Ernest G Ludy, Founding CEO, Medstat Systems; Senior Advisor, Clinical Excellence Research Center, Stanford University

Contact: ernie@egloffice.com

Abstract

What is the message?

Business model innovation in U.S. health insurance can serve as a national strategy for disrupting markets, challenging the industry’s cost-plus business model, and stabilizing premium inflation. The “optimal care” business model is an innovative, tech-enabled, win-win business model, which generates quality-based margins by eliminating the avoidable underwriting losses of suboptimal care and sharing those margins with stakeholders across the value chain.

What is the evidence?

First adopted by a large group of Fortune 300 companies, strong customer results confirmed the optimal care business model’s impact on slowing premium growth, with the best performers achieving near-zero inflation. This paper describes the paradigm and design for the new business model, and the engineering practice and technology platform for its execution.

Timeline: Submitted: June 24, 2024; accepted after review August 23, 2024.

Cite as: Ernest Ludy. 2024. Insured But Not Protected: Business Model Innovation and Stabilizing Healthcare Premium Inflation for All Americans. Health Management, Policy and Innovation (www.HMPI.org), Volume 9, Issue 3.

Introduction

U.S. healthcare inflation is an economic black hole. It consumes our individual, business, and government income faster than we can earn it, and it erodes our personal, corporate, and national net worth faster than we can build it.

Since 1980, national health spending has consistently grown two to three times faster than GDP, expanding from 9% to almost 20% of our economy. Similarly, health insurance premiums have continued to increase four to five times faster than wages, and two to three times faster than general inflation or the Consumer Price Index (CPI).

Health insurance premium inflation is posing an existential threat to the industry itself, increasingly destabilizing its own financial foundation — businesses and workers who pay premiums and taxes to finance employer- and government-sponsored health insurance.

The situation is worsened by steadily increasing coinsurance, copayments, deductibles, and out-of-pocket expenses for consumers. Poor patient care, waste, and clinical errors further erode value. Health insurance is becoming an absurdity, leaving most Americans in an untenable paradox — insured but not protected.

Solving healthcare inflation and stabilizing insurance premiums has been a decades-long and frustrating challenge, especially for the buy-side of insured healthcare. With few exceptions, most strategies launched by business and government, or advanced by policymakers and advisors on their behalf, have proven to be more tried than true, yielding little in the way of sustainable cost reduction or premium stability.

One exception was a business model innovation strategy pioneered by Medstat Systems and first adopted by its Fortune business customers. The strategy was designed to empower corporate sponsors of employee health insurance plans with a new “optimal care” business model and tech-enabled execution platform. The goal was to safely and sustainably reduce and stabilize premium inflation. The broader strategic intent was to leverage the buying power of large employers to directly challenge the insurance industry’s cost-plus business model.

It worked.

Strong customer results confirmed the impact on slowing premium growth, with the best performers achieving near-zero inflation (Figure 1). Customer retention and operating results also validated the strategy’s commercial viability. The new optimal care business model had won the day by reversing inflation and turning cost-plus insurance economics upside-down.

Figure 1: Medstat customers versus U.S. health benefit spending trend: 2005-2010; Medstat Systems business profile and operating results

The purpose of this paper is to explore how business model innovation can serve as a national strategy for reversing healthcare inflation and stabilizing insurance premiums over the next decade. The paper will cover three areas:

- First, the unique market structure and value chain economics that define the competitive landscape for building new business models in U.S. healthcare.

- Second, the optimal care business model including the paradigm for its design, and the engineering and intelligence technology platform for its execution.

- Third, the challenge of widespread business model adoption and industry transformation.

The larger intention here is to spark the imagination of innovators and entrepreneurs, from within and outside healthcare, and drive business model innovation as a disruptive strategy leading to longer term industry transformation.

Market Structure and Value Chain Economics

Healthcare inflation is systemic. It’s the outcome of an economic structure that creates it, a complex system of relationships that comprise the value chain for insured healthcare. Understanding how this value chain creates unintended consequences and drives excess inflation is fundamental for designing new business models to reverse it.

Health insurance generally works like this (Figure 2): Sponsors pay premiums to Insurers to finance health benefits for Members. Members use benefits to consume services from Providers. Providers in turn bill Insurers for costs. Insurers reimburse Providers, add administrative fees on top of reimbursements, and bill premiums to Sponsors. A four-party system, two supply chains and a cost-plus business model — a perfect storm for premium inflation!

Figure 2: U.S. insured healthcare value chain economics

Several unintended and inflationary consequences occur from this structure. First, a four-party system neutralizes demand-supply economics, weakening competitive market forces for improving quality, cost, or price.

