Christopher R. Idelson, ClearCam; Maansi Srinivasan, ClearCam; Austin Fagerberg, McGovern Medical School, The University of Texas, ClearCam; John M. Uecker, Dell Medical School, The University of Texas at Austin and ClearCam; Douglas G. Stoakley, ClearCam; Marian Yvette Williams-Brown, Dell Medical School, The University of Texas at Austin; Christopher G. Rylander, Department of Mechanical Engineering, The University of Texas at Austin

Contact: cidelson@utexas.edu

Abstract

What is the message? The adoption of new laparoscopic technologies in the healthcare ecosystem is primarily driven by cost, impact on the standard of care, and policy influences, with smaller companies facing distinct challenges compared to larger entities.

What is the evidence? Over 100 interviews with healthcare professionals and secondary research revealed that commercial factors, regulatory demands, intellectual property, and manufacturing are significant factors in product adoption, with disparities in how smaller versus larger companies navigate these obstacles.

Timeline: Submitted: September 13, 2024; accepted after review: March 11, 2025.

Cite as: Christopher R. Idelson, Maansi Srinivasan, Austin Fagerberg, John M. Uecker, Douglas G. Stoakley, Marian Yvette Williams-Brown, Christopher G. Rylander. 2025. Translation of Laparoscopic Surgical Innovation: Discovering and Deciphering Practices and Policy Impacts. Health Management, Policy and Innovation (www.HMPI.org), Volume 10, Issue 1.

Competing Interest Statement: Existing competing interests between the authors and the subject matter do not appear to be present.

Acknowledgements & Funding Sources: The National Science Foundation Innovation Corps Program, Award Number 1844732 September 5th 2018- August 31st 2019

The authors confirm contribution to the paper as follows:

- Study Design and Conceptualization: The study was conceived and designed by Christopher R. Idelson, PhD, John M. Uecker, MD, Christopher G. Rylander, PhD, Marian Yvette Williams-Brown, MD, and Douglas G. Stoakley, BS.

- Data Collection: Data gathering/interviews were conducted by Christopher R. Idelson, PhD, John M. Uecker, MD, Christopher G. Rylander, PhD, and Douglas G. Stoakley, BS.

- Analysis and Interpretation: Data was analyzed and interpreted by Marian Yvette Williams-Brown, MD; Christopher G. Rylander, PhD; Christopher R. Idelson, PhD; John M. Uecker, MD; Douglas G. Stoakley, BS; and Maansi Srinivasan, BS.

- Drafting of Manuscript: The initial draft of the manuscript was written by Christopher R. Idelson, PhD. and further contributions were made by Maansi Srinivasan, BS and Austin Fagerberg, BS. All authors reviewed and approved the final manuscript.

Each author contributed significantly to the research and manuscript preparation, ensuring the integrity and accuracy of the work.

Introduction

Medical devices are pivotal in healthcare, especially in surgery, where advancements in medical technology (MedTech) are crucial [1-3]. Surgical innovations, like the Intuitive DaVinci robotic system, have transformed procedures by enhancing precision, reducing invasiveness, and improving patient outcomes [4]. As healthcare evolves, understanding the MedTech ecosystem is essential for developing new technologies.

Commercializing innovative technologies is a complex process requiring significant time and resources [5-6]. Bringing products to market involves navigating regulatory approvals, quality assurance, distribution networks, and partnerships with healthcare providers [7]. The MedTech ecosystem presents unique challenges due to its diverse customer base, which includes a diverse group of stakeholders, of which primary segments typically include patients, providers, and payers [6-11]. This dynamic environment complicates market entry for both large enterprises and smaller businesses.

Effective customer needs analysis (CNA) is vital to ensure product design is meaningful and viable for the wide range of stakeholders in today’s medical marketplace [12-15]. Previous research has emphasized the accurate identification of customer needs through various techniques [16-21]. Stanford University’s Department of Management Science and Engineering has developed a robust “customer discovery” (CD) curriculum, recognized as the standard for the National Science Foundation (NSF) Innovation Corps (I-Corps) program since 2011 [16, 22-24]. The CD approach focuses on formulating and testing hypotheses to tackle commercialization challenges [28], acknowledging the significance of different stakeholders or “customer segments” within the ecosystem, including end-users, decisionmakers, payers, and influencers. Engaging with these stakeholders helps product teams understand the importance of, and value attributed to, specific needs [29]. Value propositions (VPs), which align with customer needs across various segments, are crucial in the CD process as they are the key link between technology features that create value propositions for customer needs [13, 24, 30-32].

The impact of organizations and policies governing the MedTech ecosystem is significant. Regulatory bodies, intellectual property protection, financial reimbursement, product development and manufacturing – these and many other aspects hold sway over the successful adoption of products and services, sometimes playing life-giver and life-taker for these technologies [33-38]. Regulatory standards and approvals, quality standards, and reimbursement mechanisms are centered around ensuring patient safety, but they can also create barriers to innovation. Regulatory bodies like the U.S. Food and Drug Administration (FDA) set important-yet-stringent requirements to ensure safety and efficacy, which may hinder innovation. Healthcare policies regarding reimbursement and funding significantly impact the adoption and scalability of new technologies. Favorable policies encourage adoption, while restrictive ones limit market penetration. Public policy influences the MedTech ecosystem through incentives like grants and tax credits, which foster early-stage research and development. However, high startup failure rates may indicate these incentives could be insufficient for many of these companies to overcome the “valley of death” in translating concepts into viable products.

Successful innovation requires understanding the interplay between policy and market dynamics. Integrating policy considerations into early-stage customer discovery and needs analysis can help innovators navigate regulations and align value propositions with incentives for successful commercial advancement. However, this can be distracting during early development stages when the focus is on proving concepts, raising capital, and achieving regulatory milestones. Given commercialization challenges, a structured approach to gathering customer requirements and understanding market influences is necessary. This study explores the practical implementation of CNA and the relevance of CD, focusing on stakeholders, policy impact, and other factors affecting surgical technology development and adoption within the MedTech ecosystem, and offering a roadmap for bringing innovative surgical devices to market [39-44].

Methods

More than 100 interviews were conducted with professionals in the healthcare ecosystem across the US, focusing on the laparoscopic operating room (OR) to aid in the understanding and development of a broad CNA for this growing surgical field. The interviews were geographically spread across the country, with a significant concentration in Texas.

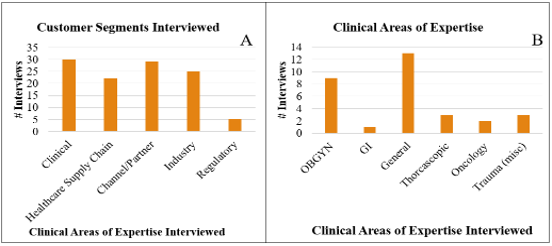

Figure 1: (A) Customer segments interviewed (B) Areas of clinical expertise interviewed regarding Minimally Invasive Surgery (MIS) surgeons.

