Sashidaran Moodley, MD, CareMore Health Plan, Los Angeles, CA; Anant Vasudevan, MD, Brigham and Women’s Hospital, Harvard Medical School; Kevin Schulman, MD, Duke University

Contact: Kevin Schulman kevin.schulman@duke.edu

Abstract

What is the message?

A private-sector healthcare service has created a three-pronged approach addressing supply and demand for healthcare services through certifying quality of care, offering micro-finance for providers, and facilitating mobile payments for patients that is improving access to high-quality care in Kenya and elsewhere in Africa.

What is the evidence?

The article highlights the experience of the PharmAccess NGO, which supports private-sector health delivery in Tanzania, Kenya, and elsewhere in Africa.

Submitted: January 25, 2017; Accepted after review: August 25, 2017

Cite as: Sashidaran Moodley, Anant Vasudevan, and Kevin Schulman. 2017. Strengthening the Private Health Sector in Africa: the PharmAccess Solution. Health Management Policy and Innovation, Volume 2, Issue 2.

Adapted From: Schulman, Kevin, Sashidaran Moodley, and Anant Vasudevan. “PharmAccess and the M-TIBA Platform: Leveraging Digital Technology in the Developing World.” Harvard Business School Case 317-103, March 2017.

Introduction

Global health often focuses on the role of the public sector in healthcare delivery. Yet, in many of the countries of Africa, the majority of healthcare services are actually delivered by the private sector. Despite the importance of private healthcare delivery, these systems remain underdeveloped across the continent. Additionally, international resources focused on healthcare or health system strengthening often are directed to the public healthcare sector, even when there is little chance of success of these efforts, further undermining potential contributions by the private sector.

At the core, the challenge in many countries in Africa—and around the world—is to attract capital and resources to the private healthcare markets. In countries with large formal sectors of the economy, this generally includes some level of provision for employer-based insurance schemes. However, in countries that have large informal sectors of their economies, employer-based approaches are not sufficient.

PharmAccess is an Amsterdam-based NGO that since 2001 has been working to strengthen the private health sector in Tanzania, Kenya, and elsewhere in Africa. PharmAccess began by working with Dutch private employers in Africa to develop private health insurance for African employees. They then worked to develop re-insurance programs to sustain private health insurance for employers caring for patients infected with HIV. In this work, they were able to observe some of the many challenges faced by the private sector as government investment and donor directed funding crowded-out efforts to recruit private capital for the health sector from within the local markets.

Reflecting on a decade of experience in the field, PharmAccess was realistic in their assessment of the challenges on the ground. On the supply side, clinical services suffered from underinvestment and lack of capital. This underinvestment led to worker shortages and, sometimes, to appalling quality of clinical services. On the demand side, these markets suffered from a lack of demand for medical services—because there is little demand for poor-quality medical care—and limited willingness to invest in scaling the care that was available.