Second, the two supply chains of insurance and care delivery obscure end-to-end supply chain visibility. Sponsors fly blind as they struggle to use modern purchasing practices to track quality and costs to improve performance and stabilize premiums.

Third, the industry’s cost-plus business model is inherently inflationary. Providers earn more if they do more. Insurers earn more if they spend more. Both drive premium inflation at sponsor expense. In this conflicted position, insurers and providers have more incentives to increase costs rather than reduce them.

Weak market forces, poor supply chain visibility, and a cost-plus business model with few incentives for reducing costs are the structural (and dysfunctional) consequences of our healthcare system that drive inflation. Reversing or neutralizing their inflationary impact defines the agenda for reframing the problem and designing new business models to solve it.

Business Model Innovation Strategy

A business model is the way a business or industry creates value for its stakeholders. Business model innovation is the process of connecting new technologies and exponential mindsets to generate new business models that drive exponential stakeholder value, often leading to market disruption, incumbent adoption, and industry transformation.

The optimal care business model was developed to disrupt the conventional cost-plus business model of U.S. health insurance. It was generated by connecting emerging intelligence technologies with a new optimal care paradigm for reducing healthcare inflation and stabilizing insurance premiums. The following discussion lays out the paradigm, business model, engineering practice and enabling technology platform.

Optimal Care Paradigm

First principles thinking and exploring different mindsets for solving intractable problems often lead to breakthrough solutions. A new paradigm emerges, causing a shift in consciousness and perception, suggesting new ways to reframe a problem so it can be solved. This was the case in discovering the Optimal Care paradigm for designing a new business model to stabilize premium inflation in health insurance.

Imagine asking an engineer and an actuary for their best thinking on how to reduce costs. What first principles would they use to solve the problem?

The industrial engineer responds that in her world of product manufacturing, the best way to reduce costs is to improve quality. She explains that by improving systems, processes, and supply chains to eliminate defects, you can avoid the unnecessary costs of do-over work and scrap.

The actuary counters that in her world of estimating the cost of underwriting losses, the best way to reduce costs is to reduce risk. She continues that by eliminating avoidable risk, you can avoid the costs of unnecessary underwriting losses.

Is there any common ground here? Is there a way to blend the two professional mindsets into a new “actuarial engineering” paradigm for solving premium inflation? Bingo!

The “actuarial engineer” would reason that in her world of insured healthcare, the way to reduce costs is to improve quality to reduce the risk of poor care. Improving quality by improving systems, processes, and supply chains to reduce patient risk for poor care, avoids the costs of unnecessary medical underwriting losses and leads to reduced premiums.

This quality-first principle is the foundation of “optimal care”. Combining risk mitigation and quality improvement drives best care-best cost healthcare and a new quality dividend for stabilizing premium inflation. Capturing this dividend is the endgame for business model innovation in U.S. health insurance — and optimal care is the north star.

Understanding the structure of patient risk for suboptimal care is critical to capturing the quality dividend. (Figure 3). In the context of value chain economics, the risk of suboptimal care (poor outcomes, excess costs, high error rates) is a function of system risk (insurance coverage, reimbursement, care delivery, and patient health), in the context of social risk (social, economic, demographic, and geographic determinants). In other words, patient risk for suboptimal care is the outcome of system and social risk drivers. Eliminating system risks while neutralizing social risks, leads to avoiding unnecessary underwriting losses and generating a quality dividend.

Figure 3: Three-tiered risk model for understanding patient risk for suboptimal care

To bring the potential economic value of the quality dividend into sharper focus, suboptimal care generally accounts for 30% of care and up to 50% total medical spend. In a five-year analysis of one million Medicare patients between 2005 and 2010, the worst 10% of care accounted for 50% of medical spend (Figure 4). Targeting the worst 10% of the nation’s suboptimal care could reasonably deliver enormous quality-based returns, especially as we approach $6 to $7 trillion in annual national health spending by 2030.

Figure 4: Annual Suboptimal care spend for one million Medicare members: 2009-2013

Achieving zero inflation healthcare is not hard to imagine given this amount of quality waste and excess spending. But capturing this quality dividend depends on a deploying a new business model with new incentives to drive new value. Without it there is little chance of avoiding the massive spending from suboptimal care or the accelerating insurance premiums to fund it.

Optimal Care Business Model

The optimal care business model is a quality-based margin growth, health insurance business model (Figure 5). It’s designed to drive the best care at the best cost for each insured member by eliminating avoidable risk and unnecessary underwriting losses caused by suboptimal care. Reducing suboptimal care reduces medical spend and generates new margins to reduce premium growth, add benefits, and fund provider incentives.