A total of 112 live, spoken interviews were completed with various experts in the clinical domain (e.g., those in the OR during surgery) (n = 32), healthcare supply chain domain (n = 21), channel/partner domain (n = 32), industrial/sales/medical device executive domain (n = 22), and the regulatory domain (n = 5) (Fig 1A). Among these, 99 were face-to-face and 13 via phone. Of the 32 interviews from the clinical domain, 31 were with surgeons experienced in laparoscopic surgery (of varying disciplines). Within the clinical customer segment of laparoscopic surgeons, various areas of clinical expertise were interviewed including obstetrics and gynecology (OBGYN), gastrointestinal (GI), general, thoracoscopic, oncologic, and trauma (Fig 1B). These laparoscopic surgeons provided meaningful insights into everyday issues and workflow in their respective institutions. Laparoscopic surgeon interviews were only counted as such if they averaged >3 laparoscopic cases/week. Sex, age, and degrees/levels of experience were not otherwise tracked. Similar to the scientific method and as employed by the I-Corps curriculum, interviews were structured to test specific hypotheses regarding customer needs in the context of the ecosystem and workflow in the healthcare field.

Interviews began with general introductions. Participants were informed that the goal of the interview was to understand their daily routine and pain points. That is to say, the only aspect interviewees were made aware of was that the team was participating in the NSF I-Corps program and wished to speak to experts in their respective fields to understand problems that they faced as well as general ecosystem dynamics. This allowed for an unbiased launch into broad interview topics. Professionals from various customer segments, including Surgeons in Minimally Invasive Surgery (MIS), Hospital Administrators, Sales, and Distribution entities, contributed to a comprehensive understanding of the roles and responsibilities driving the adoption of surgical technologies. Interview questions were prepared specific to each customer segment, included in Appendix A. Questions were structured to allow for open-ended responses, and interviewers allowed the interviewees to drive the conversation in a natural manner, so as not to impart any bias in the interview. All interviewees primarily operated in the United States, so results focus on the U.S. healthcare ecosystem.

After completing interviews and assessing the relevant raw data, secondary research was performed to assess what policies and/or policymakers existed as related to the impacted areas that interviewees discussed.

Results

Results from interviews proved extremely fruitful in providing both high-level and detailed accounts of stakeholder requirements, perspectives, and preferences when considering medical devices in laparoscopic surgery. Though numerous challenges exist in the operating room, our results demonstrate that launching and commercializing a product in this domain follows a multistep process with distinct requirements at each phase.

Interview results supported the notion that truly understanding pain points of end users, decisionmakers, and payers is the first domino to address in the innovation process to ensure that the value propositions for innovations validate a “product-market fit.” For example, our findings highlight the specific clinical needs of laparoscopic surgeons. Out of 31 clinicians interviewed, 100% identified laparoscope lens debris obstructing vision (i.e. fog/condensation, blood, or fat tissue/residue on the laparoscope lens) as a problem in the OR, with 18 mentioning this issue unprompted and the remaining 13 confirming it when specifically asked. FDA and other regulatory bodies further influence the trajectory of medical devices from an early development stage in the innovation and commercialization process, a key stakeholder ultimately providing the first “go/no-go gate” for potential clinical adoption in the U.S. Results also revealed a specialized distribution network for laparoscopic devices, which differs significantly from conventional hospital supply chains due to technical specialization and higher equipment costs. These distribution challenges are further complicated by adoption pathways that, while primarily surgeon-driven from the user needs perspective, must navigate multi-layered approval processes involving OR managers, evaluation committees, and potentially GPO negotiations before new technology can reach the operating room. Further results showcased the relevance, importance, and influence that intellectual property, manufacturing, and customer contracts may have on successful market adoption. Interview results were further supplemented by secondary research in these various domains regarding applicable policies and standards to extrapolate and elaborate on details relative to interview data.

In light of these findings, the raw interview data can be clustered into two broad themes: (i) Standards and Regulations – the essential regulatory compliance and quality standards that establish the minimum viable product for legal market entry; and (ii) Product Development & Commercialization Considerations – the subsequent development factors in MedTech affecting clinical adoption and commercial viability.

Standards and Regulations

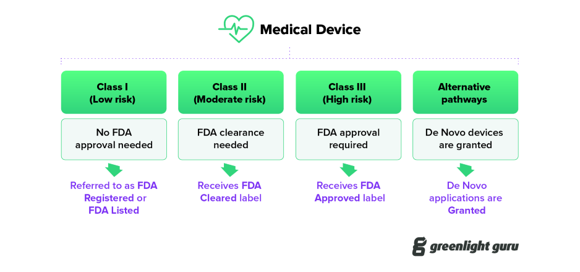

All stakeholders operating within or closely connected to regulatory processes, comprising FDA regulatory consultants, liaisons, and executives in channel/partner and industrial/sales domains (n=35), unanimously emphasized that adherence to FDA authorization and compliance underpins the safe and legal introduction of medical devices in the U.S. healthcare system. The FDA plays a central role, setting stringent standards for safety and efficacy through the established classification system (Class I, II, III), the Medical Device Reporting (MDR) regulation, and the Quality System Regulation (QSR) [45-48, 52-54].

Interviewees stressed that obtaining the FDA’s “stamp of approval” for clinical use involves navigating the FDA’s classification system (Figure 2). The FDA’s classification system (Class I, II, III) is based on device risk, requiring different levels of regulatory review and approval (registration/listing, clearance, granting, or approval) [52-54]:

- Class I Devices: These require FDA Registration/Listing.

- Class II Devices: These typically require Clearance through the 510(k) process using an established predicate device [53-54]. De Novo devices, also often Class II, require FDA Granting for novel low- to moderate-risk devices.

- Class III Devices: These need FDA Approval following the most rigorous evaluation available [52].

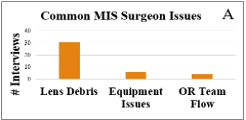

Figure 2: Common issues experienced during laparoscopic surgeries

Procurement specialists and hospital policies engage with FDA-authorized products, often excluding non-authorized products (outside of Class I designation) except possibly under extremely special circumstances. While interviewees acknowledged that FDA classification principles generally apply uniformly, they described specialty-specific variations within laparoscopic surgery. For example, most laparoscopic accessories (e.g., trocars, graspers, insufflation tubing) were identified as Class II due to their moderate risk profile, whereas certain OBGYN laparoscopic tools were mentioned as potentially qualifying for Class I if they present minimal risk. Specialty-specific classifications can shape development timelines, influence market entry strategies, and require hospitals to procure devices that match each specialty’s intended use.