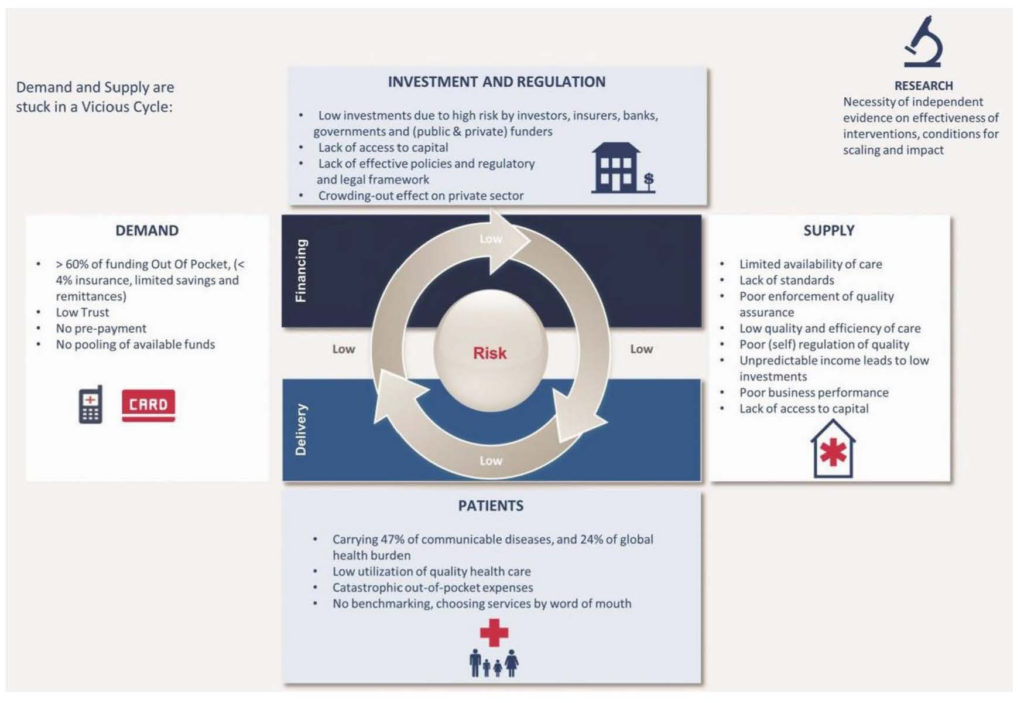

By linking together supply and demand of healthcare services, PharmAccess realized that they needed to address both sides of the market simultaneously if they were going to have a significant impact. By articulating the model in this fashion, they made a conceptual link from considering healthcare as a market to envisioning healthcare as a network of suppliers and purchasers. Networks grow in value in a virtuous cycle, but collapse in value in a vicious cycle. By this definition, the private healthcare market in Africa was in the midst of a vicious cycle. PharmAccess began to formulate a hypothesis that to transform the market, they would have to transition from a vicious cycle to a virtuous cycle addressing supply and demand concurrently.

One striking result of this planning process was recognizing the need to focus on trust in developing their solution. At the core, PharmAccess saw healthcare as an exchange of services; namely the exchange of money for treatment. As with any platform or exchange, users—in this case patients, payers and providers—will only use the service if there is a high level of trust in the system. Patients need to feel confident that they will be seeing qualified physicians in a practice equipped to treat them, and providers need to feel confident that they will be reimbursed for their services by patients, insurers, or other payers. If there is no transparency at the exchange level, financial companies, including banks, investors, and insurers, will not enter the market. Thus, Pharmaccess needed to address trust as a core part of their strategy to create a virtuous cycle in the market, as Figure 1 depicts.

The PharmAccess Approach: Three Programs

The result of this planning process was a strategy they called the PharmAccess Approach, which would systematically build trust and strengthen the private healthcare market. To accomplish this goal, PharmAccess would address supply-and-demand issues concurrently in the market. On the supply side, they established quality standards and business and quality trainings for providers (SafeCare, 2011). In addition, they developed a small and medium-size enterprise (SME) financing scheme to allow providers to invest toward meeting these new standards (the Medical Credit Fund, 2009). On the demand side, they addressed demand for services by developing a trusted platform to pay for healthcare services, while providing payment assistance for the most vulnerable (M-TIBA, 2015).

The PharmAccess Approach developed into three mutually reinforcing programs that would be implemented concurrently: quality of care, micro-finance, and mobile health payments. The three programs, and all of the partners PharmAccess recruited to implement the programs, became the platform on which to build a new private healthcare economy (1). This remarkable effort initially focused on the private healthcare market in Kenya and has since expanded to Nigeria, Tanzania, and Ghana.

Program 1 (supply): Quality of care—SafeCare

SafeCare addresses the quality of facilities and services in healthcare. To help ensure broad recognition of SafeCare standards, PharmAccess partnered with two internationally recognized healthcare-quality review bodies, the Joint Commission International (JCI) and Council for Health Service Accreditation of Southern Africa (COHSASA). JCI is an offshoot of the major U.S. based healthcare accrediting organization. COHSASA is based in South Africa. The main focus of SafeCare would be on “bottom of the pyramid” facilities. The goal was to improve the quality and safety of healthcare for the lowest-income, resource-poor settings (2).

Enrolled healthcare facilities would proceed through a staged process of quality improvement. The program grades facilities into five levels. At the lowest end, a Level 1 facility is the most unsafe and high risk, typically with limited facilities for sanitation, medication storage, or waste management. As a facility becomes more adept at providing care that minimizes the risk of infection, complications, and improper diagnosis or treatment, the quality and safety of services improve and the facility progresses from Level 1 to Level 5. Through the SafeCare program, facilities are encouraged to adopt standardized clinical, financial, and managerial processes as well as develop better record keeping to allow analysis of clinical performance and to create a feedback loop for the facility. Once a facility reaches Level 5, it can start a process for accreditation through JCI or COHSASA.