Figure 5: Optimal care business model for U.S. insured healthcare

The combined effect of insuring and delivering optimal care reverses the inflationary flywheel of conventional health insurance, captures the quality dividend, and stabilizes premium growth for individuals, business and government. If adopted by industry innovators, the premium advantage would position them to disrupt their markets and grow member enrollment, revenue, earnings, and share at their competitors’ expense. But competing based on optimal care is not likely to be championed by innovators from inside the health insurance industry.

Why? The century-old sacred cow: the cost-plus business model.

A closer look at how premiums are calculated reveals the stark difference between cost-plus and optimal care strategies for creating value, and it clarifies the disincentives for industry incumbents to lower premiums.

In general, health insurance premiums are calculated based on the expected claims experience of a given insured population, plus a regulated administrative services fee based on paid medical claims, capped at 15% to 20% of total premium (Figure 6).

Figure 6: Calculating health insurance premiums

Underlying the paid claims experience are the two drivers of payments. First, expected risk, or the probability of adverse health conditions or events. Second, expected loss, or the portion of expected risk that materializes requiring medical services. Both risk and loss can be managed and, if managed well, can reduce the total premium.

But therein lies the rub. Reducing risk and loss lowers expected payments. Lower payments reduce administrative fees and lead to lower income for insurers. Under the cost-plus business model insurers are conflicted. There is little, if any, incentive to lower the expense base (paid medical claims) for calculating service fees and premiums. Period.

In contrast, under the optimal care business model, insurers would take a longer view. Improving quality to lower costs (and administrative fees) drives margin growth. Spreading new margins across the value chain to sponsors, members, and providers to lower premiums, improve benefits, and incentivize quality, creates a best care-best cost market position. This in turn leads to growth in member enrollment, revenues, earnings, and market share.

The optimal care business model represents disruptive innovation at its best. A quality-based, margin growth, win-win business model for growing share and market leadership in markets that are value-hungry, ripe for disruption, and up for grabs.

Actuarial Engineering

Actuarial engineering is the risk management practice for executing the optimal care business model. It drives new margins for stabilizing premium inflation by improving quality to eliminate the avoidable risk and unnecessary underwriting losses from suboptimal care. As a practice it cultivates the defining core competency for innovation and creating new stakeholder value.

The actuarial engineering practice follows a four-step process for eliminating suboptimal care (Figure 7).

- Model and measure risk

- Target high impact cohorts

- Determine system and social risk drivers

- Design & refine mitigation strategies

Figure 7: Actuarial engineering practice for optimal care

The Member Risk Signature, or MRS, is the foundation of actuarial engineering. Member-centric, risk-focused, and care-based, MRS embodies both the model and metrics for estimating an individual member’s risk for suboptimal care.

MRS is built on the three-tiered risk model that frames care risk as a function of system risk in the context of social risk (Figure 3). That means that the probability of clinical transactions becoming suboptimal (poor outcomes, excessive costs, and high error rates) depends on system drivers (insurance coverage, reimbursement, care delivery, and patient health) and social determinants (social, economic, demographic, and geographic) which directly and contextually influence the quality and cost of care.

Using this multi-factor risk model, MRS accumulates deep knowledge of each insured member over time, incorporating over 100 risk variables from more than 30 sources of data. Unique MRS intelligence is developed for each member, which can be thought of as a DNA-like signature or “code” for signaling a person’s current and future risk for suboptimal care.

Applying MRS across a total insured population identifies the suboptimal care segment. This segment can be further classified into 12 cohorts based on their primary and secondary risk drivers. By further examining each cohort’s suboptimal care spend, high impact cohorts can be targeted for mitigation strategies.

By diving deeper into each cohort’s primary and secondary risk drivers, customized risk mitigation strategies can be designed, combined, tested and scaled. Tailoring coverage, cultivating health, improving care delivery, or aligning reimbursement: these are strategies aimed squarely at eliminating the risk and losses of suboptimal care, and they complete the actuarial engineering cycle by improving quality to reduce costs and capturing new margins to stabilize premium inflation.