Interviewees reinforced the importance of meeting FDA standards not only for initial market entry, but also for sustaining trust and clinical adoption over the long term. Under the MDR regulation, the Manufacturer and User Facility Device Experience (MAUDE) database collects adverse event reports with information on medical devices and patient demographics. MAUDE serves as a primary database for post-market surveillance of medical devices for the monitoring of device performance and safety. It further enables companies and regulatory bodies to make informed decisions based on reported adverse events and malfunctions. Additionally, the Quality System Regulation (QSR) mandates comprehensive documentation and manufacturing controls to ensure product integrity throughout the device’s lifecycle. It is critical to note that at the time of this manuscript’s writing and review, the QSR is transitioning to the Quality Management System Regulation (QMSR) in an effort to better align the current good manufacturing practice (cGMP) requirements with ISO 13485:2016 (details below) – the international consensus standard for a medical device quality management system (QMS) [46-48]. Beyond the FDA, other organizations play crucial roles in shaping regulations for MedTech. These include, but are not limited to:

- ISO Standards/Certifications: Regulatory consultants (n=5) emphasized that establishing a QMS aligned with ISO 13485 is not required, but could be very beneficial for FDA clearance during audits. ISO 13485 enforces standards for medical device QMS, focusing on product reliability and safety [45-48]. It is typically expected/required for a number of ex-U.S. markets. ISO 9001 (quality management) and ISO 14971 (risk management) further ensure high-quality production and mitigate potential hazards [65-66].

- The Sunshine Act: Managed and overseen by the Centers for Medicare & Medicaid Services (CMS), this law requires transparency in financial relationships between medical device manufacturers and healthcare providers, potentially impacting pathways for successful product promotion and acceptance [50].

- Anti-Kickback Statutes (HHS Office of the Inspector General and Department of Justice): These laws prevent financial relationships from inappropriately influencing medical decisions, encompassing both hospital procurement and distribution [51].

- The American Society for Testing and Materials (ASTM) and the International Electrotechnical Commission (IEC): These organizations establish guidelines for medical device standards, encompassing electrical safety and device specifications [67-70].

Product Development & Commercialization Considerations

In interviews with 31 laparoscopic surgeons, the primary challenges in the operating room (OR) were lens debris, equipment malfunctions, and workflow issues (Figure 3). All surgeons identified obscured vision from lens debris – such as fog, blood, or tissue residue – as a primary issue. Other concerns included inadequate equipment, team coordination challenges, and scheduling delays, though these were mentioned less frequently (Appendix Table B). Interviews with supply chain and OEM representatives revealed additional design criteria considerations primarily related to overhead burden and equipment compatibility. For instance, the number of parts or stock keeping units (SKUs) requiring management and compatibility with existing equipment could influence perceived value. Re-sterilization practices also emerged as a key consideration, with some hospitals valuing reusable instruments, while others favored disposables to avoid reprocessing logistics and overhead costs. This preference appears product-specific, secondarily influenced by hospital policies.

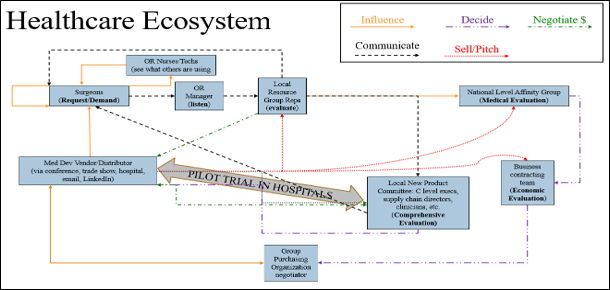

Figure 3: Map of healthcare ecosystem relative to new device workflow within hospital system.

Interview data focused on commercialization efforts primarily focused on market launch, access, and adoption. The concern that lens debris presents a barrier to surgical tool use and robotic system adoption was echoed by nine representatives from large surgical Original Equipment Manufacturers (OEMs) (OEM 1, n=3 | OEM 2, n=2 | OEM 3, n=4).

Hospitals, prioritizing economic benefits, often require third-party reimbursement (HCPCS and CPT codes [55-57]) for new devices. This CMS/AMA-overseen process (~2-3 years) involves stringent FDA labeling and manufacturing standards [58]. Reimbursement policies (Medicare, Medicaid, private insurance) greatly influence a technology’s commercial viability [59-60], with hospitals often relying on reimbursements to justify investments. Companies frequently accept reduced initial margins for long-term profitability. Hospitals may purchase low-cost, high-benefit products without reimbursement. A strategic approach considers the trade-offs between pursuing reimbursement (lengthy process) and accepting lower margins initially, and this may include different/parallel approaches depending on the product and resources. Developing a low-cost product, comparable to standard supplies, can expedite sales and adoption by circumventing the reimbursement process.

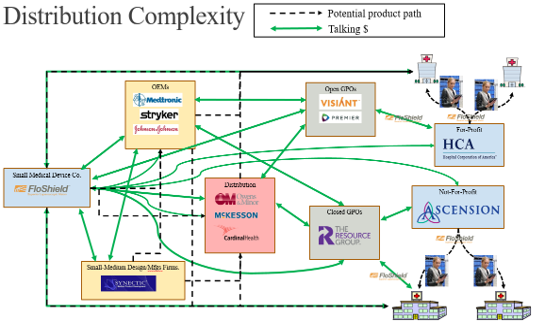

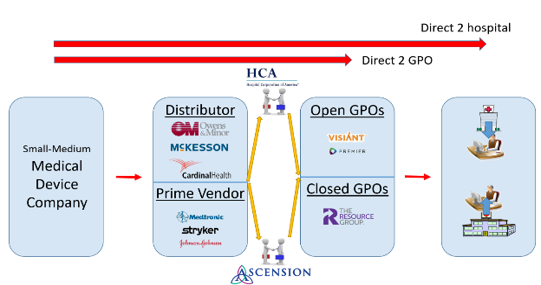

Thirty-two interviews with supply chain, sales, and medical device operations experts revealed a complex distribution network for laparoscopic surgical devices (Figures 4 and 5). While superficially similar to the conventional hospital supply chain (e.g., sourcing, procurement, logistics), the laparoscopic supply chain is characterized by specialization across clinical (12 specialties) and technical domains (robotics, advanced imaging, instrumentation, etc.) [71-74]. This specialization impacts users, administrators, and procurement pathways due to varying expertise and technical needs. Additionally, high equipment costs increase hospital cost sensitivity, while surgeon influence appears to be more prominent than in conventional procurement.

Products reach hospitals through major distributors, Prime Vendor direct sales, or GPO negotiations. GPOs exert significant influence, with hospitals utilizing Open (multiple organizations) or Closed (specific systems) GPOs, impacting product approval times (six to 24 months). Companies, especially with new products, often pursue both direct sales and GPO negotiations to expedite market entry, despite resource inefficiencies. Local contracts within a GPO’s network can sometimes shorten approval timelines. Open GPOs offer broader market access but longer approvals, while Closed GPOs may expedite approvals but limit market reach. Local/regional value analysis committees (VACs) add further complexity, with their evaluations (influenced by CMS regulations, hospital policies, and the Sunshine Act [49-50]) affecting adoption feasibility and speed. Companies must adapt to these dynamics, balancing revenue optimization with risk-reward calculations. This entire network operates under strict FDA regulations and anti-kickback statutes (DOJ [51]) intended to ensure ethical practices.