Facilities enrolled in SafeCare are evaluated by PharmAccess against these performance metrics at least once every two years. They are graded on each of a set of quality items as compliant, partially complaint, non-compliant, or non-applicable. The evaluation is positioned as more of a learning opportunity and partnership where SafeCare representatives provide concrete recommendations to the clinic based on the metrics of how to improve quality and safety of care, and how to prioritize these efforts. Individual facilities are expected to improve their performance over time, with corresponding gains in their SafeCare level.

As of October 2016, 1,300 out of 9,000 relevant facilities in Kenya had enrolled in the SafeCare program. Of that number, 30 enrolled facilities had succeeded in achieving a SafeCare Level 3 and one had attained Level 4. Many larger facilities had internal quality-improvement meetings on a monthly basis to track their progress toward recommended benchmarks, although smaller facilities struggled to institutionalize quality improvement.

Program 2 (supply): Micro-finance programs for providers—Medical Credit Fund

PharmAccess’s Medical Credit Fund provides capital to small and medium-size healthcare facilities to improve the healthcare infrastructure in the private sector. The MCF was established in 2009 with support from private investors and had its first funding closing in 2012 with $28 million from Development Finance Institutions, Development Agencies, private investors, and donors. The MCF has received several awards for its innovative “layered capital” structure, which includes blending grants, equity, and debt financing. The MCF operates in Kenya, Nigeria, Tanzania, and Ghana (3).

The MCF defined high-impact clinics as small to medium-size facilities located in urban and rural areas. In terms of the lending program, the MCF program shares the risk of local bank loans to providers. The program provides training to bank staff to help originate loans, as well as to clinic providers to help them better manage their businesses.

MCF works closely with SafeCare to ensure that clinics receiving investments under this program are serious about improving quality of care. These steps help banks mitigate uncertainty in provider lending and serve to make investment capital accessible to providers at more tenable rates. The program helps open bank partners’ eyes to the opportunities of the healthcare SME market. Some partners have started developing their own loans products for providers, as well as assuming a growing share of the risk.

Structurally, the MCF program has trained around 1,000 loan officers in four countries with the plan to eventually shift the training burden to more local partners. MCF has achieved a stunning repayment rate of around 97 percent over 950 loans (4). The organization attributes its success and competitive advantage to “hard work,” consisting of a diligent loan-appraisal process, regular technical consultancy assistance to borrowers, an in-depth understanding of the clinics’ and doctors’ needs, and a steadfast focus on accountability (5).

Program 3 (demand): Creating a trusted mobile health payment platform—M-TIBA

PharmAccess considered the challenges of a payment model in Kenya. An estimated two out of five Kenyan patients lack the money needed to seek care at hospitals. Poor mothers and children are especially vulnerable. With limited financial means, patients must call on extended families for financial assistance in emergencies. For relatives, tracking whether friends and family used the financial assistance for intended purposes is virtually impossible.

Donors had an interest in addressing the access issues for vulnerable populations, but they typically work through public-sector facilities and were reluctant to address care delivery in the private sector, even when the private organizations were largely servicing the poor. The “informal settlements” at private facilities made accountability for use of funds difficult. Further, for donors and private investors, the resources involved in healthcare created a large risk of diversion of funds from what they saw as their core uses (6).

While these issues were in play, the financial market in Kenya was moving in a novel direction. In 2007, Safaricom, Kenya’s largest cellular provider launched M-PESA. M-PESA is a mobile-money system through which users can purchase credit and pay for day-to-day expenses using a virtual currency. Today, the Central Bank of Kenya estimates that 25 million customers use mobile money payment systems, representing US$24 billion of transferred funds annually (7). M-PESA accounts for more than 90 percent of mobile money transactions in Kenya (8).

In 2013, Safaricom reached out to PharmAccess to see if M-PESA could be leveraged more directly to support the healthcare sector in Kenya. The concept they came up with, M-TIBA (in Swahili “tiba” means treatment), was envisioned as a healthcare-focused version of M-PESA: a mobile health wallet allowing anyone with a SIM card to obtain, save, and spend funds for healthcare using a mobile device. That same year, a Memorandum of Understanding was signed between PharmAccess, Safaricom, and the M-Pesa Foundation to form the partnership.

