically devotes somewhat more than 50% to acquisitions, with the remainder to dividends and share repurchases. The strong investment in targets to obtain new products and capabilities helps fuel the growth engine. At the same time, using current success to provide ongoing financial rewards to shareholders helps build loyalty and support for the company’s vision for its future

Principal 5. Seek deals that are accretive to growth

Big bets with long horizons are tempting, but often take so long to pay off that they draw down resources and constrain the ability to play the next round. Stryker most often seeks deals that offer near-term pay-offs as well as the potential for long-term wins. The early pay-offs in reduced costs and new revenue, typically aiming for milestones within the first year, maintain market confidence in the company’s growth strategy. Just as importantly, the pay-offs provide resources for investing in organic R&D and marketing initiatives.

The emphasis on accretion is central to the ability to support both internal and external resource sourcing. Internal resources that arise from accretive deals help the company avoid falling into the trap in which acquisitions suck resources away from internal activity. Instead, accretion supports the virtuous cycle of balanced growth in both internal development and acquisition activity.

Conclusion

The commercial life sciences sector is dynamic and uncertain, with rapid pace across products, markets, technologies, and competitors. Many once-leading firms have disappeared, missing changes in their core markets and being absorbed by more effective competitors. Stryker is one of the few firms that have thrived year after year in the midst of market and technological turmoil. At the core, the company’s dual growth strategy of internal development and active acquisitions underlies the ongoing success.

References

Bain & Company. February 3, 3012. Four ways to improve your chances of success in M&As. The Economic Times.

http://www.bain.com/publications/articles/four-ways-to-improve-your-chances-of-success-m-and-a.aspx

Capron, Laurence, and Mitchell, Will. 2012. Build, borrow, or buy: Selecting pathways for growth. Harvard Business Review Press: Cambridge, MA.

EXHIBIT 1. STRYKER CORPORATION FINANCIALS AND ACQUISITION TRENDS

| 1c. Stryker Stock Trend v. Dow Jones Industrial Average (DJIA), 2001-2017 | |

EXHIBIT 2. EXAMPLES OF STRYKER ACQUISITIONS, 1979-2016

| Year | Value ($ million) | Target company / product lines | Country | Key products and capabilities |

| 2016 | $2,775 | Sage Products | US | Medical supplies |

| 2016 | $1,280 | Physio-Control | US | Urgent patient care |

| 2016 | $51 | Stanmore Implants Worldwide | UK | Orthopaedic oncology |

| 2016 | CareFusion products (Becton, Dickinson) | US | Vertebral compression fracture products | |

| 2016 | Ivy Sports Medicine | US | Meniscal repair | |

| 2016 | Synergetics Neuro portfolio (Valeant) | US | Neurosurgical instruments | |

| 2016 | Restore Surgical / Instratek | US | Implants for feet, ankles, and upper extremities | |

| 2016 | SafeWire LLC Product Portfolio | US | Minimally invasive spine surgery instruments | |

| 2015 | Muka Metal | Turkey | Patient room furniture | |

| 2015 | CHG Hospital Beds | Canada | Hospital beds | |

| 2014 | $375 | Small Bone Innovations | US | Joint replacement |

| 2014 | $172 | Berchtold Holding | Germany | Hospital equipment |

| 2014 | $120 | Patient Safety Technologies / SurgiCount | US | Operating room compliance software |

| 2014 | Pivot Medical | US | Hip instruments & implants | |

| 2013 | $1,650 | MAKO Surgical | US | Robotics |

| 2013 | $764 | Trauson Holdings | China | Spinal instruments |

| 2013 | $30 | ActiViews Ltd | Israel | CT-Guide navigation |

| 2012 | $135 | Surpass Medical | Israel | Stent technology |

| 2012 | Innovative Infusions | US | Infusion services | |

| 2012 | P.M.F. SAS | France | Spine surgery | |

| 2011 | $1,500 | Neurovasco (Boston Scientific) | US | Neurovascular technology |

| 2011 | $316 | Orthovita Inc | US | Orthobiologic and biosurgery products |

| 2011 | $150 | Memometal Technologies | France | Podiatric surgery |

| 2011 | $135 | Concentric Medical | US | Interventional neurovascular |

| 2010 | $150 | Gaymar Industries | US | Pressure ulcer management |

| 2010 | Porex Surgical | US | Bioimplantable porous polyethylein products | |

| 2009 | ~$55 | OtisMed Corp | US | Implant software support |

| 2009 | ~$55 | Sonopet ultrasonic controls (Mutoh) | Japan | Ultrasonic support for bone surgery |

| 2009 | $525 | Ascent Healthcare Solutions | US | Remanufacturing of medical devices |

| 2007 | Everest Biomedical Instruments | US | Handheld diagnostics | |

| 2006 | $140 | Sightline Technologies | Israel | Gastro-intestinal endoscopes |

| 2005 | $50 | eTrauma | US | Picture Archive and Communications Systems |

| 2005 | $18 | PlasmaSol | US | Sterilization equipment |

| 2004 | $360 | SpineCore | US | Spinal disc technology |

| 2002 | $135 | Surgical Dynamics (Tyco) | US | Spinal implants |

| 2002 | Dekompressor (Pain Concepts) | US | Interventional pain technology and products | |

| 2000 | $12 | Image Guided Technologies | US | Surgival navigation |

| 1999 | Infomedix | US | Medical image communication | |

| 1998 | $1,650 | Howmedica (Pfizer) | US | Orthopedic products |

| 1998 | $20 | Creative BioMolecules rights | US | Orthopaedic reconstruction production rights |

| 1998 | Bertec Medical | Canada | Medical beds | |

| 1996 | Osteo Holdings | Switzerland | Orthopedic trauma | |

| 1994 | $600 | Matsumoto Medical Instruments | Japan | Medical distribution |

| 1992 | $11 | Dimso | France | Spinal fixation |

| 1991 | Prab Robots plants | US | Robotics facilities | |

| 1990 | Quintron-Driskell product line | US | Dental implant products | |

| 1987 | Hexcel Medical | US | Medical composites and polymers | |

| 1987 | Adel Medical | US | Labor and delivery stretchers | |

| 1981 | SynOptics | US | Endoscopy | |

| 1979 | Osteonics | US | Orthopedic implants |

Note: All data in exhibits 1 and 2 are drawn from public sources, including company annual reports, corporate histories, Thomson SDC Platinum, and the ReCap IQ database.