Seventeen executives – 10 from the healthcare supply chain and 7 from industrial/sales/medical device sectors – confirmed that surgeons are the primary drivers of medical device adoption in the OR, with OR nurses and technicians also playing influential roles (Figure 6). These personnel engage with medical device sales representatives within hospitals, at conferences, trade shows, and through digital media. Requests to purchase or trial new devices typically go through the OR manager, the initial “gatekeeper,” before being reviewed by local representatives and then local or national evaluation committees. For initial demo/trial approval, three major criteria must typically be met: product need, cost-effectiveness, and alignment with current medical standards. If the product is contracted with the hospital or an affiliated GPO, the process may often be streamlined. Otherwise, evaluation timelines range from one to six months for local groups to six to 24 months for national groups, influenced by factors like hospital/system type, product type, cost, and impact/need. Status as a “Prime Vendor” (e.g., Medtronic, Johnson & Johnson, Stryker) versus a smaller company also affects adoption speed, often due to the influence of existing contracts. The evaluation process often involves a clinical champion presenting to an evaluation committee comprising medical, technical, and business professionals. Their decision, based on clinical and economic impact, is followed by a trial period to collect evaluation data, after which a final decision is made. Some evaluations may involve free product trials, though some institutions, such as military/government-funded ones, may not allow for free trials and require product purchase.

Figure 4: Broad-strokes sample map of the many paths to bring a medical product to market, with channels and partners included with customer segments. Map primarily helps illustrate extremely convoluted distribution system and level of considerations/entities relative to navigating this space.

Figure 5: Potential routes for small-to-medium sized companies attempting to enter medical device space within healthcare ecosystem. Note that this figure is not all-encompassing of the many healthcare industry entities, but instead just a representation with core example groups.

Figure 6: Medical Device Classification and FDA Approval Pathways

Intellectual Property (IP) protection is critical in the MedTech industry. Companies employ extensive patent strategies that vary depending on business goals and resources, incorporating nuances for patent filing dependent on depth and breadth of claims and descriptions, as well as geographic coverage potentially further influenced by market sizes and dynamics. The types of protections may also influence strategies. For example, while many companies rely on patents for protection, trade secrets may be the better course of action, since a patent eventually must be publicly disclosed. Companies engage with the United States Patent and Trademark Office (USPTO) and the World Intellectual Property Organization (WIPO) [61-63]. These organizations help ensure that IP rights are legally upheld. In the U.S., the Federal Trade Commission (FTC) and the Department of Justice (DOJ) enforce antitrust and competition laws to prevent monopolistic practices, which may be particularly relevant during mergers and acquisitions involving smaller companies [64]. IP concerns also arise during hospital product approvals, especially when clinician champions have a stake in a particular product (conflicts of interest). Internal hospital policies play a crucial role in managing these conflicts, with some institutions prohibiting the use of products with potential conflicts, while others allow them with proper disclosure and alternative clinician/personnel involvement. These various organizational frameworks collectively influence legal protection, market competition, and ethical considerations in the commercialization of MedTech innovations.

Discussion

This study illuminates the intricate landscape of the U.S. MedTech ecosystem, particularly for laparoscopic surgical innovations. Our findings, drawn from over 100 interviews with diverse stakeholders, reveal critical challenges and opportunities spanning standards and regulations, product development, and commercialization. These challenges disproportionately burden smaller companies, hindering their ability to bring innovative solutions to market and potentially limiting patient access to improved surgical technologies.

Surgeons consistently cited lens debris and obstructed views as major procedural issues. However, analysis of standards and regulations revealed a notable absence of policies specifically targeting these issues. This gap represents opportunities for stakeholders to collaborate on developing and implementing standards that directly address such critical clinical concerns. While excessive regulation can stifle innovation, establishing objective standards for commonly encountered issues, offers a significant opportunity to improve patient care while concurrently reducing economic burden on hospitals and the broader healthcare system. Moreover, the potential variations in regulatory requirements across laparoscopic specialties introduce added complexity. In this context, guidelines must provide sufficient clarity to address critical challenges – such as lens debris and obstructed views – yet remain flexible enough to foster the timely introduction of novel technologies that meet evolving clinical demands.

The optimal source for these standards, potentially a combination of guidance from leading clinical societies coupled with government incentives, merits further investigation. Furthermore, uncertainty about reporting requirements and time/resource constraints are significant factors contributing to underreporting in the MAUDE database. These issues, combined with the underutilization of the system, create substantial challenges for effective post-market surveillance of medical devices [75-79]. Smaller companies often rely heavily on a feedback loop of clinical use data for product improvement, regulatory compliance, and scaling newer technologies, while larger companies with product lines leveraging years of use cases have a large amount of historical use data to feed into their design feedback loop. While it may seem intuitive to attribute fewer or delayed submissions of MAUDE reports from smaller manufacturers to limited staffing, the reality is that underreporting and delays reflect broader, systemic deficiencies in reporting practices across all manufacturers. Underreporting encompasses not only the scarcity of submitted reports, but also the frequent submission of incomplete or insufficient clinical information. Beyond underreporting itself, delayed reporting, mainly from manufacturers who file 97% of MAUDE reports (some taking up to 80 days), points to deeper problems with database usage and standardized reporting beyond just company size or representation [80].

Comprehensive post-market surveillance data is essential for smaller companies to demonstrate adherence to applicable standards (e.g., QMSR, ISO 13485), further strengthening their QMS. Developing more robust reporting systems and addressing OR inefficiencies will not only enhance innovation opportunities and commercial success of large and (especially) smaller companies, but also broadly improve the quality of patient care.

Investigation of product development factors highlights significant hurdles faced by smaller companies seeking to introduce novel MIS technologies. Although the FDA’s rigorous regulatory pathways are essential for ensuring device safety and efficacy, they often pose substantial financial and logistical challenges for smaller entities that have limited resources. This disparity may create an uneven playing field, placing smaller companies at a distinct disadvantage and potentially hindering groundbreaking innovations. Compounding this issue are the complexities of IP protection. Market adoption can expose smaller companies to IP vulnerabilities, including potential legal challenges or infringement claims by competitors. Moreover, larger competitors often possess the financial means and legal expertise to circumvent or leverage existing patents, effectively exploiting the vulnerabilities of emerging innovators. By contrast, smaller entities are forced to divert limited capital and attention toward safeguarding their IP, potentially delaying product development and undermining their ability to effectively compete at a global, and potentially even national, scale.

The rigorous standards required for manufacturing and design processes, including FDA’s QMSR, ISO 13485, ISO 9001, ISO 14971, along with guidelines such as those seen in ASTM and IEC, further exacerbate the challenges for bringing innovations to market. These standards, while crucial for ensuring traceability of products, designs, and materials, confirm product safety, but demand significant resources in terms of funding and personnel. The necessity of these standards underscores the importance of regulatory approval and patient safety, but simultaneously reinforces the impact of barriers faced by smaller companies in achieving market adoption where personnel headcount is lean and bandwidth is already spread thin. Resources, such as fractional headcount (i.e., part time consultants/contractors/advisors) and specialty software tools, might enable greater management and efficiency for accessing and maintaining such standards which could provide notable value to smaller companies to be more competitive.