Intelligence Technology

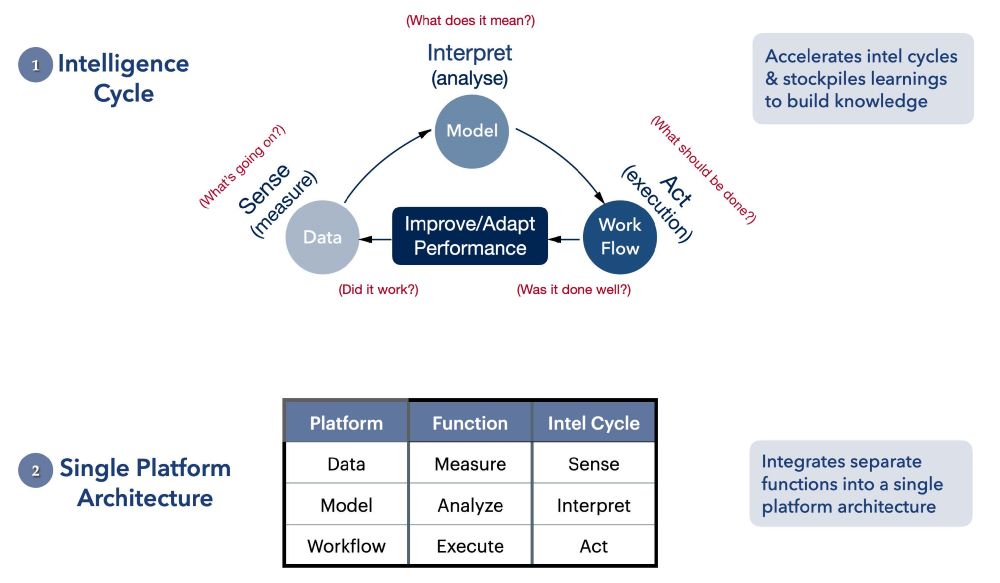

Intelligence technology platforms combine advanced computing and information technologies on a single platform and are designed to achieve three objectives. First, to automate and accelerate intelligence cycles for decision-making and performance improvement. Second, to stockpile learnings from recurring intelligence cycles to build higher order knowledge. Third, to link knowledge to workflow, fast and at scale, to reduce cycle time from intelligence to operations, and to narrow the gap between what we know and what we do (Figure 8).

Figure 8: Intelligence technology platform for optimal care

Intelligence cycles are data-model-workflow cycles which enable measurement, analysis and execution. Five questions reveal the structure of a complete cycle: What’s going on? What does it mean? What should be done? Was it done well? Did it work?

Answers create intelligence. Recurring cycles refine intelligence and stockpile knowledge to improve performance. And single-platform architecture, integrating data-model-workflow cycles, drives intelligence fast and at scale.

In the context of optimal care business model execution, the intelligence platform is the enabling technology that performs the heavy lift of actuarial engineering: detecting and modeling risk using MRS-like models; refining and targeting customized risk mitigation strategies based on system and social risk drivers; and modeling margin growth and designing incentives for quality improvement to further stabilize premium inflation. This is the work of intelligence technology — automated intelligence cycles imbedded into a single platform that learns fast, scales quickly, and, in a word, is indispensable.

Indispensable in two ways. First, without an intelligence technology platform, meaningful initiatives for driving optimal care fall victim to the daunting complexity and scale of the data acquisition and curation work that drives analytics and workflow. Inertia prevails with no momentum for reversing the inflationary flywheel.

Second, with such a platform, insured healthcare becomes AI-ready, countering inertia with exponential speed, and making it easy to imagine a powerful Actuarial Engineering AI-assistant for accelerating optimal care and stabilizing premiums — a highly probable development for achieving escape velocity in the very near future.

Optimal Care as A National Strategy

The central thesis of this paper is that business model innovation can serve as a national strategy for reversing healthcare inflation and stabilizing insurance premiums for individuals, business and government. The underlying reasoning goes as follows:

- First, healthcare inflation is systemic and the outcome of a four-party economic structure which neutralizes demand-supply economics, weakens competitive market forces, obscures supply chain visibility, and tolerates the industry’s inflationary cost-plus, fixed margin business model.

- Second, stabilizing premium inflation requires strengthening market forces, and empowering sponsors with an alternative paradigm, engineering practice, and intelligence platform. The goal is to clarify supply chain performance and build new business models that grow margins and offset premium increases.

- Third, the optimal care business model is a tech-enabled, win-win business model which empowers sponsors to drive quality-based margins by eliminating suboptimal care, and then to deploy those margins to stabilize premiums, add benefits, and incentivize providers.

Adopting the optimal care business model as a national strategy would leverage the immense buying power of business and government to stabilize premium inflation by reducing suboptimal care. The intention would be to empower markets to drive value and then let markets work — no new legislation or regulation, while aligning the healthcare economy with the national economy and the general inflation rate.

We have the intelligence technology and engineering know-how to build and execute a new healthcare business model and stabilize premium inflation at CPI levels and below. We have the purchasing power of large corporate sponsors and the ability to consolidate smaller business sponsors to create scale. State and Federal government could play an even larger purchasing role, insuring more than half the nation through Medicare, Medicaid, and its employee health plans.

But the question remains: Over the next decade will we have the moral imagination and compassionate resolve to end high inflation healthcare and the hardship it causes for so many?

High inflation healthcare is a choice. Will we choose to stabilize it or not?