The M-TIBA system aimed to address the financial access challenges in the private healthcare market. First, through M-TIBA, patients can save money specifically for healthcare. Patients can add this money to their M-TIBA account quickly and easily directly from their normal M-PESA account on their own mobile phone (to top up their M-PESA accounts, Kenyans can visit any of the more than 100,000 M-PESA agents located on virtually every block in Kenya). M-TIBA only allows payments for healthcare services at providers contracted by CarePay, as we describe below. Once funds are available, M-TIBA can transfer money directly to a healthcare provider or facility for services. Typical monthly M-TIBA deposits, which could not be used for any purpose other than healthcare, were modest (usually less than 500 Kenyan shillings/month, about US$5).

The system did encounter challenges in the market. The healthcare restriction was a sticking point for many Kenyan patients since their limited disposable income forced them to prioritize necessities over preventative care. Most tended to view healthcare just like any other emergent expenditure, such as their dwelling being damage— unlikely to happen and, therefore, not critical to save for in advance.

Despite the challenges, the program has had strong success. Besides facilitating and potentially stimulating savings for health, M-TIBA builds trust within the existing “harambee” community-based informal financial support systems. Depositors know that their remittances to relatives and friends in need are actually used for healthcare.

Beyond individuals, M-TIBA solved the accountability problem for donors. With this system, donors have a secure way to transfer money to individuals through a platform where the money can only be withdrawn for healthcare purposes. Transactions can be tracked and audited to ensure the integrity of the system. The data obtained through the M-TIBA transactions can be aggregated to show payers including insurers and donor organizations how their money is used, as well as to increase insight into the health situation of certain target groups.

M-TIBA also provides access to populations that do not have access to public healthcare facilities—typically in rural areas and urban slums. For donors, this creates an opportunity to provide direct, efficient support to the lowest income populations who secure care through the private sector. Indirectly, M-TIBA could work directly to facilitate health-system strengthening through the re-establishment of normal market mechanisms for the delivery of care in the private sector.

The PharmAccess Solution: Looking Forward

While the PharmAccess solution has had success in its pilot testing, the final verdict on the network approach to developing the private healthcare market in Africa remains a work in progress. Concurrently with implementing of this program, public physicians in Kenya launched a national strike, highlighting the importance of the private sector in caring for all segments of society.

While the PharmAccess approach is novel, it also resembles a more generalizable platform model that has been successful in other markets. In the PharmAccess model, the three-pronged approach helps expand the private healthcare market as a trusted platform. By starting from this framework, PharmAccess has opportunities to analyze its initial learnings as they face challenges in implementation. Further, this framework can serve as a model to develop novel programs in other markets. More generally, characterizing the failures of the private healthcare market in Africa as a failure of a network of buyers and sellers is a key perspective that can open doors to addressing the challenges of global health in Africa, some of the most pressing global health challenges in the world.

Figure 1: The PharmAccess Virtuous Cycle (Source: [9])

References

- Platform Revolution: How Networked Markets Are Transforming the Economy—And How to Make Them Work for You. Sangeet Paul Choudary, Marshall W. Van Alstyne, Geoffrey G. Parker. W. Norton and Company, NY. 2016.

- SafeCare Standards V3.1. July 2016. http://www.safe-care.org/uploads/standards/2016/SafeCare%20Standards%20for%20Website_V3.1.pdf. Accessed 10/19/16.

- Medical Credit Fund, Africa. http://www.medicalcreditfund.org/clinics. Accessed 5/2/16.

- Medical Credit Fund. http://www.medicalcreditfund.org/results/contents/#loans, accessed 10/19/16.

- Conversation with Monique Dolfing-Vogelenzang and Bart Schaap. Mar 18 2016.

- PharmAccess brief received from Alexander Boers by email. Accessed Mar 11 2016.

- Ochieng, Moses. “Why Obama will need M-Pesa for his visit to Kenya.” FSD Africa (July 23, 2015), accessed online 5/3/16. http://www.fsdafrica.org/knowledge-hub/blog/why-obama-will-need-m-pesa-for-his-visit-to-kenya.

- USITC Executive Briefing on Trade, “Mobile Money in Kenya.” https://www.usitc.gov/publications/332/executive_briefings/forden_mobile_money_kenya_june2015.pdf, accessed 5/3/16.

- Schulman, Kevin, Sashidaran Moodley, and Anant “PharmAccess and the M-TIBA Platform: Leveraging Digital Technology in the Developing World.” Harvard Business School Case 317-103, March 2017.