Interview results shed light on FDA authorization/compliance as a critical, non-negotiable milestone for introducing medical devices into clinical settings. However, for many smaller MedTech ventures, the most daunting challenge is actually centered on commercialization [81]. While MedTech regulatory standards and commercialization efforts are both complex, standards are readily accessible, change very little (mostly), and are broadly applicable from one company to the next. However, commercialization efforts require navigation of a more nebulous and amorphous arena with variables such as technology, people, patients, hospital site locations and policies, hospital systems, and timing – all yielding a seemingly ever-changing landscape requiring constant adaptation. While there is of course some level of structure, the equation for successful clinical adoption of a technology does shift quite often, but is easier to manage once a company already has a foot in the door. This is why the current system favors large OEMs/Prime Vendors who leverage market dominance and established relationships to fend off competition.

Associated complex distribution channels create substantial barriers to entry for smaller innovators. This limited market access, coupled with lengthy hospital evaluations (exacerbated by GPO influence), hinders smaller companies from gaining traction, securing funding, and reaching patients. Furthermore, the complex reimbursement process (HCPCS and CPT codes [82]) adds another hurdle, directly impacting financial viability and overall success or failure of early-stage companies. Standardized, transparent evaluation criteria are essential for a level playing field. A nationally standardized systematic product evaluation, while potentially similar to health technology assessments (HTAs) (considering clinical effectiveness, safety, and cost-effectiveness), would likely need to differ in scope and implementation. HTAs comprehensively evaluate a technology’s healthcare system impact, including societal and ethical considerations [76]. Conversely, a standardized evaluation might focus more narrowly on product-specific features, performance, and value within a hospital or health system. While less comprehensive, such standardized criteria could empower smaller manufacturers by providing an objective framework to demonstrate value, facilitate comparisons, and streamline purchasing decisions.

Current market dynamics necessitate a deep understanding of all stakeholder interests, encompassing the full cycle of care, financial considerations, and the broader MedTech ecosystem [30]. This understanding is crucial for identifying advocates within the system, anticipating potential resistance, and identifying opportunities to streamline processes for cost-effective resource allocation. While not inherently advantageous or disadvantageous, the comparatively higher levels of process ownership and flexibility observed in military/government hospitals are noteworthy. By strategically focusing on key roles and influencing factors within the procurement process (i.e., communication and negotiation), companies can improve their chances of overcoming these complex barriers.

Conclusion

This study reveals the significant hurdles in translating MIS medtech innovations in the U.S. market. Findings, based on extensive stakeholder interviews, expose critical challenges across standards and regulations, product development, and commercialization, which, due to their frequently limited resources, disproportionately impact smaller companies and potentially limit patient access to innovative technologies. Furthermore, findings highlight how current policies often exacerbate these challenges, creating a systemic bias that favors established players and stifles disruptive innovation.

A primary concern is the disconnect between surgeons’ clinical needs and the existing regulatory framework. While surgeons prioritize solutions for visualization challenges, current policies lack specific guidance on these crucial issues. This gap necessitates policies that better reflect real-world OR needs and directly address surgeon priorities. Moreover, the underutilization of the MAUDE database for adverse event reporting limits access to valuable data, especially crucial for smaller companies who rely on this information for iterative product development and navigating regulatory compliance. The costs/complexities associated with robust MAUDE reporting create an additional burden for smaller companies, making policy changes to simplify and incentivize reporting even more critical. Improving MAUDE reporting, especially the impact on small companies, should be a focus of policy changes.

The path from product development to commercialization is fraught with obstacles heavily influenced by policy. The current FDA approval process, while vital for safety, places heavy financial and logistical burdens on smaller companies, often stressing or even exceeding their limited budgets and personnel. A similar burden is also seen in the lengthy and complex reimbursement process, which further disadvantages resource-constrained startups. For these small companies, navigating reimbursement and demonstrating clinical and economic viability during protracted regulatory processes is extremely taxing on limited runway budgets. Moreover, current policies governing distribution channels and hospital evaluations often favor established entities with existing contracts/relationships, creating an uneven playing field for smaller innovators. As well, the nebulous and dynamic nature of the commercial and stakeholder engagement disproportionately impacts the ability of smaller companies to drive clinical adoption and achieve commercial success. This systemic bias limits market access for smaller companies, hindering competition and potentially delaying, or even preventing, the availability of beneficial patient technologies.

Beyond these direct policy implications, other product development, manufacturing, and legal considerations further disadvantage smaller companies. Limited resources, coupled with the need to operate leanly, and further impacted by existing policies such as FDA, MDR, and QMSR that set high bars for design, testing, quality control, and manufacturing, make navigating these complexities even more difficult. This high bar often exceeds the financial, operational, and logistical resources that small companies have access to. This can create vulnerabilities that larger, more established companies can exploit, reinforcing the urgent need for policies that promote a more equitable environment for competition and innovation.

To foster a more innovation-friendly MedTech ecosystem, policies must adapt to support emerging companies:

- Prioritize clinical needs: Policies should address unmet surgical needs (e.g., visualization challenges), enhancing the standard of care and opportunities for innovation.

- Streamline regulatory and reimbursement processes: Streamlined regulatory and reimbursement pathways for smaller companies are crucial to reduce financial and logistical barriers, accelerating patient access to innovative surgical tools.

- Democratize market access: Implement standardized, transparent evaluation criteria and possibly restructure distribution channels to mitigate bias, promote competition, and better enable smaller companies to reach the market. Adoption of standardized policies will further level the playing field by encouraging a more steady and structured sector regarding clinical and commercial adoption opportunities.

- Improve adverse event reporting mechanisms: Improved reporting mechanisms are essential for collecting comprehensive data, improving device safety, and informing both product development and regulatory policies. This is especially critical for smaller companies who rely on this information for product development and market entry.

- Foster collaboration and transparency: Enhanced communication among stakeholders (policymakers, regulatory bodies, hospitals, manufacturers, and clinicians) is crucial for identifying systemic barriers, sharing best practices, and promoting successful integration of innovations.

By addressing these issues through targeted policy changes, a more balanced and dynamic MedTech ecosystem might better improve patient safety and foster development and adoption of innovative surgical technologies, leading to better outcomes for all.

References

- Reid, P., et al., Building a Beter Delivery System: A New Engineering/Healthcare Partnership. National Acadmy of Engineering, 2005. Crossing the Quality Chasm: p. 95-97.

- West, D., Improving Health Care through Mobile Medical Devices and Sensors. Brookings Institution Policy Report, 2013.

- Ackerly, C., et al., Fueling Innovation In Medical Devices (And Beyond): Venture Capital In Health Care. Health Affairs, 2008. 28(1). https://doi.org/10.2147/RSRR.S119317

- Ngu, J. C.-Y., Tsang, C. B.-S., & Koh, D. C.-S. (2017). The da Vinci Xi: A review of its capabilities, versatility, and potential role in robotic colorectal surgery. Robotic Surgery: Research and Reviews, 4, 77–85. https://doi.org/10.2147/RSRR.S119317

- Bergsland, J., Elle, O. J., & Fosse, E. (2014). Barriers to medical device innovation. Medical Devices (Auckland, N.Z.), 7, 205–209. https://doi.org/10.2147/MDER.S43369

- Dougherty, D., Interpretive Barriers to Successful Product Innovation in Large Firms. Organization Science, 1992. 3(2): p. 179-202.

- Sliwa, J., & Benoist, E. (2015). Research and Engineering Roadmap for Development and Deployment of Smart Medical Devices: Proceedings of the International Conference on Biomedical Electronics and Devices, 221–232. https://doi.org/10.5220/0005291002210232

- Thompson, M., et al., Medical device recalls and transparency in the UK. BMJ, 2011. 342(d2973).

- Pietzsch, J., et al., Stage-Gate Process for the Development of Medical Devices. Journal of Medical Devices, 2009. 3(2): p. 0210041-1 – 021004-15.

- Soenksen, L. and Y. Yazdi, Stage-gate process for life sciences and medical innovation investment. Technovation, 2017. 62(63): p. 14-21.

- DeAna, F., et al., Value Driven Innovation in Medical Device Design: A Process for Balancing Stakeholder Voices. Annals of Biomedical Engineering, 2013. 41(9): p. 1811-1821.

- Barczak, G., Identifying new product development best practice. Business Horizons, K Kahn. 55: p. 293-305.

- Calantone, R. and R. Cooper, New Product Scenarios: Prospects for Success. Journal of Marketing, 1981. 45(2): p. 48-60.

- Cooper, R. and E. Kleinschmidt, An Investigation into the New Product Process: Steps, Deficiencies, and Impact. The Journal of Product Innovation Management, 1986. 3(2): p. 71-85.

- Cui, A. and F. Wu, The Impact of Customer Involvement on New Product Development: Contingent and Substitutive Effects. Product Development & Management Association, 2017. 34(1): p. 60-80.

- Rothwell, R., Factors for Success in Industrial Innovation. Journal of Generam Management, 1974. 2(2): p. 57-65.

- Cespedes, F., T. Eisenmann, and S. Blank, Customer Discovery Validation for Entrepreneurs. Harvard Business School Entrepreneurial Management Case No. 812-097, 2012.

- Blank, S., INNOVATION CORPS: A REVIEW OF A NEW NATIONAL SCIENCE FOUNDATION PROGRAM TO LEVERAGE RESEARCH INVESTMENTS. Subcommittee on Research and Science Education Committee on Science, Space, and Technology U.S. House of Representatives, 2012.

- Smith, P. and D. Reinersten, Developing Products in Half the Time: New Rules, New Tools. strategy2market.com, 1998.

- Stokes, D., Entrepreneurial marketing: a conceptualisation from qualitative research. Qualitative Market Research: An International Journal, 2000. 3(1): p. 47-57.

- Griffin, A., Obtaining customer needs for product development. John Wiley & Sons, Inc, 1996. Chapter 13: p. 213-230.

- Thamjamrassri, P., Song, Y., Tak, J., Kang, H., Kong, H.-J., & Hong, J. (2018). Customer Discovery as the First Essential Step for Successful Health Information Technology System Development. Healthcare Informatics Research, 24, 79. https://doi.org/10.4258/hir.2018.24.1.79

- Lin, J. and C. Seepersad, Empathic Lead Users: The Effects of Extraordinary User Experiences on Customer Needs Analysis and Product Redesign. ASME Intl. Design Engineering Technical Conferences and Computers and Info in Engineering Conf. 3: p. 289-296.

- Vaughn, M., C. Seepersad, and R. Crawford, Creation of Empathic Lead Users From Non-Users via Simulated Lead User Experiences. ASME Intl. Design Engineering Technical Conferences and Computers and Info in Engineering Conf., 2014. 7.

- NSFI-Corps2021BiennialReport.pdf. (n.d.). from https://nsf-gov-resources.nsf.gov/2022-06/NSFI-Corps2021BiennialReport.pdf

- 2023 Ascend Medtech Accelerator Cohort. (n.d.). VentureWell. from https://venturewell.org/2023-leap-ascend-medtech/

- Dykstra, J., Fante, M., Donahue, P., Varva, D., Wilk, L., & Johnson, A. (2019). Lessons from Using the {I-Corps} Methodology to Understand Cyber Threat Intelligence Sharing. 12th USENIX Workshop on Cyber Security Experimentation and Test (CSET 19). https://www.usenix.org/conference/cset19/presentation/dykstra

- Robinson, L., I-Corps and the Business of Great Science. Journal of Metals, 2012. 64(10): p. 1132-1133.

- Yock, P. G., Zenios, S., & Makower, J. (2015). Biodesign: The process of innovating medical technologies (2nd ed.). Cambridge University Press.

- Donaldson, K., K. Ishii, and S. Sheppard, Customer Value Chain Analysis. ASME Proceedings of DETC’04, 2004. 3d(8): p. 993-1001.

- I-Corps. (2022, February 10).Center for Entrepreneurship. https://cfe.umich.edu/category/for-researchers/i-corps/

- South Dakota Established Program to Stimulate Competitive Research. (2022). SD EPSCoR Strategic Plan. https://sdepscor.org/wp-content/uploads/2022/05/SD-EPSCoR-Strategic-Plan.pdf

- Brougher JT. Intellectual Property and Health Technologies: Balancing Innovation and the Public’s Health. Springer; 2014. doi:10.1007/978-1-4614-8202-4

- Bruen BK, Docteur E, Lopert R, et al. The Impact of Reimbursement Policies and Practices on Healthcare Technology Innovation.

- Guerra-Bretaña RM, Flórez-Rendón AL. Impact of regulations on innovation in the field of medical devices. Res Biomed Eng. 2018;34:356-367. doi:10.1590/2446-4740.180054

- Maresova P. Impact of Regulatory Changes on Innovations in the Medical Device Industry. Int J Health Policy Manag. 2022;12:7262. doi:10.34172/ijhpm.2022.7262

- Patino RM. Moving Research to Patient Applications through Commercialization: Understanding and Evaluating the Role of Intellectual Property. J Am Assoc Lab Anim Sci. 2010;49(2):147-154.

- Stern AD. Innovation under regulatory uncertainty: Evidence from medical technology. J Public Econ. 2017;145:181-200. doi:10.1016/j.jpubeco.2016.11.010

- Guo, J., et al., A needs analysis approach to product innovation driven by design. Procedia CIRP – TFC 2015 – TRIZ FUTURE 2015, 2016. 39(3016): p. 39-44.

- Utterback, J., et al., The process of innovation in five industries in Europe and Japan. IEEE Transactions on Engineering Management, 1976. EM-23(1): p. 3-9.

- Buzzell, R. and B. Gale, The PIMS Principles: Linking Strategy to Performance. The Free Press, 1987: p. 100-130.

- Cooper, R. and A. Sommer, Agile-Stage-Gate: New idea-to-launch method for manufactured new products is faster, more responsive. Industrial Marketing Management, 2016. 59: p. 167-180.

- Zirger, B. and M. Maidique, A Model of New Product Development: An Empirical test. Management Science, 1990. 36(7): p. 867-883.

- Joshi, B., Surgical Equipment: Technologies and Global Markets. bcc Research: Market Forecasting, 2014.

- Health C for D and R. About Manufacturer and User Facility Device Experience (MAUDE) Database. FDA. Published online June 6, 2024. Accessed September 13, 2024. https://www.fda.gov/medical-devices/mandatory-reporting-requirements-manufacturers-importers-and-device-user-facilities/about-manufacturer-and-user-facility-device-experience-maude-database

- Health C for D and R. Quality Management System Regulation: Final Rule Amending the Quality System Regulation – Frequently Asked Questions. FDA. Published online August 7, 2024. https://www.fda.gov/medical-devices/quality-system-qs-regulationmedical-device-current-good-manufacturing-practices-cgmp/quality-management-system-regulation-final-rule-amending-quality-system-regulation-frequently-asked

- Health C for D and R. Medical Device Reporting (MDR): How to Report Medical Device Problems. FDA. August 28, 2024. Accessed September 13, 2024. https://www.fda.gov/medical-devices/medical-device-safety/medical-device-reporting-mdr-how-report-medical-device-problems

- ISO 13485:2016(en), Medical devices — Quality management systems — Requirements for regulatory purposes. https://www.iso.org/obp/ui/en/#iso:std:iso:13485:ed-3:v1:en

- Hospital Value-Based Purchasing Program | CMS. https://www.cms.gov/medicare/quality/initiatives/hospital-quality-initiative/hospital-value-based-purchasing

- Physician financial transparency reports (Sunshine Act). American Medical Association. September 11, 2024. https://www.ama-assn.org/practice-management/medicare-medicaid/physician-financial-transparency-reports-sunshine-act

- Finding a Safe Harbor: Anti-Kickback Implications of Medical Device Co. https://www.mddionline.com/medical-device-markets/finding-a-safe-harbor-anti-kickback-implications-of-medical-device-consulting-agreements

- Health C for D and R. Regulatory Controls. FDA. August 15, 2023.https://www.fda.gov/medical-devices/overview-device-regulation/regulatory-controls

- FDA Cleared vs Approved vs Granted for Medical Devices. https://www.greenlight.guru/blog/fda-clearance-approval-granted

- Health C for D and R. How to Find and Effectively Use Predicate Devices. FDA. Published online August 15, 2023. Accessed September 13, 2024. https://www.fda.gov/medical-devices/premarket-notification-510k/how-find-and-effectively-use-predicate-devices

- Dotson P. CPT® Codes: What Are They, Why Are They Necessary, and How Are They Developed? Adv Wound Care. 2013;2(10):583-587. doi:10.1089/wound.2013.0483

- CPT® Codes. American Medical Association. September 11, 2024. https://www.ama-assn.org/topics/cpt-codes

- Healthcare Common Procedure Coding System (HCPCS) | CMS. https://www.cms.gov/medicare/coding-billing/healthcare-common-procedure-system

- All about CPT codes – NIH’s seed. https://seed.nih.gov/sites/default/files/2023-09/CPT-Codes-Presentation.pdf.

- Health C for D and R. Medical Device Coverage Initiatives: Connecting with Payors via the Payor Communication Task Force. FDA. Published online July 2, 2024. Accessed September 13, 2024. https://www.fda.gov/about-fda/cdrh-innovation/medical-device-coverage-initiatives-connecting-payors-payor-communication-task-force

- Reinert C. Reimbursement Knowledge Guide for Medical Devices. https://seed.nih.gov/sites/default/files/2024-01/Reimbursement-Knowledge-Guide-for-Medical-Devices.pdf

- World Intellectual Property Organization. Accessed September 13, 2024. https://www.uspto.gov/ip-policy/patent-policy/world-intellectual-property-organization

- Rajan R, Bhasi AB. Open Innovation and IP Management in Medical Devices: A Review on Scope, Drivers and Barriers. | Trends in Biomaterials & Artificial Organs | EBSCOhost. January 1, 2021. Accessed September 13, 2024. https://openurl.ebsco.com/contentitem/gcd:150399400?sid=ebsco:plink:crawler&id=ebsco:gcd:150399400

- About Us. August 29, 2024. https://www.uspto.gov/about-us

- Antitrust Division | Antitrust Enforcement And Intellectual Property Rights: Promoting Innovation And Competition (04/2007). June 25, 2015. https://www.justice.gov/atr/antitrust-enforcement-and-intellectual-property-rights-promoting-innovation-and-competition

- ISO 9001:2015(en), Quality management systems — Requirements. https://www.iso.org/obp/ui/en/#iso:std:iso:9001:ed-5:v1:en

- ISO 14971:2019(en), Medical devices — Application of risk management to medical devices. https://www.iso.org/obp/ui/en/#iso:std:iso:14971:ed-3:v1:en

- Medical Device Standards and Implant Standards – Standards Products – Standards & Publications – Products & Services. https://www.astm.org/products-services/standards-and-publications/standards/medical-device-standards-and-implant-standards.html

- admin. IEC 60601 Standard : Everything You Need to Know. MPE Inc. September 12, 2022.

- What IEC does. ttps://www.iec.ch/what-we-do

- ASTM Fact Sheet – Overview – About Us. Accessed September 13, 2024. https://www.astm.org/about/overview/fact-sheet.html

- Laparoscopic Surgery | University of Miami Health System [Internet]. [cited 2024 Nov 19]. Available from: https://umiamihealth.org/en/treatments-and-services/surgery/laparoscopic-surgery

- Laparoscopic Surgery | Houston Methodist [Internet]. [cited 2024 Nov 13]. Available from: https://www.houstonmethodist.org/surgical-services/minimally-invasive-surgery/

- Laparoscopic Surgery » Palmer General Surgeon | Mat-Su Surgical Associates, A.P.C. [Internet]. [cited 2024 Nov 19]. Available from: https://matsusurgical.com/services-procedures/laparoscopic-surgery/

- Minimally invasive surgery – Mayo Clinic [Internet]. [cited 2024 Nov 13]. Available from: https://www.mayoclinic.org/tests-procedures/minimally-invasive-surgery/about/pac-20384771

- dp_admin. EUPATI Toolbox. 2016 [cited 2024 Nov 13]. Clinical effectiveness assessment in HTA. Available from: https://toolbox.eupati.eu/resources/clinical-effectiveness-assessment-in-hta/

- Ziapour B, Zaepfel C, Iafrati MD, Suarez LB, Salehi P. A systematic review of the quality of cardiovascular surgery studies that extracted data from the MAUDE database. J Vasc Surg. 2021;74(5):1708-1720.e5. doi:10.1016/j.jvs.2021.01.050

- Davies C, Nieri CA, Sheyn A, Rangarajan S, Yawn RJ. The Use and Utility of Food and Drug Administration Adverse Event Data from the Manufacturer and User Facility Device Experience Database in Otology: A Systematic Review. Otol Neurotol. 2023;44(6):534.

- Cooper MA, Ibrahim A, Lyu H, Makary MA. Underreporting of Robotic Surgery Complications. J Healthc Qual. n/a(n/a). doi:10.1111/jhq.12036

- Adverse Events Stack Up At FDA; 2016 Warning Letter Data Show Troubles With MDRs, Complaints. Medtech Insight. October 11, 2016. Accessed September 13, 2024. http://medtech.citeline.com/MT103785/Adverse-Events-Stack-Up-At-FDA-2016-Warning-Letter-Data-Show-Troubles-With-MDRs-Complaints

- Mishali, M., Sheffer, N., Mishali, O., & Negev, M. Evaluation of reporting trends in the MAUDE Database: 1991 to 2022. Digit Health, 2025;11:20552076251314094. doi:10.1177/20552076251314094. PMID: 39850626; PMCID: PMC11755539.

- Hafer N, Buchholz B, Dunlap D, Fournier B, Latham S, Picard MA, Tello S, Gibson L, Lilly CM, McManus DD. A multi-institutional partnership catalyzing the commercialization of medical devices and biotechnology products. J Clin Transl Sci. 2021 Apr 8;5(1):e119. doi: 10.1017/cts.2021.779. PMID: 34267946; PMCID: PMC8256316.

- Modina CAE, Sandra Waugh Ruggles, Makower J, Perl J. Current Common Procedural Terminology (CPT®) Coding Process Challenges: Impact on the HealthTech Innovation Ecosystem. HMPI Health Manag Policy Innov. 2024;(April 2024: Volume 9, Issue 1). https://hmpi.org/2024/04/12/current-common-procedural-terminology-cpt-coding-process-challenges-impact-on-the-healthtech-innovation-ecosystem/

Appendix A

Interview Questions – Rubric/Guideline: Minimally invasive surgeons who use laparoscopes (including residents, fellows, medical students)

- How many surgeries do you perform each year?

- Do you have a specialty?

- What types of surgeries do you perform more often than others?

- How many of these surgeries do you perform each year?

- How long have you been performing surgeries that use a laparoscope?

- What are the most common and frustrating/annoying problems you experience on a daily basis, throughout all the laparoscopic procedures you perform?

- Are there current methods, practices, or devices that try and solve these problems?

- Could you list them?

- How well do they work?

- Could you provide a range on how much they cost?

- Which issues are more important than others? Which issue(s) annoy you the most?

- What issue occurs the most often?

- How often does that one occur?

- What are some general trends you notice with the field of laparoscopic surgery? Regarding preparation, execution of surgery, overall process, and equipment?

- What items/aspects of your job are most important in terms of job performance, both from your personal opinion and on a professional level with how surgeons are evaluated?

- How do you find out about new medical products? What makes you decide to try a new product? What’s the process of getting a new product into a hospital for you to try?

If they do not talk much about the scope getting dirty, we then dive into the topic….

- Other surgeons have mentioned that their lens becomes obstructed by debris in the body – it doesn’t sound like that is much of a problem for you at all. Does that even happen for you?

- How often does this happen in a typical surgery?

- Does it happen more often in some surgeries compared to others?

- Is losing visual during even a concern for you? Why/why not?

- On a scale of 1-10 (with 10 being high importance), how serious is this concern? Why did you choose that number?

- Can you describe the current solutions to this problem that you use most?

- Are there any other solutions you are aware of that you don’t use, or don’t use as often?

- Could you imagine in your head the steps you go through to clean the scope, and roughly how long it takes?

- On a scale of 1-10 (with 10 being high importance), how important is it to be able to quickly and effectively clean the laparoscope and re-obtain visual? Why?

- Are there any other issues you have with current laparoscopes or laparoscopic technologies?

- Are there any other clinicians, hospital administrators, purchasing agents, or even patients who you could put us in contact with?

Medical Device Channel Experts

- What type of instruments do you typically sell?

- What’s your average process to try approaching new hospitals/customers?

- What do you find is the most effective strategy?

- Do you think/know of any ways

- What “selling points” do you typically see work best when selling products to new customers? Is it usually financial benefits, patient safety, physician preferences? Something else?

- Who do you really need on your side to get your product into a hospital?

Supply chain agents (i.e. purchasers, coders, etc)

- How much does a typical minimally invasive surgical procedure cost?

- Could you provide a cost range and possibly break it down into major sectors/focuses (e. laparoscopic, robotic, VATS, etc)?

- What major instruments or packages are purchased for every procedure that uses a laparoscope?

- How do you decide what instruments you purchase? Are these purchasing decisions made by you, or someone else?

- What factors influence whoever makes the decisions regarding what to purchase?

- On average, how much does each instrument or package or device cost the hospital?

- If that information is proprietary, then could you offer a maximum amount the hospital would be willing to pay for such instruments or packages or devices?

- Or perhaps an estimate/range for what the industry standard cost might be for such instruments or packages or devices?

- What and who are the major factors and/or decision makers that encourage you make purchases of certain items?

- What about certain items over others when they perform a similar task?

- Could you try and weight the importance of these factors in the decision making process?

- Are there any other clinicians, hospital administrators, purchasing agents, or even patients who you could put us in contact with?

Hospital directors

- What and who are the major factors and/or decision makers that encourage you make purchases of certain items?

- What about certain items over others when they perform a similar task?

- Could you try and weight the importance of these factors in the decision making process?

- What are important metrics that matter most for your job performance?

- Are considerations such as readmission rates a big deal for you, in particular? What about occurrences of surgical complications or post-surgical site infections? Are those important for you, or for the surgeons?

- Are there any other clinicians, hospital administrators, purchasing agents, or even patients who you could put us in contact with?

Reimbursement experts

- What and who are the major factors and/or decision makers that encourage you make purchases of certain items?

- What about certain items over others when they perform a similar task?

- Could you try and weight the importance of these factors in the decision making process?

- What are the most important factors that you decide how much you will reimburse for certain types of surgeries

- Are there certain factors regarding surgeries that help you save money, either immediately or later on down the road?

- Is length of time of the surgery something you care about?

- Why/why not?

- How much do you care about it on a scale of 1-10 (with 10 being “I care a lot”)?

- Do you reimburse for the amount of time spent under anesthesia?

- Is a shorter surgery likely to save you money?

- Is overall cost of the surgery something you care about?

- Why/why not?

- How much do you care about it on a scale of 1-10 (with 10 being “I care a lot”)?

- Are there any other clinicians, hospital administrators, purchasing agents, or even patients who you could put us in contact with?

- Surgical patients

- What are the most important factors that you think about when you decide whether or not to get surgery?

- Is length of time of the surgery something you care about?

- Why/why not?

- How much do you care about it on a scale of 1-10 (with 10 being “I care a lot”)?

- Is cost of the surgery something you care about?

- Why/why not?

- How much do you care about it on a scale of 1-10 (with 10 being “I care a lot”)?

- Are there any other clinicians, hospital administrators, purchasing agents, or even patients who you could put us in contact with?

Appendix B

Tables of Results by Domain

Table B.1: Clinical Domain – Key Laparoscopic Surgery Issues Identified from Surgeon Interviews

| Issue | Description | Number of Surgeons | Priority |

| Lens Debris | Obstacles to clear visibility caused by debris (e.g. fat, blood, condensation) on the laparoscopic lens. | 31 | High |

| Equipment Issues | Problems related to defective or incorrect surgical equipment. | 6 | Medium |

| OR Team Workflow | Delays and inefficiencies in the OR due to team coordination. | 4 | Medium |

|

Other |

Wasted time and delays due to OR scheduling. Challenges with inexperienced or out-of-sync surgical team members. | 2 | Low |